My phone has been ringing off the hook.

Relatives and friends are reaching out to me.

They want to know what I’m doing with my money.

When I say I’ve been loading up on stocks, they can’t believe it.

They want to know what stocks they should be “shorting,” or betting against!

And I get where they’re coming from…

We’ve been getting a steady stream of bad news lately.

Coronavirus has spread across the world like an inferno… Huge parts of the economy have shut down… Unemployment has shot through the roof… And the oil market has imploded!

Many stocks have also been crushed. Just look at the airliners, cruise line operators, and hotel chains. These companies are fighting for their lives.

- It’s hard not to be pessimistic with everything that’s happening…

This is why many investors I speak with think the market’s headed off a cliff.

Some are even certain that we’re going to have a repeat of the global financial crisis… or worse.

But I’m simply not seeing it.

The current “crisis” has been nothing like what we saw in 2008.

Back then, everything sold off! Even utilities, which are supposed to be “defensive,” plunged 29%.

Consumer staples stocks, which sell toilet paper, toothpaste, and basic necessities, were the year’s top-performing sector. And they still plunged 15%!

There was no place to hide.

In March, we got a taste of that. The entire market sold off. Investors threw out the baby with the bath water. Since then, it’s been a completely different story.

The world’s most disruptive companies are thriving.

- This is a market of “haves” versus “have nots”…

See for yourself.

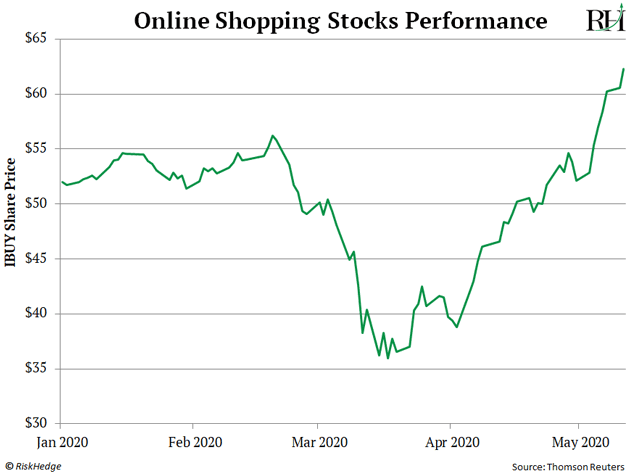

This compares the performance of the Amplify Online Retail ETF (IBUY) with the S&P 500. This fund invests in a basket of online retailers including Amazon (AMZN), Shopify (SHOP), and Wayfair (W)—the world’s largest online furniture store.

IBUY has surged an incredible 73% since mid-March. That’s more than triple the 500’s return over the same period.

- Now, the naysayers will tell you this rally isn’t for real…

They’ll say stocks are only rallying because the Federal Reserve is propping up the market. But that’s complete nonsense.

Online shopping has been booming for years. And the coronavirus only accelerated this megatrend.

If you’re like most Americans, you’re probably “social distancing.” Instead of buying socks at the mall or speakers at Best Buy, you’re buying these items online and getting them shipped to your doorstep.

But don’t take my word for it.

Amazon’s selling 50 times more household items than normal… Shopify is “handling Black Friday-level traffic every day”… Target’s (TGT) internet sales doubled in March… and then jumped another 275% in April!

Wayfair’s sales also doubled in March. That’s a big reason why Wayfair’s stock has rocketed more than 800% since March.

In short, the explosive rally by online retail stocks isn’t a fluke. It’s what should be happening.

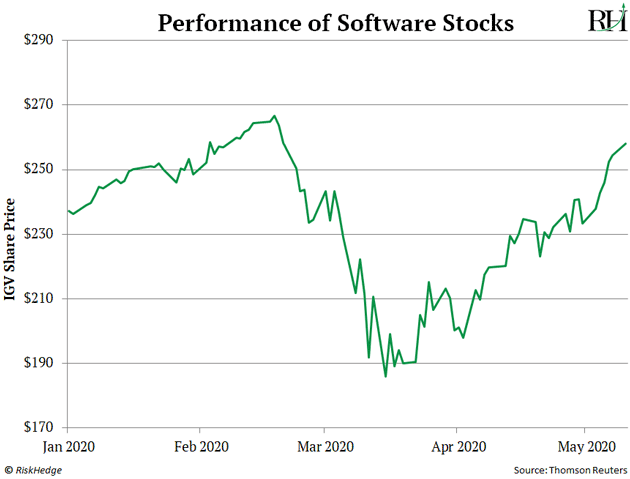

- Software stocks have also been red-hot…

This chart shows the performance of the iShares Expanded Tech-Software Sector ETF (IGV) this year. IGV invests in a basket of software stocks like Adobe (ADBE), Salesforce (CRM), and Microsoft (MSFT).

IGV has surged 46% since in March.

Like online retailers, software stocks were “leaders” before the market broke down. But these stocks are in even greater demand today due to the coronavirus.

And it’s not hard to see why.

Software makes businesses more efficient. These companies also make it easier for employees to work from home.

Many of these companies also sell their software on a subscription basis. Their customers pay a monthly subscription fee for access, instead of buying software outright.

Because of this, many software companies enjoy predictable and dependable revenue streams. That makes them safer bets during uncertain times like we face today.

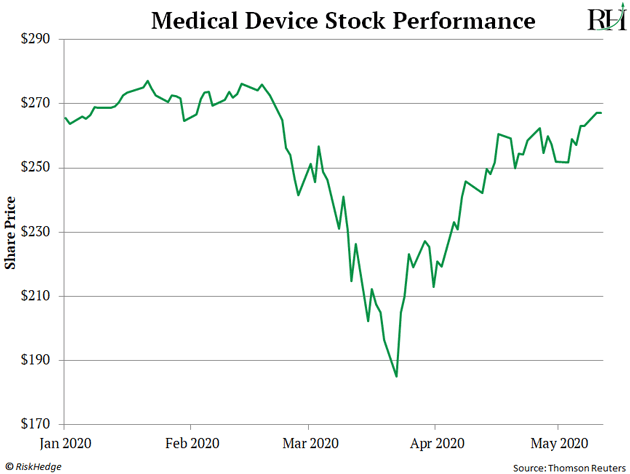

- Medical device stocks have also been high-flyers…

Medical device companies make products that help diagnose, prevent, and cure diseases. They sell everything from artificial joints to robotic surgery systems.

You can see below that the iShares U.S. Medical Devices ETF (IHI) has rallied 46% since March. Medical device stocks outpaced the S&P 500 by more than 2-to-1 during that stretch.

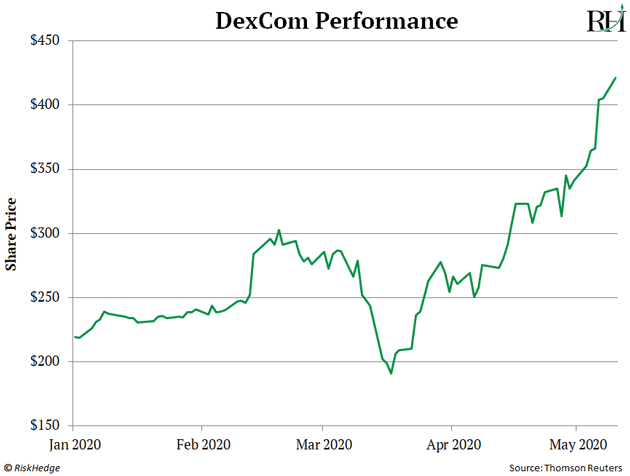

DexCom (DXCM)—one of my favorite medical device stocks—fared even better.

Dexcom makes glucose monitoring systems. Its devices help people living with diabetes monitor their glucose levels. You can see that it’s surged more than 50% since I encouraged readers to buy it on April 14.

Tandem (TNDM) and Insulet (PODD)—two other diabetes stocks that I highlighted in that RiskHedge Report—have rallied 36% and 21%, respectively. Both stocks are now trading at record highs!

And Livongo (LVGO)—my #1 “diabetes” stock—has skyrocketed 112% since I recommended it in my advisory IPO Insider in February.

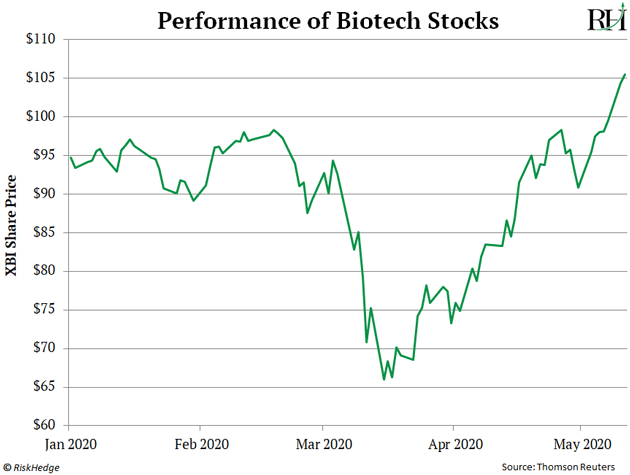

- Biotech stocks are also roaring higher…

The chart below says it all.

You’re looking at the performance of the iShares Nasdaq Biotechnology ETF (IBB) this year. IBB invests in a basket of biotech stocks, including industry titans like Gilead (GILD) and Amgen (AMGN).

Biotech stocks have rallied 10% this year, and 70% since March! They’ve absolutely obliterated the S&P 500.

Smaller biotech stocks have done even better. Moderna (MRNA)—a recent IPO—has surged 242% this year, while Inovio Pharmaceuticals (INO) has surged 260%!

Money is pouring into biotech stocks for a simple reason.

Scientists around the world are frantically developing treatments and vaccines for coronavirus. According to the New York Times the pharmaceutical industry is currently working on roughly 90 vaccines

- Unfortunately, most investors have missed out on these breathtaking rallies…

And it’s because all they’re fixated on is the bad news.

They’re not focusing on the big picture.

As I showed you, key groups of stocks aren’t just weathering the storm… they’re thriving!

Now’s the time to be invested. But it’s more important than ever to put your money in the right stocks.

I suggest betting on “leaders” in industries riding multi-year megatrends. This is by far the No. 1 way to make a killing in months and years ahead.

Justin Spittler

Editor – IPO Insider

Omaha, Nebraska