Energy investors have been taking a beating.

Well, not all energy investors… just the ones investing in what I like to call “dinosaur energy stocks.”

Dinosaur energy stocks include oil, natural gas, and coal companies. These used to be the stocks to own. Investors loved them for their steady revenues and generous dividends.

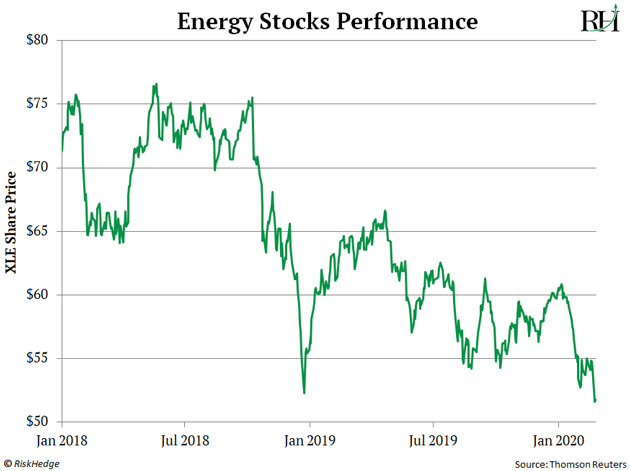

But these once iconic businesses are no longer loved. They’re HATED. Many investors want nothing to do with them, as you can see below.

You’re looking at the performance of the Energy Select Sector SPDR Fund (XLE) since the start of 2018. This fund invests in giant energy companies like Exxon Mobil (XOM) and Chevron (CVX).

XLE has plunged 22% since last April… and a gut-wrenching 32% over the last two years.

Exxon – America’s largest energy company – has done even worse. It’s plunged 38% over the past two years and is now trading at its lowest level in 15 years!

But it’s not all doom and gloom in the energy sector…

- There’s a specific type of energy stock that’s quietly minting fortunes…

And today, I’ll explain how you too can collect fat profits.

Don’t worry. You don’t need to short, or bet against, oil and gas stocks.

You can do something much simpler

I’m talking about investing in “green energy” stocks…

As I’ll show you, the appetite for green energy stocks is through the roof right now – and this trend will only get stronger from here.

But don’t just take my word for it…

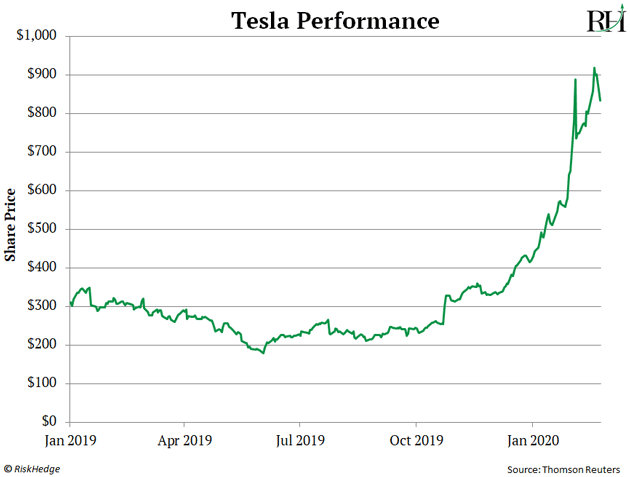

- All you have to do is look at a recent chart of Tesla (TSLA)…

Tesla is one of the world’s hottest stocks. It’s nearly tripled in value since November, and has skyrocketed 400% since last June.

Its monster rally is a clear sign that green energy stocks are where you want to be right now.

You see, Tesla is more than just the world’s largest electric carmaker.

Tesla is a green energy company at its core.

In addition to making electric cars, it’s also a rising player in solar energy.

See for yourself. The “shingles” on that house are Tesla’s new solar panels!

Source: Tesla.com

Tesla’s also pioneering battery storage technology. In fact, its innovative Powerwall battery accomplishes the difficult feat of capturing and storing energy collected from solar panels.

But Tesla’s not the only green energy stock soaring.

- Many other green energy stocks have gone ballistic lately…

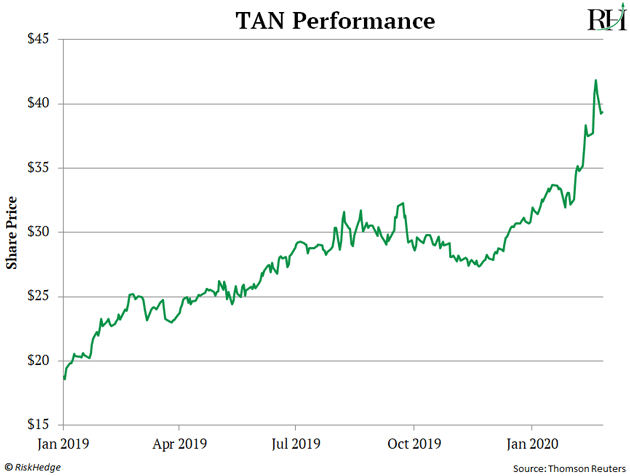

The Invesco Solar ETF (TAN) – a fund that invests in a basket of solar stocks – has surged 70% over the past year…

Many investors were completely blindsided by this. But RiskHedge readers saw this huge move coming months ago.

In a September RiskHedge Roundup, we explained how solar stocks were “the lone bright spot for energy investors.” Since then, TAN has spiked 104%. That’s a tremendous move.

- But individual solar stocks have done even better…

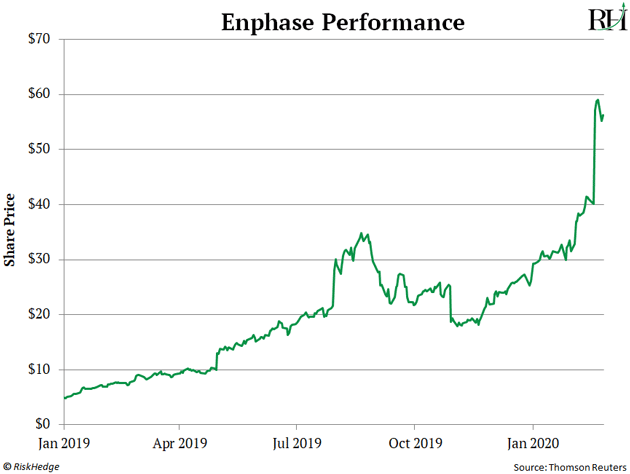

Enphase (ENPH) has skyrocketed 95% since the start of the year, and an incredible 657% over the last 12 months!

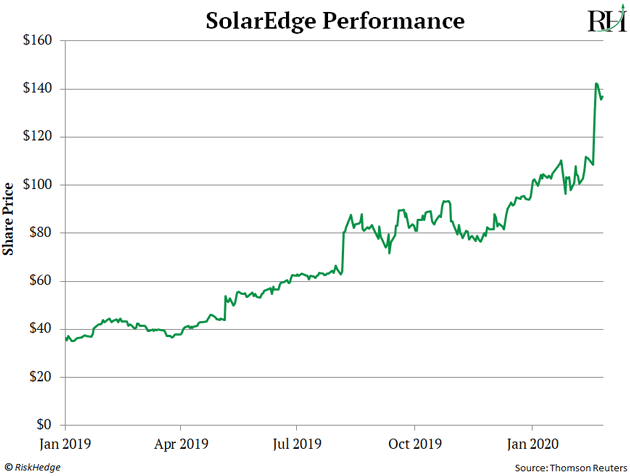

SolarEdge (SEDG), another red-hot solar stock, has exploded 34% higher this year… and 239% since last February.

In other words, “energy investors” weren’t betting on the wrong sector…

They were buying the wrong stocks.

You see, XLE doesn’t hold any of the stocks I just mentioned. It only invests in the dinosaur energy stocks.

Because of this, most investors have no clue that the energy sector is making savvy investors a fortune.

- And it’s not just solar stocks that have been on a tear…

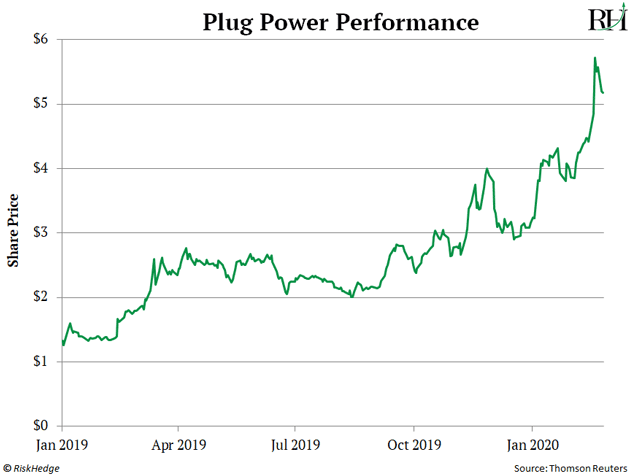

Look at this chart. It shows the performance of Plug Power (PLUG) – a hydrogen fuel cell company. It’s soared 268% since the start of 2019.

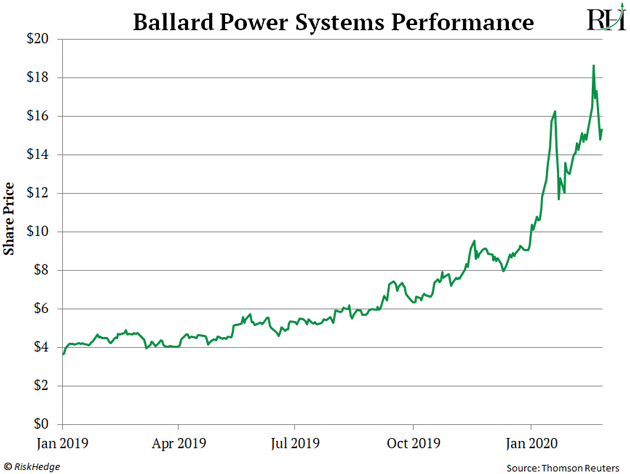

Fellow fuel cell stock Ballard Power Systems (BLDP) has also defied gravity recently. It’s skyrocketed 282% over the same period.

- Of course, I know you don’t read the RiskHedge Report to find out what happened yesterday…

You want to know where the market’s headed.

But I can practically guarantee that green energy stocks will be big winners for years to come.

How do I know?

One word: millennials.

Their habits and values all but ensure this massive trend will accelerate.

I say this for a few reasons…

- For starters, just look at the current climate change debates….

Now, I’m not going to tell you what you should or shouldn’t think about climate change. But the reality is a lot people are deeply concerned about climate change. In fact, it’s the No. 1 issue for nearly half of millennials. It’s far more important to these young people than war or even income inequality.

This has massive implications on spending habits.

Many young people today will pay a premium to own a Tesla. They’ll also pay extra to have solar panels installed on their home. These purchases make them feel like they’re “doing their part.”

And this will only continue….

The wealth held by millennials is poised to grow nearly 5x over the next decade.

By 2030, millennials will be worth $20 trillion.

The richer millennials get, the more they’ll spend. Goldman Sachs (GS) expects millennial spending to grow 17% over the next five years. Meanwhile, baby boomer spending will drop 10% during that period.

- Investor appetite for green energy stocks will also explode…

Think about it. The more money millennials make, the more they’ll invest.

MSCI – which manages some of the world’s biggest stock indices – believes millennial investors could put between $15 trillion and $20 trillion into U.S.-domiciled environmental, social, and governance (ESG) investments over the next couple decades.

Keep in the mind, the current U.S. stock market is worth around $27 trillion. So, we’re talking about some serious money.

- None of this is good news for dinosaur energy stocks…

Now, that doesn’t mean oil and gas stocks can’t rally from here. But any rally will be short-lived.

These stocks are in a death spiral. I believe Exxon and Chevron will bleed market value over the next five years.

These are NOT trends you want to bet on. You’d be much better off betting on green energy stocks. They have much more working in their favor.

The simplest way to get exposure to this megatrend is by buying a clean energy ETF. And TAN – the solar ETF – is a personal favorite of mine.

- Just understand that solar energy stocks have been on an absolute tear…

So, wait for a healthy pullback before taking a position.

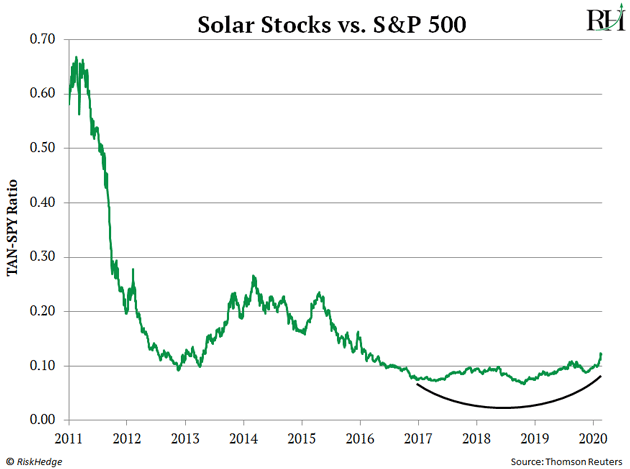

But make no mistake. The future is bright for solar stocks. In fact, I expect them to outperform the broad market for years to come. To understand why, look at this chart. It compares the performance of TAN compared with the SPDR S&P 500 ETF (SPY).

When this line is rising, it means solar stocks are outperforming the S&P 500. When it’s falling, solar stocks are lagging the market.

You can see that solar stocks underperformed the S&P 500 for years. But the tide turned in late 2018. Since then, TAN has beaten the S&P 500 by more than five-fold.

I expect this to continue. After all, this key ratio has put in both higher highs and higher lows since then. This is extremely bullish. It tells us solar stocks should outperform the S&P 500 for years to come.

Justin Spittler

Editor – IPO Insider

Omaha, Nebraska