Back in 2022, I was part of a private discussion with Marko Papic…

If you don’t know the name, few people on Earth are as qualified to talk about how war affects stocks as Marko.

He’s been studying geopolitics and markets for more than a decade. He wrote the book “Geopolitical Alpha: An Investment Framework for Predicting the Future.”

During the discussion, he said, “You should just buy every time there is a geopolitical conflict. There are only 1 out of around 80 events where this hasn’t been the case.”

After US forces bombed three key nuclear sites in Iran this weekend, I wanted to take this a step further, so you know exactly what to expect in case stocks sell off in the coming days.

My team and I looked at over 50 major geopolitical and warlike events since the 1950s…

And, more important, what happened to stocks during each event.

Here’s what we found:

- US stocks tend to fall at the outbreak of war… and then almost always recover quickly from these plunges.

Specifically, our research found stocks typically drop around 10% in the days following the start of a conflict.

But one year after the onset of the war, they gain 11%, on average.

In other words, if history holds true, any weakness in stocks will be short-lived.

Let’s look at some examples…

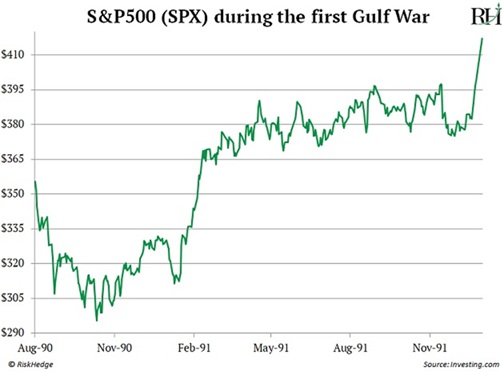

Here’s how the S&P 500 fared during the first Gulf War in the early 1990s:

Stocks fell 20% when the war broke out. But they then rallied 10% over the next year.

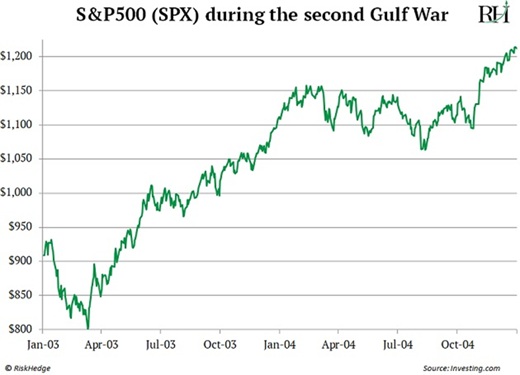

Here are US stocks a decade later, during the second Gulf War:

Again, stocks fell in the beginning but rallied 26% over the following 12 months.

US stocks followed this pattern the last time conflict broke out between the Ukraine and Russia, in 2014:

You can see the right decision during all these events was to buy, not sell.

Now, stocks did fall for most of the year after Russia invaded Ukraine in February 2022. But remember: They were also caught up in the worst bear market since 2008. Everything plummeted that year.

Fast-forward to today, and stocks have risen 38% since the attack.

- When the guns start firing… get out your shopping lists.

Look, I’m not downplaying war.

But this is an investment letter. We’re here to make money.

And the facts are clear: The absolute worst thing you can do is panic and sell.

Of course… there’s always a chance that markets won’t follow historical patterns.

What if Iran attacks the US and this war isn’t like the others?

|

What if it defies the odds and crashes the stock market?

It’s a valid concern. But that’s the nature of stock market investing. There’s always some potential disaster looming.

We, as long-term investors, get paid to accept this short-term risk.

We acknowledge and respect the fact that the market can decline 20% at any time for any reason, or for no reason at all.

So we don’t use leverage. We own world-class businesses, like those in the Disruptor 20, that will overcome any setback and continue to compound wealth.

So while it feels more natural to hit the sell button... history has shown us time and time again that you want to buy during these times.

- So, what types of stocks do you buy?

Most will pile into the “Big 5” defense contractors like Lockheed Martin (LMT), RTX Corp. (RTX), and Northrop Grumman (NOC).

But as I wrote, these stocks are past their prime. It’s best to avoid them.

If you are investing in war stocks, buy those outside of the US. You can learn about the top ones here.

More broadly, you want to use any stock market corrections that result from the conflict with Iran to your advantage.

Look to invest in high-quality businesses profiting from disruptive megatrends like artificial intelligence, robotics, blockchain, biotech, drones, and so on.

Stephen McBride

Chief Analyst, RiskHedge