As I (Chris Reilly) write you on December 15, we’re winding down another good year for stocks.

The S&P 500’s up 16%... the tech-heavy Nasdaq’s risen 20%... and many of the recommendations in our RiskHedge premium advisories have climbed much higher.

For example, in Disruption Investor, Stephen McBride and Chris Wood’s solar play, Nextpower (NXT), is up 110%. Artificial intelligence (AI) staples Nvidia (NVDA) and Taiwan Semiconductor (TSM)—which we’ve been in since 2020—continue to power along, both up 30%+. And CrowdStrike (CRWD), part of our “build your own” cyber ETF, has jumped 48%.

Disruption_X, our advisory that targets small fast-growing stocks, has been even more impressive. Subscribers have locked in profits on three stocks that at least doubled, along with a string of double-digit gains in small AI, robotics, and space stocks.

And Justin Spittler is once again leading our trading services to a strong year. His recent standout was Bloom Energy Corp. (BE), which more than doubled in just three months.

How did 2025 treat your investments? Let me know at chrisreilly@riskhedge.com.

But today...

- I’m going to talk about a hard truth that often gets swept under the rug.

While 2025 has been a good and profitable year… it wasn’t “easy” by any means.

Let’s rewind nine months. It’s easy to forget about this red circle...

When Trump’s tariff announcements plunged the Nasdaq into a bear market. It was bad. How bad?

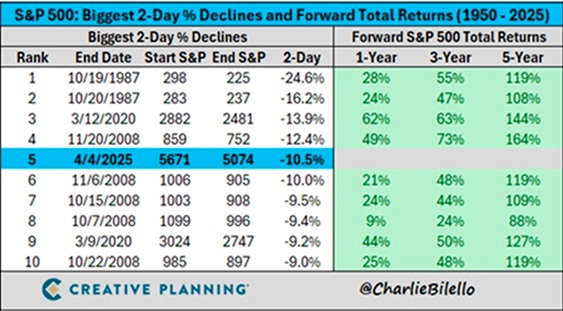

The S&P 500 crashed 11% in two days. Since 1950, the market’s only experienced that kind of rapid decline three other times: Black Monday in 1987, the financial crisis in 2008, and the COVID lockdown crash of 2020.

Markets were in a precarious spot, right up there with some of the most traumatic wealth-destroying times of the last 75 years.

- This is where most financial newsletters fall short.

To give you some background, I’ve been in this business for almost 13 years. I’ve overseen the editing of probably 5,000 newsletter issues, alerts, and daily emails… including the work of some famous investors.

So, I like to think I have more insight on this than most.

And hands down, here’s what I hate most about the newsletter industry...

All gurus are quick to celebrate big gains.

But when things get tough... like they did earlier this year... too often, all you hear is “crickets.”

|

Communication dries up. Alerts stop hitting your inbox.

When you need guidance most, you’re all alone.

Maybe you know what I’m talking about. Maybe you’ve paid for newsletters like that before...

I don’t mean to rant... and I know gurus who “ghost” their subscribers at the worst possible time aren’t necessarily bad people.

It’s simply human nature. Many folks can hardly wait to log into their brokerage account in the morning and look at how much money they’re making... when markets are strong.

But when markets are bleeding red... a different part of the brain takes over. Many folks will avoid looking at their account statements for weeks on end.

Financial professionals—from hedge fund managers to newsletter writers—are human too. Like all humans, they want to avoid confronting pain.

Delivering bad news is painful. And so many will procrastinate—or outright avoid—picking up the phone or sending an email alert to guide their clients.

It took me years to realize this, but now I’m certain...

- The hardest part of our job is also the most important part of our job:

To help subscribers through tough times.

And while our editors have led our subscribers to some great profits this year, I’m most proud of how they guided our subscribers through the March/April selloff.

During that time, Stephen and Chris Wood held a members call for Disruption_X subscribers covering the state of the market and more. Chris said:

It's wild times right now, but the most important thing to do is tune out the noise as much as you can. Don't pay attention to “hot takes” from social media gurus or headlines from mainstream financial reporters. It just confuses otherwise smart people into doing dumb things with their money.

You don't need to think back far, just to the tech selloff of 2022. Tons of folks cut amazing stocks like Nvidia (NVDA) from their portfolios because they believed the headlines that tech was dead, AI was a fad, all that nonsense. NVDA is up 1,000% since then.

Many other great tech/AI names are up 100%, 200%, 300%. So many investors got left behind because they were scared by doomsdayers who sounded smart.

See what I mean? As an investor, what you do in pivotal moments like March 2025 can decide your wealth for years to come. Clear, calm, frequent guidance during these times is priceless.

You will find similar guidance in all of our publications. In Disruption Investor, Stephen and RiskHedge publisher Dan Steinhart sent a special video message urging subscribers to avoid stocks that need hype to produce gains and instead stick with world-class disruptors that will continue to grow revenues and profits.

Justin Spittler, who approaches markets with a shorter-term trader’s mentality, was warning his premium subscribers about severe weakness under the surface as early as February.

I’m no guru, just a writer and editor. But I tried to do my part by sharing an excerpt of research from analyst Charlie Bilello in early April.

He calculated the subsequent returns for stocks following the worst two-day crashes in history. He found stocks were up 100% of the time one, three, and five years later. Here’s the table I shared at the time:

Source: @CharlieBilello on X

My conclusion? Don’t panic and hold onto the great businesses in your portfolio. Stocks have surged 41% since then.

- No one should have to “go it alone.”

It’s important to have a guide you can trust. In both the good times and the bad.

Here at RiskHedge, we’ll continue being there for you in 2026 and beyond.

Chris Reilly

Executive Editor, RiskHedge