Longtime RiskHedge readers know I’m not a fan of the big defense “primes.”

Companies like Boeing (BA) and Lockheed Martin (LMT) used to be true cutting-edge innovators.

Lockheed alone invented: the world’s first stealth fighter… high-altitude surveillance planes that fly near the edge of space… and my personal favorite plane of all time, the SR-71 Blackbird which could fly over three times the speed of sound.

Unfortunately, these once great companies have turned into sclerotic, slow-moving bureaucracies run by accountants and lawyers.

“Sclerotic, slow-moving bureaucracies run by accountants and lawyers.”

That’s exactly how I’d describe Europe too!

Not exactly the most enticing setup for investors, right?

Well… something very interesting is happening in the European defense industry.

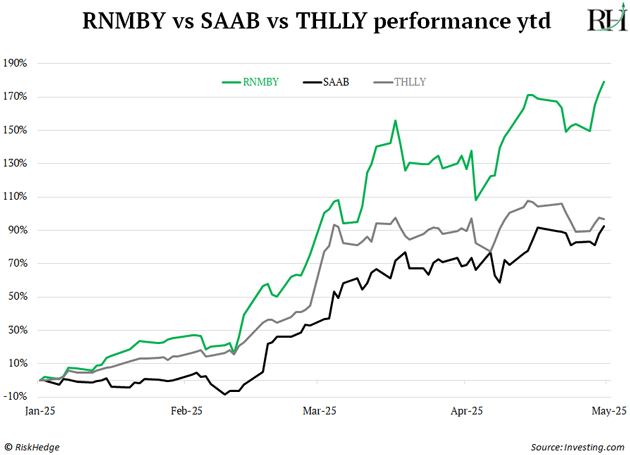

Look at this chart. It shows the year-to-date performance of three of Europe’s largest defense companies: Germany’s Rheinmetall (RNMBY), France’s Thales (THLLY) and Sweden’s Saab (SAAB).

These companies didn’t invent some new world changing artificial intelligence (AI). They’re profiting off what could be one of the most disruptive trends over the next decade: the new global arms race.

Governments in Europe and around the world are boosting defense spending for the first time in 30+ years. And they’re not writing checks to Boeing and Lockheed Martin.

Instead, they’re handing it out to their own homegrown companies.

|

Let me show you how to take advantage of this opportunity.

-

America is done playing world policeman

I often joke I’m de facto American. But as someone who (currently) lives in Europe and chats with many European investors, the Trump-Zelensky car crash meeting at the end of February was a watershed moment.

Trump and JD Vance made it crystal clear: “Guys, you have a mess. And we don’t want to deal with your mess.”

The demolition of a 75-year security arrangement was livestreamed around the world. It doesn’t matter whether you think this stance is right (for what it’s worth, I agree that America shouldn’t bankroll European security).

What matters is the market’s reaction.

Within days, Germany announced a €1 trillion stimulus plan, including €500 billion for defense. This is a bigger cash bazooka than the post-WWII Marshall Plan and German reunification in the early 1990s.

The UK, Italy, and France are all ramping up defense spending. Japan is doubling its military budget for the first time since WWII. Europe is even building its own version of Starlink.

This = trillions of dollars flowing into defense companies’ coffers.

-

But not into Boeing or Lockheed Martin’s…

The money is staying local.

Most of us don’t care where our t-shirts and sneakers are made.

But when it comes to weapons systems like fighter jets and missiles it kinda sorta matters where you buy them.

For the past few decades Europe spent tens of billions of dollars buying US war machines.

But in this new arms race, it’s strongly favoring “made in Europe.”

When governments build up their militaries, they don’t spread the cash around. They typically pick a couple of “national champions” and shovel truckloads of money their way.

In Germany, that’s Rheinmetall. Their core business is building tanks and armored vehicles. Now, they’re also making laser weapons that shoot drones out of the sky. As I showed you earlier, the stock is up 170%+ this year.

Rheinmetall just announced plans to build a new munitions factory every six months. Let that sink in. A new weapons plant, twice a year.

France has Thales. It’s Europe’s drone and anti-drone heavyweight. It makes unmanned systems and the tech to detect, jam, and disable enemy drones in real time.

The global arms race stretches outside Europe too. Elbit Systems (ESLT) is Israel’s national champion.

It helped create the Iron Dome. Now, they’re working on laser-based missile defense that zaps cheap drones and rockets at a fraction of the cost of interceptors. Its stock has jumped 59% this year.

These aren't one-and-done deals. Governments are signing multi-year, sometimes decade-long contracts to rearm from top to bottom.

-

Here’s my preferred way to profit from global rearmament.

I usually prefer to buy individual companies.

But pick a national champion from each country and you’ll end up with a portfolio of dozens of stocks or more.

We might look for which of these is the best for our Disruption Investor members in the future. (Upgrade here.)

For now, the easiest way to profit from the massive defense spending is to invest in an ETF like the Global X Defense Tech ETF (SHLD).

About half of the fund invests in defense stocks outside of the US. Rheinmetall, Leonardo, BAE Systems, Elbit Systems, and Thales are among its top 15 holdings.

For decades, Europe (and most of the world) treated its defense industry like a dusty museum exhibit. The continent was happy to outsource its military muscle to the U.S. and spend its money elsewhere.

That era is over. We’re witnessing the largest global military spending spree in over 30 years. Time to invest!

Stephen McBride

Chief Analyst, RiskHedge