*** Explaining “stock market gravity”…

*** Biggest driver of individual stock performance

*** Tom Brady and the Power Law…

Markets are down…

Portfolios are red…

And some investors are having trouble sleeping…

As you probably know, the US Federal Reserve is largely to blame. It recently announced it plans to hike interest rates more aggressively than many expected.

But what exactly does that mean for your investments?

Chief Analyst Stephen McBride explained in his brand-new issue of Disruption Investor:

Interest rates are the cost of money. And rising rates hurt borrowers. If you have a variable rate loan on your car, your monthly repayments might have inched up recently.

This recent uptick in rates caught many folks off guard. For the past two years the cost of money has been pinned to the floor. For example, 30-year mortgage rates hit a record low 2.65% last January.

Interest rates don’t only set the price of money. They also influence stock market valuations.

Super investor Warren Buffett compares interest rates to gravity: “Interest rates are to the value of assets what gravity is to matter.”

In other words, when interest rates are low, stocks can shoot for the stars. Simply put, low interest rates mean money is cheap. And when money is cheap, investors are more willing to risk it in the stock market.

On the other hand, rising rates can pull prices back down to earth.

That’s exactly what we’re seeing now. Since worries about rising rates began, tech stock valuations have collapsed 30%.

When the markets get shocked, it’s helpful to take a breath and look at the facts.

As you’ll see… there’s a lot to be optimistic about.

In Saturday’s Roundup I showed you how higher interest rates aren’t bad for stocks. In the 14 rising interest rate periods since 1955, stocks have risen 10% on average.

Today, we’ll look at two more important insights from Stephen…

-

For one, take a look at the 30-year mortgage rate...

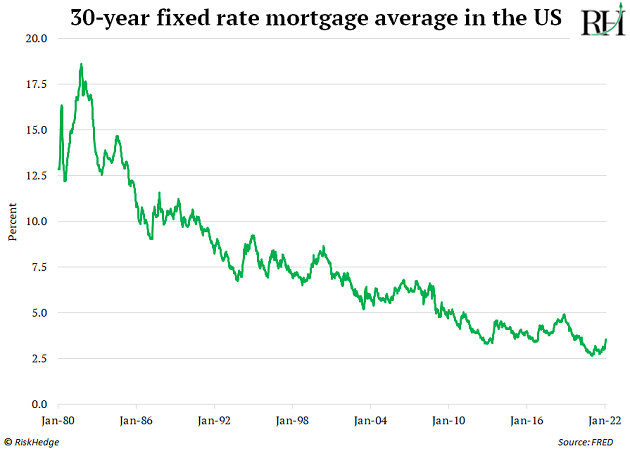

The chart below shows the 30-year mortgage rate going back to 1980.

You can barely make out the recent uptick:

Even though rates are up a bit, the cost of money is still lower than at virtually any other time in US history.

From Stephen:

Outside of the past 18 months, interest rates have never been lower. As Buffett said, “Interest rates are to the value of assets what gravity is to matter.” And today gravity is almost nonexistent. That continues to be great for stocks.

Yale’s Dr. Robert Shiller analyzed how stocks performed at various interest rate levels since the 1940s. He found when the US 10-year Treasury yield is 2% or less, as it is now, US stocks climbed 15.4% per year, on average.

If rates soar to 4%–5%, I’d be worried. But the current level of interest rates has been historically great for stocks.

And there’s another thing you should know…

-

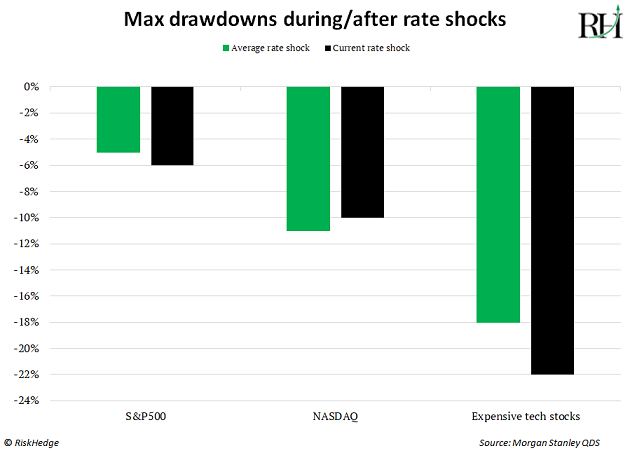

Stocks have already experienced an average “rate shock.”

A “rate shock” is when interest rates change suddenly. Wall Street powerhouse Morgan Stanley looked into how stocks fared during the past six rate shocks. It found the Nasdaq usually drops 11%, and “expensive” tech stocks fall 18% on average.

Well, the Nasdaq already dropped 16% during this rate shock, and expensive tech stocks already plunged 22%.

Here’s more from Stephen…

This is extremely important to understand. Stocks have already experienced an “average” rate shock. Even if this ends up equaling the worst rate shock ever, the market only has 5–10% left to fall.

It could get worse than that, but history tells us this is usually where stocks bottom out and start rising again. And I’d argue this rate shock is already overdone.

Remember, rising rates pull stock valuations back down to earth. Bloomberg data shows tech valuations collapsed 35% during this selloff. Many high-quality growth companies trade at or below where they were during the last rate shock in 2018.

Stephen’s seen this play out before. In September 2018, Stephen recommended Nvidia (NVDA). It declined over the next three months as interest rates rose. When the rate shock passed… Nvidia went on to 4X.

Of course, Nvidia also posted blistering sales growth of 123% since September 2018.

Which leads me to my next point…

-

Morgan Stanley dug into the biggest drivers of stock returns since 1990…

Although interest rates are like gravity for the stock market as a whole… there’s a far more important driver of individual stock returns.

Morgan Stanley’s study found 78% of a stock’s performance is driven by profit and sales growth over any five-year period. That figure jumps to 90% when you zoom out a decade.

Stephen continued: “The Morgan Stanley data shows us a company’s ability to grow profitably is a 10X more important indicator of its future stock price than whether Treasury yields are at 1% or 2%.”

-

Before I sign off today, let me tell you why I’m breathing a sigh of relief…

The greatest quarterback of all time is officially retiring.

I’m a New York Jets fan. So I was happy to hear Tom Brady, the man who has crushed my team for over two decades, is hanging up his jersey for good.

Not only has Brady won more Super Bowls than any other player. His seven wins are more than every other team!

You might think this has nothing to do with investing. But behind Brady’s success is an obscure mathematical principal known as the Power Law.

This principle explains why just two teams, the Boston Celtics and the Los Angeles Lakers, have won nearly half of all the championships in NBA history...

Why even more wealth flows to the already rich 1%...

And why only a small fraction of stocks like Apple and Amazon generate almost all of the stock market’s returns.

Chris Reilly

Executive Editor, RiskHedge