Stocks got clobbered yesterday.

Well, not at the index level.

The S&P 500 (SPY) finished the day down just 0.5%, while the Invesco QQQ Trust (QQQ) dropped 1.3%.

These aren’t alarming figures. Pullbacks like this happen all the time.

So, why are many referring to yesterday’s action as a “bloodbath?”

Simple. Growth stocks got slammed.

Palantir Technologies (PLTR)—one of the world’s leading artificial intelligence stocks—finished down 9%. Nvidia (NVDA) slid 3.5% and finished below its 21-day moving average for the first time since April.

Plenty of other leaders got clipped as well, some suffering double-digit percentage closes.

This is a concern because leaders convey a lot about the overall market, including risk appetite. But they don’t tell the whole story.

Market breadth was actually quite strong yesterday.

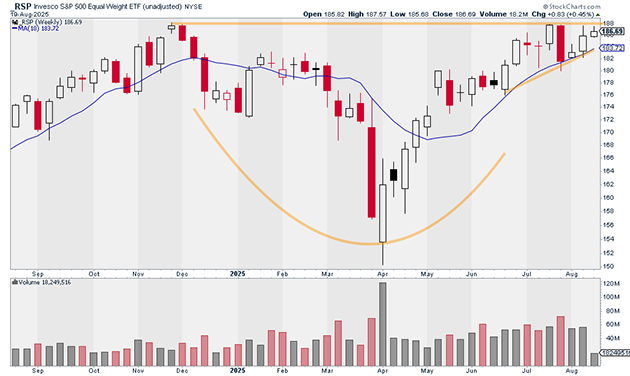

The Invesco S&P 500 Equal Weight ETF (RSP)—a fund that equally tracks the performance of every stock in the S&P 500—climbed 0.5% yesterday.

The number of stocks in the S&P 500 above their 20-day moving averages jumped 16%. The number above their 50-day moving averages rose 8%. And the number above their 200-day climbed 3%.

What’s even more encouraging is that RSP appears to be on the verge of a major breakout. It would be hard to get bearish if that happens.

Source: StockCharts

Source: StockCharts

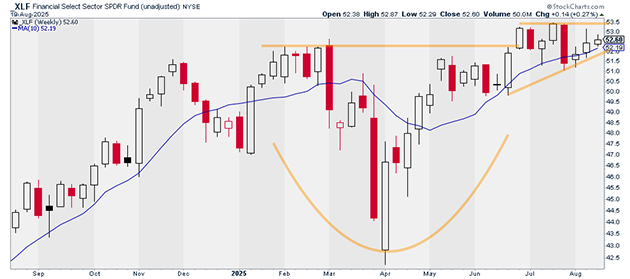

Financials also showed strength yesterday. The Financial Select Sector SPDR Fund (XLF) finished yesterday up 0.2%.

Financials are one of the most important “risk on” sectors. If they’re performing well, I can’t be too worried about the market… even if growth stocks are taking a breather.

And like RSP, XLF also appears to be on the verge of a breakout:

Source: StockCharts

Source: StockCharts

What should we take away from this…?

I don’t think yesterday’s selloff was a warning shot. It was an invitation to look at other corners of the market.

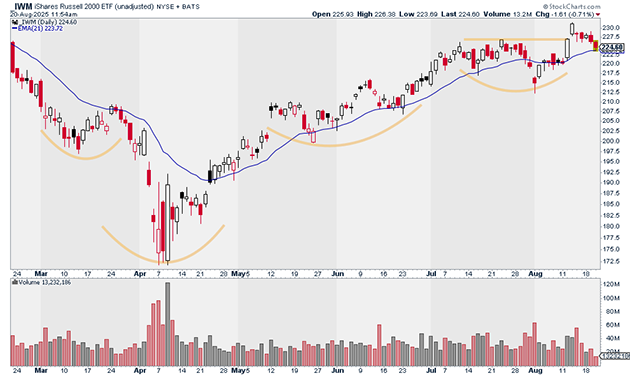

One area to look at is small caps.

Last week, the iShares Russell 2000 ETF (IWM) gained 3.1%. It massively outperformed both SPY and QQQ.

Source: StockCharts

Source: StockCharts

This is a big deal. Small caps are, by their nature, riskier than large caps. They’re less-proven companies.

Many small caps only work in the “right” conditions, like when interest rates are falling or are expected to fall.

Justin Spittler

Chief Trader, RiskHedge