My warning is coming true… “When the going gets tough, you lie”… US banks are more than half a trillion dollars in the red… Banks shortchanged their clients; now they’re paying the price… Trade your dollars for these two assets…

- I warned you this would happen when Silicon Valley Bank collapsed in March…

I said there was a real chance dozens of US banks would go belly-up in the coming weeks.

Now, I’m afraid my prediction is coming true…

Last week, First Republic Bank—America’s 18th-largest bank—went under. This was the largest bank failure since the 2008 financial crisis.

And it probably won’t be the last.

In today’s issue, I’ll show you exactly why formerly sturdy banks are dropping like flies…

And the two best ways to guard against this risk.

- Did you catch Fed Chair Jerome Powell’s big lie last week?

This is the guy in charge of the stability of the US financial system.

At the official presser, Powell was asked about the health of US banks.

He called them “sound and resilient.”

This reminds me of what Jean-Claude Juncker, former president of the European Commission, said about financial crises:

“When things are serious, you have to know how to lie.”

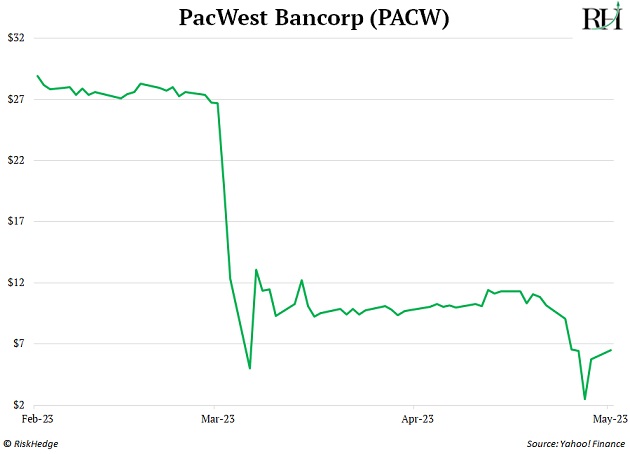

A day after Powell’s presser, news emerged that PacWest Bancorp (PACW), a bank with $40 billion in assets, was in trouble. The stock crashed 50% the next day.

PACW has plummeted 89% in the past three months...

And it’s not the only bank stock under pressure…

First Horizon Corp. (FHN) nosedived 59%:

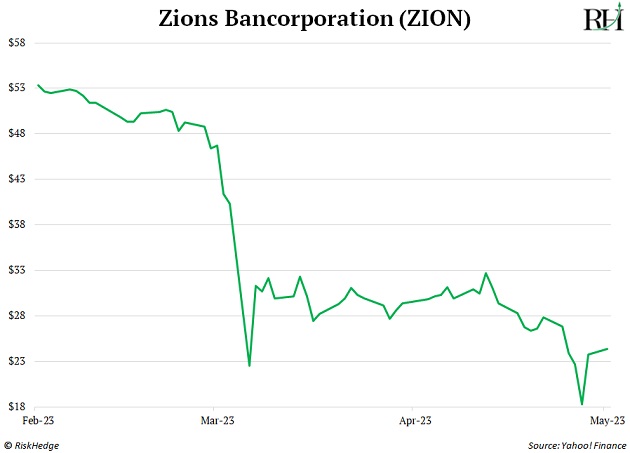

Zions Bancorporation (ZION) plunged 63%:

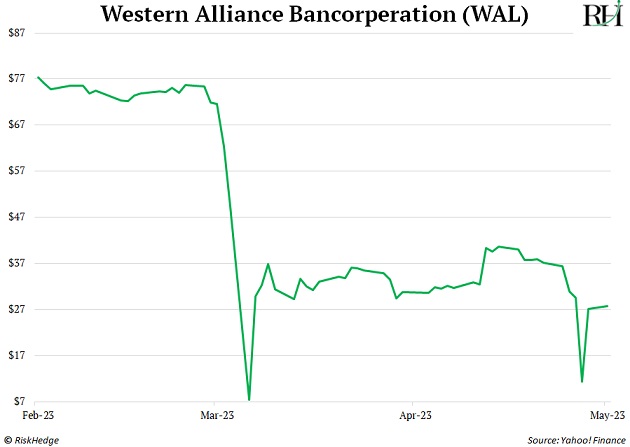

Western Alliance Bancorporation (WAL) cratered 77%:

And I could list dozens more.

Stocks of firms in “sound and resilient” industries don’t crash like that.

- This is the inconvenient truth Powell is hiding…

America’s banks are sitting on $620 billion in losses.

That’s because their investment portfolios are loaded with US bonds. And if you remember, 2022 was the worst year for US bonds on record.

It pushed their bond positions more than half a trillion dollars in the red.

In normal circumstances, this wouldn’t be such a big issue, because the losses are “unrealized.”

In other words… the banks haven’t actually lost that money. It’s only a representation of the amount of money they would lose if they were forced to sell their bonds.

The problem is banks’ clients are forcing them to sell their bonds now.

For the first time since the Great Depression, the US is dealing with bank runs. Folks are withdrawing their deposits in droves.

And the only way for banks to cough up the money is to dump their bonds and “realize” the losses.

- Banks did this to themselves by shortchanging their clients…

Bank runs began long before the media reported on it… although it’s been more of a walk than a run.

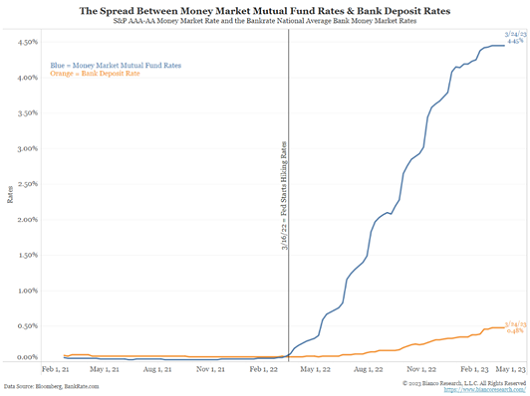

Folks have been withdrawing money from banks for over a year… simply because most banks are not paying a fair rate on savings.

Most banks offer just 0.5% to 1% yield on their deposits. Meanwhile, you can easily get 4% to 5% by shopping around. Or by buying T-bills yourself and circumventing banks entirely.

My colleague Dan Steinhart recently shared a story about how a bank tried to scam his mom this way.

As you can see below, the average rate paid by banks on CDs (orange line) has barely budged… while the rate on the average money market fund has soared (blue line).

(Click to enlarge)

Source: Bianco Research

As long as that huge gap remains, folks will continue withdrawing deposits… banks will be forced to sell their bond holdings at a loss… and this crisis will persist.

- I’ll reiterate my warning from one month ago:

Get some of your money out of US dollars right now.

I won’t recap my whole argument (you can read it here). But in a nutshell, the US government will do whatever’s necessary to bail out any banks that go bust.

It’ll tax. It’ll borrow. It’ll create money from nothing, if necessary… thereby torching the value of the US dollar.

To be clear, I hope my scenario is wrong.

I hope no more US banks go belly-up.

Odds are this crisis will pass without exploding into a full-blown banking meltdown that rapidly devalues the US dollar.

But the chances of this happening are higher now than at any point since 2008.

So I recommend making two “asymmetric” investments—small bets that can pay off big if we spiral into a nightmare banking crisis.

- It’s time to buy Bitcoin (or Ethereum) and gold…

Why?

They exist outside of the banking system.

You’re not relying on some Wall Street bank to keep your gold or crypto safe. You can buy physical gold and hold Bitcoin in your own private “cold” wallet.

If the banking system goes bust, those assets will still be in your possession.

Most important, the Fed can’t decide to print more gold or bitcoin, like it can with US dollars.

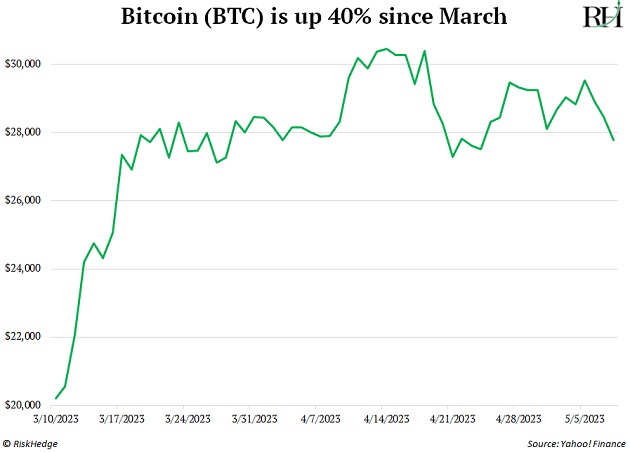

Bitcoin has surged roughly 40% since Silicon Valley Bank went bust on March 10…

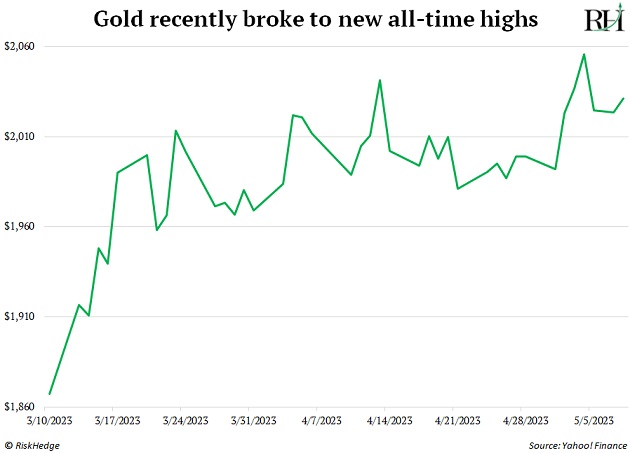

Gold has jumped roughly 8%. Last week, it even broke to new all-time highs…

Regardless of what happens with banks, my research suggests crypto and gold are poised to outperform this year.

Stephen McBride

Chief Analyst, RiskHedge

PS: What do you think the safest asset is right now? Let me know at stephen@riskhedge.com.