Silicon Valley Bank was just the beginning… $620 billion in “unrealized” losses… The US government’s dangerous new precedent… Trade your dollars for these two assets…

If your bank fails, you’ll be bailed out. BUT…

Today’s essay isn’t about a new disruptor. Or artificial intelligence upending America’s most broken industries.

It’s about something much more urgent.

As I’ll show you... There’s a small but real chance dozens of US banks go belly-up in the coming weeks. And what follows would destroy the value of your hard-earned savings unlike anything we’ve seen over the past few decades.

I’ll lay out the facts and let you be the judge. I’ll also show you the two best investments you can make to guard against this risk.

- There are more “Silicon Valley Banks” lurking in the shadows.

In 2022, the US Federal Reserve hiked interest rates at its fastest pace ever, clobbering bond prices.

This led to the downfall of Silicon Valley Bank (SVB)—America’s 16th-largest bank—earlier this month.

SVB loaded up on US Treasurys when interest rates were at historic lows. But when rates surged, its bond portfolio took a beating.

Unfortunately, SVB isn’t alone.

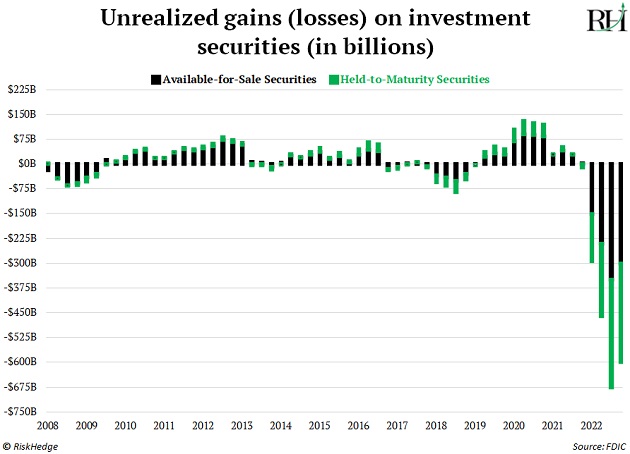

America’s banks are sitting on $620 billion in “unrealized” losses. In other words, if they sold these bonds today, they’d be more than half a trillion dollars in the red.

SVB racked up $17 billion in unrealized losses. This wasn’t a problem until customers started pulling their cash. As soon as they did, SVB was forced to sell bonds to “realize” these losses, sending it into a death spiral.

Today, dozens more US banks are nursing huge losses and hoping depositors don’t come calling for their money.

A Fed report from September 2022 shows 333 community banks may be short on cash to pay back depositors. That’s a massive jump from the four troubled banks it identified a year earlier.

- This warning sign is flashing “DANGER” for US banks.

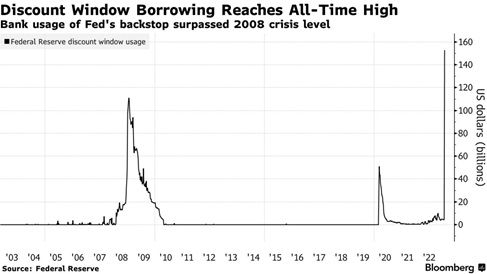

Ever hear of the Fed’s “discount window?”

It’s a system which allows banks to borrow money straight from the US central bank.

Banks only use the discount window when they’re really strapped for cash. That’s because it’s expensive. The Fed currently charges 4.5% to borrow from its discount window.

Last week, banks borrowed $152 billion through the discount window. That’s an all-time record.

In fact, it’s more money than the Fed lent to banks during the 2008 financial crisis:

Source: Bloomberg

This doesn’t mean US banks are insolvent. It tells us they’re tapping the Fed for record amounts of cash to make sure they’re not the next SVB.

- Stephen, are you telling me we’re headed for another financial crisis?

I doubt we’re headed for another “2008.”

But my research suggests there’s a roughly 10% chance dozens of smaller, regional banks go bust over the coming weeks.

Those seem like low odds, and they are. But the consequences are severe enough that you must be prepared.

- The US government has backed itself into a corner.

It guaranteed all Silicon Valley Bank deposits, which set a dangerous new precedent.

FDIC insurance, which was capped to $250K per account, is now essentially unlimited.

This is not codified into law (yet). But in rescuing SVB, the government saved many Silicon Valley millionaires from losing their deposits. I assure you it will do the same if, say, the Farmer’s Bank of Kansas implodes.

|

Co-founder of RiskHedge: "This is the surest, easiest-to-follow, and quickest-to-get-started way to beat the market with your core portfolio I’ve found. And it works particularly well in highly uncertain markets like we’re seeing today." Click to discover more about the strategy and how this little-known way of investing produced 302% returns in the worst markets of our lifetimes. (Monthly subscriptions available.) |

A new line in the sand has been drawn. Uncle Sam will backstop every deposit from every bank in every state.

Don’t worry about losing your money in a good old-fashioned bank run anymore. Here’s the real risk…

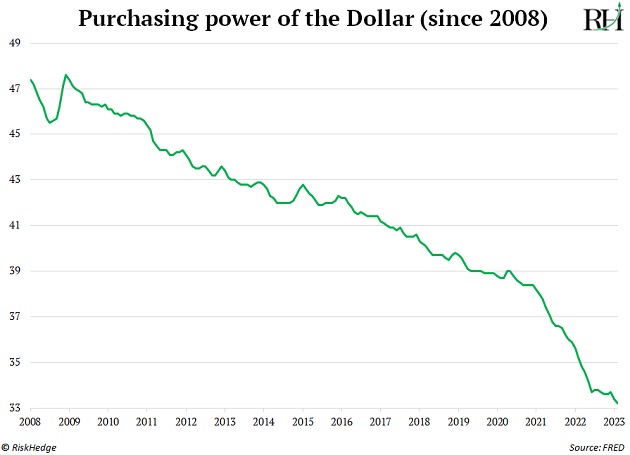

The US government prints so much money bailing out banks it torches the value of your hard-earned savings.

In other words, you’re guaranteed to get your money back. But those dollars will be worth a lot less than before.

This sounds radical. But it’s simply pouring gasoline on an already blazing fire.

The Fed’s own numbers show the mighty dollar lost roughly one-third of its value since bailing out Wall Street in 2008:

The Fed already printed $540 billion in the last two weeks to save a handful of banks. And as I showed you, more dominos might fall.

I wouldn’t be surprised if the “tab” exceeds $1 trillion.

- It’s time to get out of US dollars.

To be clear, I hope my scenario is wrong.

I hope no more US banks go belly-up.

And odds are, this crisis will pass without exploding into a full-blown banking meltdown that rapidly devalues the US dollar.

But the chances of this happening are higher now than at any point since 2008.

So I recommend making two “asymmetric” investments—small bets that can pay off big if we spiral into a nightmare banking crisis.

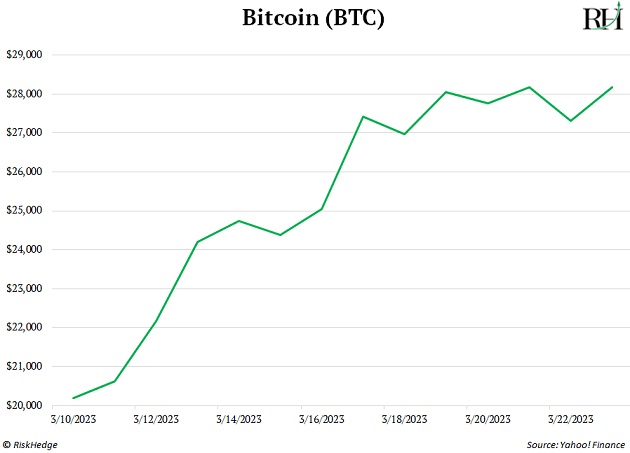

It’s time to buy some bitcoin (or Ethereum) and gold.

Why?

They both exist outside of the banking system.

You’re not relying on some Wall Street bank to keep your gold or crypto safe. You can buy physical gold and hold bitcoin in your own private “hardware” wallet.

If the banking system goes bust, those assets will still be in your possession.

Most important, the Fed can’t decide to print more gold or bitcoin, like it can with US dollars.

Bitcoin surged roughly 40% since SVB went bust on March 10.

Gold has jumped roughly 7%. It briefly crossed $2,000/ounce this week, and is a hair from all-time highs.

Regardless of what happens with banks, my research suggests crypto and gold are poised to outperform this year.

Stephen McBride

Chief Analyst, RiskHedge

P.S. What other methods are you using to protect your portfolio right now? Let me know at stephen@riskhedge.com.

In the mailbag…

Readers are still talking about our RiskHedge Report on ChatGPT and the death of college. Here’s what a few of your fellow subscribers had to say:

Thank you for the wonderful, insightful post on the disruption of university education, Stephen.

As a former educator—I taught one of the practical subjects: chemical engineering—I had finally had enough when I realized the university’s edict was to “retain” as many students as possible, even though many were not very prepared for university courses, didn’t want to study engineering, or did not want to put in the time and effort to learn it.

Education should be available to everyone who is willing to work hard and learn, not just those who are willing to sign loan papers.

I beg your readers to be very selective when choosing a university with their kids. Be sure to ask: “Where are the BOTTOM 50% of this year’s graduating class working right now. What are their job titles? What was their average starting salary, and how does this compare to the national average for college graduates earning the same degree?” If the department representatives cannot answer these questions or give a vague answer, that tells you the university does not truly value job placement.

I sincerely hope ChatGPT can take the place of and outperform traditional university teaching someday, as it can give opportunity to those who want it. —Marina

John said:

I think in-person teaching will need to continue for professions which involve injury risk, specifically medical and engineering. There are things that can only be learned by doing, and most traditional engineering/medical falls into that category. Can the memorization courses be automated? Yes.

It is interesting, as I’m thinking about a MS in electrical engineering, which is remote and is very inexpensive from a top 10 university. Much cheaper than moving to a city, trying to find a job, and having to commute to campus each day. —John

And here’s Chris’s take on the collapse of SVB:

I could not agree more about the Silicon Valley mess before us. I always wondered how these start-ups could get funding when they never made any money... and were not GOING to make any money in the near future.

I started and operated three successful businesses during my life and the only way I received loans was with collateral... and usually one to two times the value of the loan I wanted. I hope [there’s a] real lesson learned for the hoodie generation that "profit" is an essential element in running a successful business... and not at the expense of some hard-working individuals’ pension money. —Chris