I’m going to miss Uncle Warren.

After nearly six decades at the helm of $1 trillion giant Berkshire Hathaway (BRK-A), Warren Buffett will step down at the end of the year.

Buffett is simply the greatest investor of all time. He’s handed investors 5,500,000% gains since 1965. His run will never be topped, at least not in my lifetime.

And do you know what his “winningest” investment of all time was?

Apple (AAPL).

Buffett is sitting on roughly $120 billion in profits since he first bought Apple in 2016. That’s, ahem, excluding the $800 million-ish in dividends he was getting paid each year.

As he said last Saturday, “I’m somewhat embarrassed to say Tim Cook has made Berkshire a lot more money than I’ve ever made.”

One thing I’ve always loved about Buffett is that, for a long term investor, he knows when to hold em’ and when to fold em.’

Buffett has sold two-thirds of his Apple stake since last year. It’s Buffett’s last great trade. And I suggest you follow Uncle Warren out the door.

- Apple is a “big idea” disruptor.

It changed the world with the Mac. Then it did it again with the iPod. Then again with the iPhone.

I love Apple’s products. I own two Macs and an iPhone. The unboxing of a new Apple product feels magical. (Anyone who buys an Android or Window’s device, I’m sorry for your loss.)

But as an investor, I always ask, “What have you done for me lately?”

Apple hasn’t shipped a truly revolutionary product since 2007. The iPhone is now old enough to vote.

iPad and AirPods? Billion-dollar businesses but barely growing. They don’t really move the needle for Apple.

Recent “big idea” shots like the Vision Pro headset were total flops.

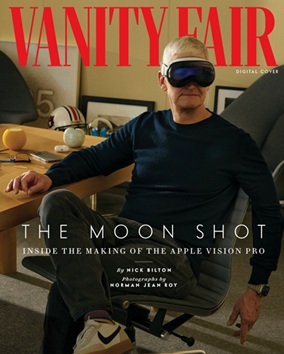

Remember all the hype around the Vision Pro when it launched? Tim Cook appeared on the cover of Vanity Fair:

Source: Vanity Fair

The headline story: “Why Tim Cook Is Going All In on the Apple Vision Pro”...

Cook recently said, “At $3,500, it’s not a mass-market product.” It was also reported that Apple could fully stop making the Vision Pro by the end of the year.

Do you know anyone who bought a Vision Pro? I don’t.

Apple is also having an artificial intelligence (AI) crisis. The Apple Intelligence features it’s rolled out so far are useless.

The “AI-powered” Siri it demoed last summer was just a computer-generated mockup and won’t be ready until 2027.

We’re sprinting into the biggest technology revolution since the internet, and Apple is nowhere to be seen!

|

Apple TV+ was another flop. Despite spending $20 billion on shows and movies, Apple’s streaming platform generates less viewings per month than Netflix (NFLX) does per day.

Topping it off, we have the Apple Car. Apple sank roughly $1 billion a year into a car it never built! The project was scrapped in early 2024. Big ooof.

- Did you see Apple’s earnings last week?

It sold $47 billion worth of iPhones last quarter. Impressive, until you realize that’s down from $51 billion two years ago for the same quarter.

iPhone sales are shrinking. Apple’s revenues have been flat for almost three years.

Apple also expects profits to take a $1 billion hit from tariffs next quarter. Who knows if tariffs will stick. But if they do, that billion-dollar hit is the least of its worries.

Tariffs will add hundreds of dollars to the bill for a single iPhone. This will force Apple to raise prices, which means fewer iPhones sold.

Guess what year iPhone sales peaked?

…2015.

A decade ago!

Apple was able to keep growing profits by hiking iPhone prices. Now, that trick has run its course too.

- Apple admitted it’s out of big ideas.

Apple is supposed to be an innovator. It invents world-changing products. Yet it’ll spend $100 billion buying back its own stock this year.

That’s great for investors in the short term. Fewer shares help push the stock price up, even when the business isn’t actually growing.

But buybacks are what companies do when they’ve run out of better ideas for their cash... when there are no new projects worth investing in. It’s corporate lingo for admitting, “We’re out of innovation.”

Hardware companies don’t get to coast forever. Remember Nokia… Blackberry… Motorola. All were once giants, toppled by better tech.

Despite Apple’s lack of growth and baron pipeline, its stock trades at a ridiculously high valuation.

Its price-to-earnings ratio sits at 27, a big premium over the S&P 500’s average of 21.

You could argue it deserves that, if it were still innovating. But it’s not.

Apple is no longer a disruptor. It’s a sitting duck waiting to be disrupted.

Warren Buffett, the greatest investor of all time, made his money and got out.

If you own Apple, you should too.

Stephen McBride

Chief Analyst, RiskHedge

PS: Apple isn’t the only big tech company that’s in trouble… In our latest issue of Disruption Investor, Chris Wood and I share why money is starting to move out of US big tech stocks—and where it’s going next.

Make no mistake: This is likely the biggest market rotation we’ve seen in 15+ years. And now’s the time to prepare.

Go here to upgrade to Disruption Investor and read our full analysis.