You ever get the feeling things just aren’t right in America?

The cost of living is out of control. A small group of people seem to make most of the money, while the average guy can barely keep his nose above water.

None of this is new, of course. While it may be approaching a boiling point, this ugly trend has been entrenched for about 50 years, since 1971.

So… WTF happened in 1971?

Wtfhappenedin1971.com is one of my favorite websites. It’s a collection of dozens of charts showing that something undeniable and insidious was set in motion in America in 1971.

Here are three:

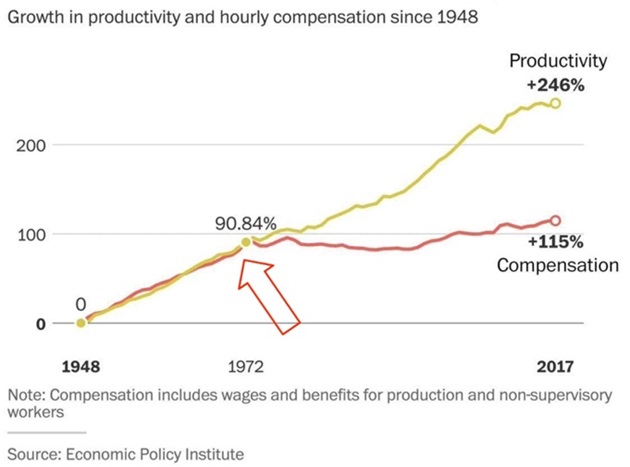

Wages detaching from productivity…

Source: Economic Policy Institute

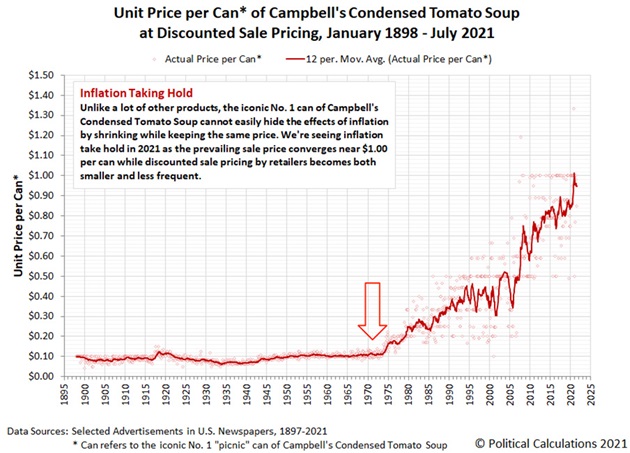

Endlessly rising prices…

Source: Political Calculations

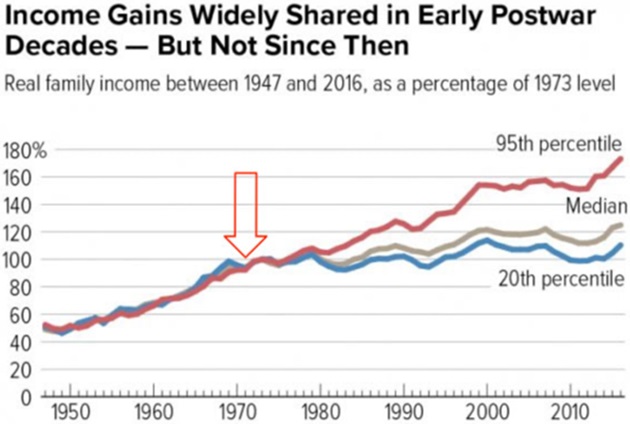

And the wealth gap…

Source: CBPP.org

These charts all show the same thing in different ways: Prior to 1971, Americans enjoyed shared prosperity—together. Then something changed. The rich started getting a lot richer, while everyone else stagnated.

The “wealth gap” shown in these charts largely defines American politics. I’d argue that Americans’ differing feelings on what’s causing this wealth gap got both Obama and Trump elected.

Now let me show you some newer, surprising data…

Did you know America’s poorer citizens have been getting a lot richer lately?

According to the Federal Reserve, real (after inflation) incomes are hitting new record highs.

FactSet data shows the net worth for the bottom half of Americans has grown 65% since 2020—more than double any other cohort. This has never happened before.

According to the Federal Reserve, the bottom 50% of Americans’ share of the overall wealth of the nation is rapidly rising after decades of decline.

And recent data from the Economic Policy Institute shows wages are growing much faster for high school grads than college degree holders.

I’m sharing my thesis (inspired by fellow techno-optimist Packy McCormick, who writes the excellent Not Boring blog) for what’s causing this.

I believe the forces that set the widening wealth gap in motion in 1971 are reversing.

If I’m right, the next 50 years will look radically different than the last 50 years.

If I’m right… you should put extra thought into the way you invest in 2024 and beyond. Because what “worked” in investing for most of our lifetimes is unlikely to produce strong returns going forward.

And if I’m right, our kids and grandkids will look back and ask, “WTF happened in 2023?”

To start, let’s answer the all-important question…

WTF happened in 1971?

President Nixon took America off the gold standard in 1971.

For a full explanation of how this decision warped the American economy, I recommend Lyn Alden’s book, Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better.

Here’s a quick summary...

Before 1971, US dollars = a fixed amount of gold. After 1971, US dollars = nothing but a promise.

Once we went off the gold standard, prices started to rise rapidly. In the charts above, we saw the price of a can of Campbell’s soup take off. Asset prices began a dramatic rise, too.

Americans who owned stocks and real estate benefitted, or at least kept up. Everyone else suffered as inflation ate away at their savings and salaries.

Perhaps most important of all, the price of oil skyrocketed and became unpredictable.

Here’s the price of oil since 1946. Up until the early 1970s, it was pretty stable. The oil shock of 1973 caused the price to nearly triple overnight and ended the era of reliably cheap oil:

Source: FRED

It’s hard to exaggerate how important the price of oil is. Expensive oil doesn’t only make it more expensive to fill your tank and heat your home. It drives up prices across the board.

You need energy to grow food… harvest it… and then deliver it on gas-guzzling trucks. And how do supermarkets keep the lights on? Electricity… from oil.

Higher energy prices squeeze almost every corner of the economy. Especially manufacturing.

The early ‘70s was peak “Made in USA.” Many of our largest companies were manufacturers. One in four Americans worked in factories. These factories hosted millions of reliable middle-class jobs.

Suddenly, spiking oil prices made it a lot more expensive to make stuff. This was a gut punch to America’s largest companies. Profits plunged, leading to mass layoffs.

Thousands of manufacturers went bust. Most of those that survived abandoned the Rust Belt for cheap foreign labor.

America’s manufacturing base was hollowed out, and the country largely stopped producing most physical “stuff” for 50 years.

Until… 2023.

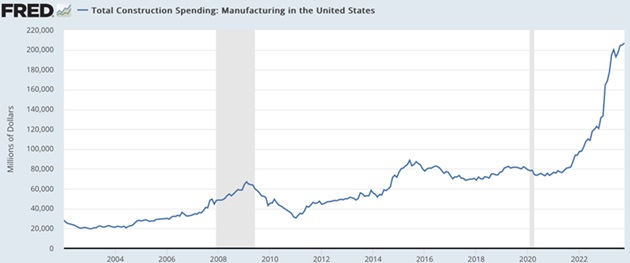

Spending on new American factories hit $205 billion last year… easily a record. Look at that “hockey stick” growth:

Source: FRED

“Made in the USA” is being reborn before our eyes.

Most of that $200 billion is being spent building computer chip plants and electric vehicle factories—technologies of the future.

We’ll explore what this looks like below…

The rise of the digital revolution

Did you know Henry Ford designed a “flying car” in the 1920s?

Imagine this “Ford Flivver” parked in your driveway:

Source: The Old Motor

Source: The Old Motor

Flying cars are the poster child for all the innovations we didn’t get because they got too expensive to make stuff.

To quote PayPal (PYPL) and Palantir (PLTR) co-founder Peter Thiel, "We wanted flying cars, but all we got was 140 characters?" (The former character limit on Twitter was 140 characters.)

Before the 1970s, America pumped out bigger, faster, more powerful machines.

Cheap energy was the key ingredient behind American muscle cars… jet engines that allowed us to cruise across the Atlantic... spaceships… and new power-hungry appliances.

Expensive oil made it risky to innovate new physical products.

So America’s entrepreneurs responded to incentives. Innovators shifted their focus to creations that didn’t need barrels of oil (or millions of workers, as you’ll see in a second).

Cue the digital revolution.

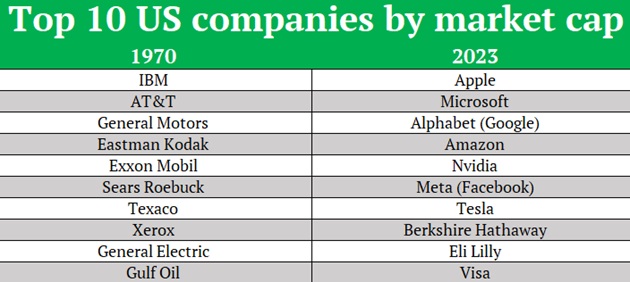

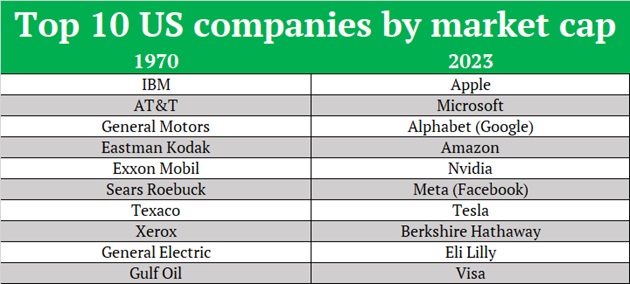

Look at the 10 most valuable US companies in 1970 vs. 2023:

In 1970, we had General Motors (GM), ExxonMobil (XOM), Texaco (CVX), General Electric (GE), Gulf Oil, and Sears.

These are companies that make and sell physical stuff.

Apple (AAPL) and Microsoft (MSFT) were born in the ‘70s. And while the growth of digital technology has been tremendous since the ‘70s, it’s the only significant part of our world that’s advanced.

Look around. Buildings… bridges… highways… they all look the same as they did in 1970. In many parts of the country, they look worse than 50 years ago because maintenance has barely kept up.

America is the wealthiest country in history thanks to its digital innovations. But digital businesses need much less manpower. So those riches were captured by fewer people.

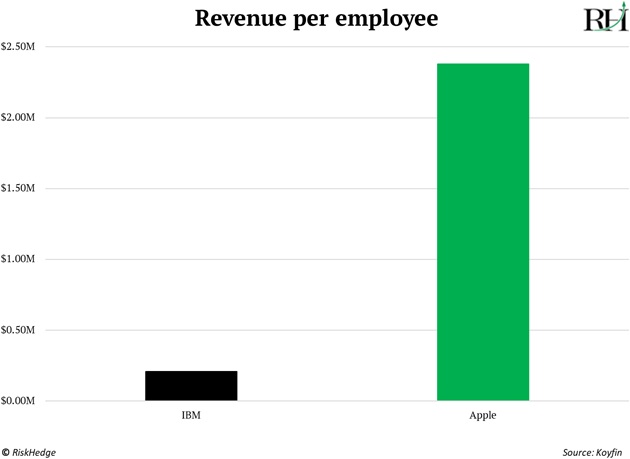

IBM (IBM)—the largest company in 1970—and Apple—the largest company in 2023—both make computers. But when you look at their “revenue per employee,” there’s no comparison. Apple makes 10X more revenue per employee!

In other words: More money is going to fewer people…

As a result, America’s best and brightest gravitated toward the digital world. There were benefits to this. We got genuinely great new inventions like Uber (UBER), Airbnb (ABNB), and streaming.

But I’d argue the drawbacks were bigger.

Since the companies with most of the money attracted most of the talent, many of America’s best and brightest worked at places like Google, where they figured out how to get you to click more ads rather than pushing forward the boundaries of the physical world.

So that’s the situation today. A handful of dominant tech companies are wildly profitable because they produce software, games, apps, and other digital things. These things require little energy and manpower—by far the two biggest input costs for most businesses—compared to making physical “stuff.”

America finds itself in an odd place. It’s the richest country in history. It has the richest, most successful companies in history (there’s no close second).

Yet most of America also looks like it’s stuck 50 years in the past. And many Americans are deeply unsatisfied and feel like they’ve been left behind.

But just like 1973… 2023 will be viewed as a major turning point for America.

Future generations will ask, “WTF happened in 2023?”

Except they’ll wonder why things started rapidly improving.

Let’s look at this chart again that I shared earlier: It shows construction spending on new American factories.

After being stuck in the mud for all of modern history, it’s spiked to new highs and shows no sign of slowing down:

Source: FRED

Source: FRED

We’re building stuff again.

Guys like Elon Musk have revived the American spirit of imagining big, bold, brash innovations.

There are five industries driving this innovation shift.

I call them…

The “five horsemen of disruption.”

- The energy revolution… better late than never.

I already showed you how expensive energy suppresses real innovation.

Good news: Two types of better, cheaper, cleaner energy are coming.

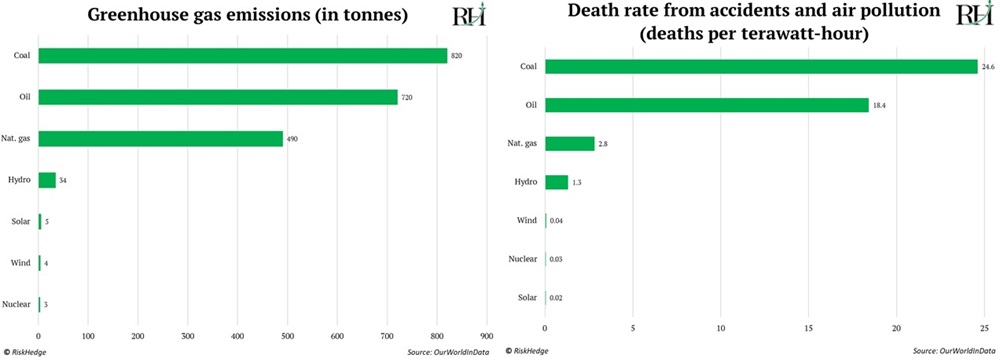

First, nuclear. Nuclear is indisputably the cleanest AND safest energy source in the world, as these charts show:

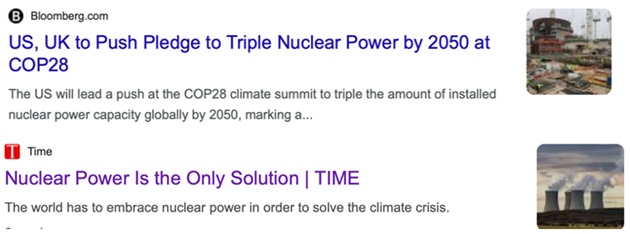

America made a horrible decision turning its back on nuclear decades ago. Well, better late than never. 2023 was the beginning of a nuclear renaissance.

Not only did we get the first-ever plant restart, but America’s first new nuclear unit in over 30 years is now up and running in Georgia.

Bureaucrats spent decades hating on atomic energy. Now they’re doing a complete U-turn, as these recent headlines show:

Source: Google

Source: Google

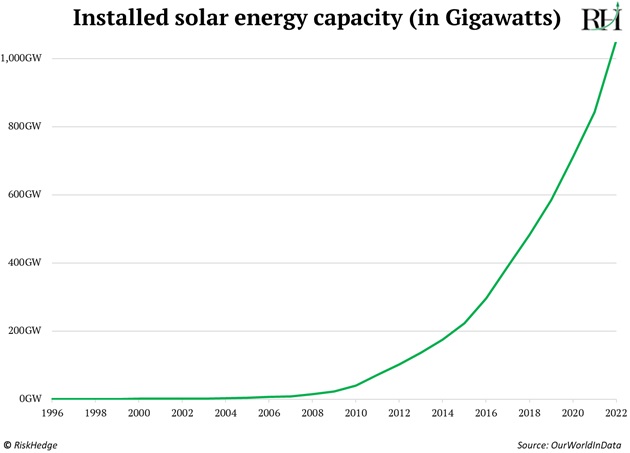

And don’t sleep on solar, which is one of the fastest-growing technologies ever.

In the last six months alone, $225 billion was spent rolling out solar energy. My math suggests the only tech deployed at a faster clip was railroads in the 1800s.

In 2023, investments in solar beat out investments in oil for the first time. The amount of “sun power” installed around the world is going parabolic:

This will bring back something we haven’t seen in many decades—cheaper energy!

That alone has the potential to drive productivity growth to levels not seen since the 1960s.

And we must talk about electric vehicles (EVs), which are enjoying rocket-ship growth.

EV sales topped 14 million in 2023, doubling in just two years.

Tesla’s (TSLA) Model Y was the best-selling car in the world last year. No, not the best-selling electric car. The best-selling car. Period.

EVs will win because they’re better than gas guzzlers. There are only 20 moving parts in an EV engine compared to roughly 2,000 in today’s traditional motors.

- The AI age has arrived.

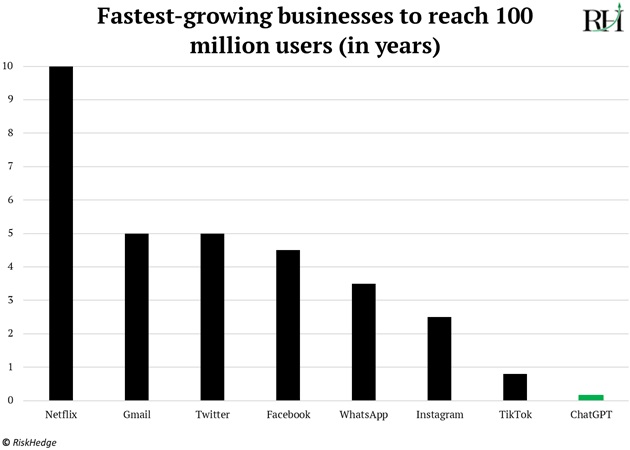

2023 was ChatGPT’s year.

It gained 100 million users in just two months, making it the fastest-growing product ever:

Artificial intelligence (AI) will move the needle for America by transforming our two most broken industries: healthcare and education.

It can take up to 15 years and several billion dollars to get a new drug approved and on pharmacy shelves.

AI solves this problem by analyzing mind-bending amounts of medical data. It then offers new ideas that would take us mere mortals a lifetime to discover.

AI systems are already dreaming up new drugs nobody has ever thought of, in a fraction of the time. There are currently 19 drugs developed by AI companies in clinical trials, up from zero three years ago.

Marc Andreessen—the venture capitalist who predicted the software revolution—recently said when describing this new era of AI, “Every child will have an AI tutor that is infinitely patient, infinitely knowledgeable, infinitely helpful.”

That era arrived in 2023.

New AI learning tools like Synthesis and Khanmigo look INCREDIBLE! The “magic” here is these AIs can learn the best way to teach each individual child.

They’ll know their strengths and weaknesses. They’ll be able to tailor lessons to each kid’s needs. “Stephen struggles with math, is a visual learner, and is sharpest in the morning. Design tomorrow’s lesson with these inputs.”

AI can already teach middle and high school kids. How long before it takes you through an entire four-year business degree… for FREE?

AI will steamroll education and build it back better. Future’s bright.

But AI’s single biggest impact will come from getting “physical.”

That includes self-driving cars, which drove a record number of miles in US cities in 2023. And autonomous drones, which recently got cleared to make long-range deliveries without someone watching from the ground (game-changer).

And above all else… I think AI robotics will revive “Made in the USA.”

If American factories automate, we could make stuff cheaper than China.

If THAT happens (it’s already started), take your idea of what’s possible and multiply it by 100X. This could create trillions of dollars in wealth for America—and the companies behind it.

- Space exploration makes a comeback.

Space hasn’t been this exciting since NASA was operating like a nimble startup.

Elon Musk’s SpaceX built the largest and most powerful rocket ever—Starship—which is designed to get us to Mars. SpaceX already launched the 400-ft. rocket into space twice last year.

Look at this incredible photo of Starship’s 33 huge engines firing. Man-made beauty at its finest:

Source: @elonmusk on X

Source: @elonmusk on X

Then you have Starlink, which is bringing high-speed internet to the world.

SpaceX is launching thousands of small satellites into space to create a network that can provide cell and internet access almost anywhere on Earth.

Of the roughly 7,500 satellites in orbit, SpaceX owns two-thirds of them. And it’s launching more every month!

Starlink is like telecom towers in space that bring fast internet to you from all over the world… even when you’re flying. Hawaiian Airlines became the first major airline to sign up for SpaceX’s internet.

Already, Starlink has 2 million paying customers.

- New medical advances will help save millions of lives.

I’m sure you’ve heard of the “wonder drug” Ozempic. It suppresses hunger and helps folks lose weight in a hurry.

It was originally prescribed as a diabetes drug. But 2023 was the year Ozempic was retooled into a “cure for all.” The research I’m reading on it is mind-blowing.

A new study in The Journal of Clinical Psychiatry found Ozempic basically makes alcoholics not want to drink. It’s also been shown to dramatically reduce sugar, smoking, and gambling addictions.

Ozempic could give the iPhone a run for its money as the most successful product on the market. I wouldn’t be surprised if creator Novo Nordisk (NVO) sells a trillion dollars’ worth of it.

I’ve also said before that artificial intelligence (AI) will help save millions of lives. Here’s further proof: Using AI, Harvard and MIT researchers discovered a whole new class of antibiotics to tackle the most hard-to-kill superbugs.

Antibiotic resistance killed over a million people last year. But with AI’s help, these hard-to-treat illnesses could become less lethal.

2023 also brought us cancer-killing pills.

According to researchers at California’s City of Hope National Cancer Center, a new drug eliminated all solid tumours derived from breast… prostate… brain… ovarian… cervical… skin… and lung cancers in pre-clinical trials!

Yeah, you read that right: A cancer-killing pill.

- Biotech will “rewrite” today’s deadliest diseases.

Scientists are now using mRNA technology to develop vaccines to eradicate killer diseases, including malaria and pancreatic cancer. That’s huge!

Then there’s gene editing.

Often referred to as “CRISPR,” gene editing allows scientists to “cut” out bad genes that cause disease and replace them with healthy genes.

Gene editing was in “demo mode” for the past decade. Then 2023 hit.

The first-ever CRISPR therapy was approved in America and the UK. It will target sickle cell disease, a debilitating illness affecting some 100,000 Americans.

All this has led me to one conclusion…

America has awoken from its innovation slumber.

We’re no longer talking about dating and food delivery apps. We’re building Mars-bound rockets and developing cancer-killing pills!

The number of game-changing breakthroughs that occurred in 2023 tops every other year in recent memory. It’s not even close.

It even brought back the hope of flying cars. The “overlord” of America’s skies, the FAA, set a goal to get air taxis up and running by 2028. It’s already issued air-worthiness certifications to several flying-car startups.

Can all this innovation counteract, and ultimately undo, the ruinous “WTF shift” from 1971?

I think so.

Remember, technology is deflationary. It makes luxuries affordable. (For example, the price of TVs has declined 99% since 1950.)

Innovation has been confined to the digital world since the 1970s. But as innovation gets physical, I think we’ll soon see lower prices in the physical world, too.

Finally… all the studies I’ve read on AI tools like ChatGPT show they give a much bigger boost to low-performers than to high-performers. AI is the great equalizer.

The shifts I’ve described will create more opportunities to generate wealth than ever before. Those who ignore it will be left behind, just like many 1970s-era workers.

That’s why it’s up to each of us to seize this opportunity. Will you ride the coattails of the disruptive megatrends transforming our world, or will you sit back and miss the freight train whizzing by?

You must seize the opportunity. No one can do it for you.

Maybe you think I’m mad for suggesting we’re on the cusp of a major positive turning point for America.

But clearly, something BIG changed in 2023.

Our grandkids will pull up a bunch of charts and wonder, “WTF happened in 2023?”

Lastly, let’s quickly touch on the investment implications of this innovation shift.

I showed you this table of the 10 most valuable US companies in 1970 vs. 2023:

In 1970, businesses that made and sold physical stuff ruled.

In 2023, the digital world dominated.

My prediction: Businesses that make physical “stuff” will soon control the top 10 list once again.

I’m not saying Kodak and Xerox will be resurrected.

I’m saying where innovation happens will dramatically shift from just software (cloud computing and apps) to the combination of software and hardware (tech you can touch).

That includes:

- AI-powered self-driving cars

- Factory robots

- Robo-tutors

- Cancer-killing pills

- Malaria vaccines

- High-speed internet on planes

- Next-generation nuclear plants

…and many more opportunities.

Forget the malaise of the past few decades and dream big. The future’s bright.

Stephen McBride

Chief Analyst, RiskHedge

P.S. If you liked this, I write a Monday, Wednesday, Friday investing letter called The Jolt. In it, I show you what’s really moving the markets and how to profit. You can sign up for free here.