America spent $600 billion (in today’s dollars) building the Interstate Highway System, which stretches some 50,000 miles.

Big tech companies will spend more money building artificial intelligence (AI) data centers in the next 4 years.

It’s the biggest infrastructure buildout in history, and it’s not even close.

Heavy hitters Microsoft (MSFT), Google (GOOG), and Meta (META) all reported earnings last week. The #1 takeaway: They continue to plow historic sums of money into AI.

See this chip Nvidia (NVDA) CEO Jensen Huang is holding up?

Source: The Crypto Times

Price tag: $40,000. Big tech companies are buying them by the boatload.

Microsoft and Google both announced a doubling of the amount of money they’re spending on chips, servers, switches, and cooling equipment.

Meta said it’ll spend $40 billion building out its AI data centers this year.

Would you rather own the companies spending all this money… or those receiving it?

There are few no-brainer choices in investing. Investing in the companies capturing the hundreds of billions of dollars of guaranteed AI chip spending is one of them.

|

Nvidia has already been a big winner here. We took profits on it back in February and are now reinvesting into other AI winners in Disruption Investor.

One business we own just announced its AI-related orders more than doubled in the last two months. Access the full portfolio, here.

- Folks who don’t invest are getting boiled alive.

The Wall Street Journal found shoppers have to spend $137 to buy groceries that cost $100 before the pandemic.

Meanwhile, the cost of insuring your car jumped 25% in just the past year.

I bring this up not to complain, but to make sure you’re doing something about it.

There’s only one way to beat inflation: own assets that outpace rising prices.

These days owning stocks isn’t a nice-to-have. It’s a must. People who don’t invest are getting boiled alive. Please don’t be one of them.

Beat inflation in two easy steps:

#1: Own great businesses

Rising prices are bad for you and me. But great businesses can pass rising costs on to customers. Truly great ones grow profits even as costs rise.

#2: Own the fastest horse

The best way to beat inflation is to own top-performing assets. That’s been crypto. Bitcoin (BTC) has surged 13,000% in 10 years.

My grandad used to save $5 in the bank for me every week. I have really great memories of talking with him about it. By the time he gifted it to me, it was real money.

Do the same today and the money will be almost worthless by the time you give it to your kids.

Cash is trash. You must invest.

- “Why is moving your family out of Europe a big deal for you?”

A subscriber asked me this.

I’ve lived all over the world. But it wasn’t until I had kids that I really started thinking about where to settle down.

I want to give them the best possible opportunities.

Unfortunately, Europe is the land of stagnation.

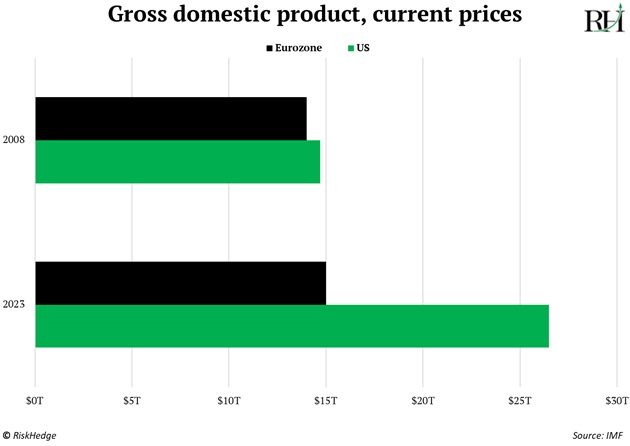

Look at this chart. It compares the size of Europe and America’s economies in 2008 and 2023. In ’08 they were dead even. Today, the US is 50% bigger. Europe has barely grown in 15 years.

Source: International Monetary Fund

This means fewer opportunities… fewer jobs… lower wages… less wealth… and ultimately, less freedom and independence for folks in Europe.

Back in 2000, Europe was a genuine leader in technology. It had Nokia… Siemens… Ericsson… SAP… Vodafone… Deutsche Telekom… and more.

Now it’s a laughingstock when it comes to innovation. Netherlands’ ASML (ASML) is the sole exception.

Any serious European entrepreneur moves to America to get their startup off the ground. Europe hates anything new.

EU bureaucrats never met a technology they didn’t want to regulate. It stifles innovation and makes it almost impossible to build anything new.

Don’t take my word for it. Here’s Patrick Collison, Irish-born founder of payments giant Stripe:

“I’m sometimes asked whether Stripe could have been started in Ireland. It’s impossible to really know the counterfactual, but I suspect not.”

Apple (AAPL) or Microsoft alone are now more valuable than the entire stock markets of Germany, France, and Italy.

Stagnation is a choice and leads to less wealth and opportunity.

I want my kids to grow up in a place that values innovation—that’s constantly pushing the boundaries and striving to create a new frontier.

That’s why I’m out, and excited for what’s next.

- Today’s dose of optimism…

Heart disease is the #1 killer in the world. But unlike many causes of death, it’s largely preventable.

Don’t be fooled into thinking cholesterol is the magic number that says whether your heart is fine. Half of people who suffer a heart attack have normal cholesterol levels.

This is why I recommend getting a calcium CT scan.

It’s a non-invasive scan of your chest which takes roughly 30 minutes and costs 100 bucks.

Cholesterol scores don’t look inside your arteries. A CT scan does and allows you to see if you have a buildup of plaque that can narrow or block them.

You then get a “calcium score,” which helps determine your risk of heart disease… heart attack… and stroke.

Calcium CT scans have been around for decades, but doctors are only starting to use them now. I discovered them through a friend who’s a longevity nerd.

If you’ve over 35, consider a calcium CT scan. For $100, it’s a no-brainer.

Pass this information on to your family and friends too so they can have this test done. It may save someone’s life.

Your health is your wealth.

Stephen McBride

Chief Analyst, RiskHedge