A massive bubble is about to pop.

When it does, countless investors will get hung out to dry.

It’s easily one of today’s most crowded trades.

No, I’m not talking about tech stocks… or “work-from-home” stocks.

- I’m talking about Special Purpose Acquisition Companies (aka “SPACs”)…

Last week, I showed you how hot the IPO market has been this year…

SPACs have been even hotter.

You may be wondering… What the heck is a SPAC?

In short: SPACs are vehicles private companies use to go public. They’re a cheaper and faster way to take a company public than a traditional initial public offering (IPO).

SPACs have been around for decades. But they’ve taken center stage in 2020.

They’re especially popular with Millennial investors and Robinhood traders. And I get the attraction…

Most companies going public via SPACs are young companies. In some cases, startups that haven’t even booked their first sale yet. So investors feel like they’re getting in on the “ground floor” when they invest in SPACs.

Unlike many IPOs, SPACs don’t begin trading up 30%... 50%... or even 100% right out of the gate… leaving more upside for everyday investors. Plus, SPACs start trading at around $10 per share. That’s “cheap” in the eyes of many investors.

Finally, many of today’s SPACs are focused on exciting megatrends. There are SPACs for space tourism, electric vehicles, 3D printing, satellite delivery, and self-driving car technology.

- So far in 2020, SPACs have delivered some monster gains…

Space tourism company Virgin Galactic (SPCE), which went public via SPAC, soared over 360% between December and February.

Source: StockCharts

Online sports giant DraftKings (DKNG) also had a phenomenal run…. surging nearly 300% since the start of the year.

Source: StockCharts

Then there’s electric truck maker Nikola Motors (NKLA). I recommended Nikola to my IPO Insider subscribers back in March when it was still a SPAC—trading under the ticker VTIQ.

It went on to soar 435% just three months after we added it to the portfolio… handing us huge gains. (The company was later accused of fraud, but we cashed out well before that.)

Now, if you’re wondering whether now’s a good time to join the frenzy, let me be clear…

- 2020 will go down as the “Year of the SPAC” for all the wrong reasons.

See, SPACs have a long history of disappointing investors.

According to Renaissance Capital, there have been 313 SPAC IPOs since the beginning of 2015. Of these, just 93 actually took a company public through a reverse merger. These stocks have fallen 9.6% on average since then.

For companies that went public via traditional IPOs, the average return over that same stretch is 47%. Not only that, just 29 of those SPACs that completed a merger have generated positive returns!

In other words, huge winners in the SPAC market are rare. And yet, the SPAC market is on fire.

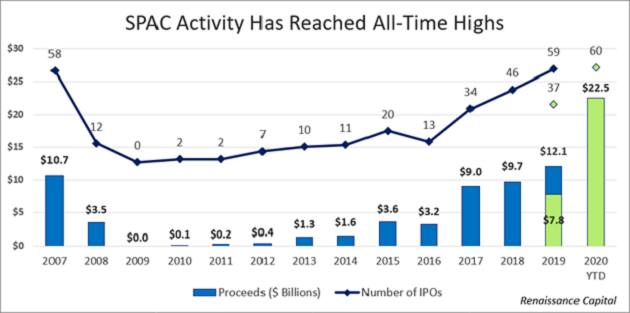

According to Refinitiv, US-listed SPACs have raised a mind-boggling $54 billion this year. That’s 4X more than the next closest annual total. And 2020 isn't over yet!

As if that weren’t crazy enough, 83 SPACs raised a record $30.6 billion in the third quarter alone.

Source: Renaissance Capital

SPACs are now so popular that they account for nearly half of all money raised by US IPOs this year!

According to Renaissance Capital, more than 250 SPACs are currently on file, looking for a company to partner with, or pending acquisitions. That’s more than two-and-a-half times the number of SPACs in the past 5 years!

This means SPAC investors will have plenty of investment opportunities to choose from. That’s the good news. The bad news is that supply will almost certainly outweigh demand.

- We’re already starting to see this play out...

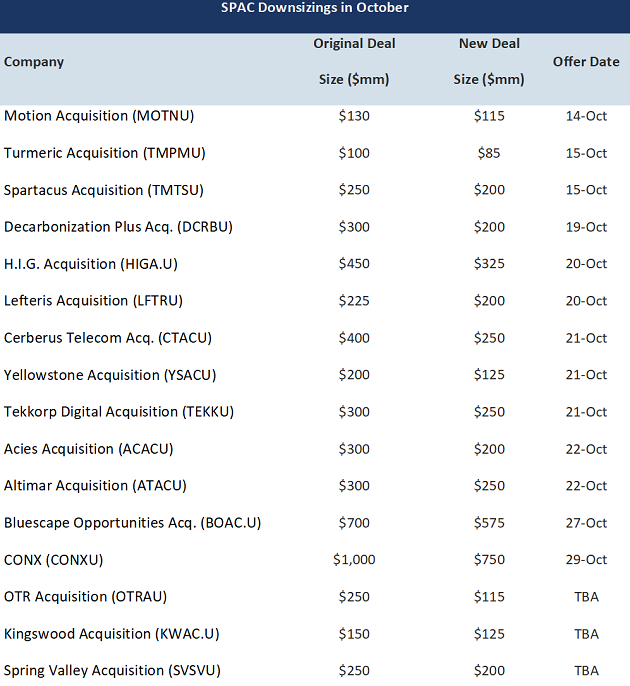

Take a look at this table. You can see that 14 SPACs have downsized their offerings in recent weeks. In other words, these companies are looking to put together smaller deals than they originally anticipated.

Source: Renaissance Capital

During the first nine months of the year, only five IPOs downsized their offerings. Just 13 did during all of 2015 through 2019.

So, this is a major red flag. But it’s hardly the only one…

Last month, the Defiance Next Gen SPAC Derived ETF (SPAK) was launched. This fund invests in a basket of SPACs. It’s a one-click way for investors to bet on SPACs.

- When Wall Street rolls out ETFs like this, it’s often a huge warning sign.

In many cases, it can signal that a top is in.

We’ve seen this happen countless times, including during the last cryptocurrency bull market. As you may recall, cryptos went on an insane run a few years back. Bitcoin—the world’s most important cryptocurrency—soared nearly 20X between January and December 2017. Ethereum surged 10,000% over the same period, while Ripple skyrocketed over 35,000%.

It was one of the greatest money-making opportunities in history. Everyone wanted to get in on the action. So, Wall Street gave the people what they wanted.

In February 2018, the Blockchain Technologies ETF (HBLK.TO) was launched. This fund gives investors exposure to different blockchain companies.

It hit the market just weeks after the crypto markets started to unravel. It was a major warning sign.

The crypto market entered a brutal two-year bear market. Many cryptos lost 90% of their value.

HBLK also went into freefall, crashing 53% before finally bottoming out in April of this year!

Source: StockCharts

SPAK could very well serve as a major warning sign to SPAC investors this time around. In fact, it’s already struggling. As you can see, it fell 14% in one month after it was listed.

Source: StockCharts

Now, I’m not saying that SPAK will plummet as far as the Blockchain Technologies ETF. But funds like this usually hit the market near market tops, not bottoms.

So, I strongly encourage you to not get caught up in the SPAC frenzy.

This has disaster written all over it: and your hard-earned money is better off elsewhere.

Justin Spittler

Chief Trader, RiskHedge

P.S. In my IPO Insider advisory we’ve largely avoided SPACs for the reasons I mentioned above. Instead, we’re focused on the explosive IPOs you’re not hearing about on TV. (Or if they do get air time, it’s because they’re downright hated).

You may be wondering how anyone can make big money off hated stocks… But as I explain here, it’s actually pretty simple…