In the 1980s, AT&T (T) hired top consulting firm McKinsey to estimate how big the market for cell phones would be in the year 2000.

Cell phones were as heavy as bricks. They didn’t work half the time. And they cost $10,000 in today’s dollars.

So, McKinsey concluded the market was limited to just 900,000. Off by 108 million. Whoops!

Consultants failed to realize phones would get smaller, cheaper, and 1 million times more powerful. They underestimated the power of disruptive innovation.

Today, people vastly underestimate the stunning pace of solar innovation. Technologies that grow this fast don’t come along often. But when they do, they change the world and present huge opportunities for investors.

Before we dive in, please ignore the political drama surrounding solar. It’s all noise that distracts us from what matters: making money.

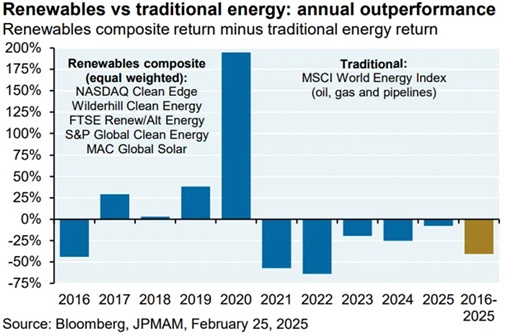

Case in point: Renewables stocks outperformed oil and gas companies every year when Trump was president during his first term.

Source: Bloomberg

- For the first time, solar power generated more electricity worldwide than nuclear power.

Solar also hit 10% of global electricity generation for the first time on record last month.

What tips me off to real, true, disruptive megatrends is how often records are broken. If new heights are constantly being hit, that tells me it’s the real deal.

After decades of being dismissed as “not quite ready,” solar is finally in the big leagues.

In California, solar now supplies a third of peak electricity demand. And it’s not just powering homes when the sun is shining. Energy is captured by solar panels during the day and stored in massive battery systems. Then, it’s pumped back into the grid after dark when demand is at its highest.

In 2004, it took a whole year to install one gigawatt of solar power. Now, we’re deploying that much every 12 hours!

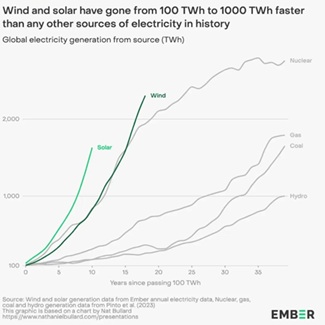

Solar is the fastest-growing energy source in human history, and it’s not close.

Source: Ember

Solar energy isn’t some “West Coast liberal” money pit, either.

Guess who’s leading America’s solar boom? Texas!

Yep, the heart of oil country installed more solar capacity than any other state the past two years running.

- Meet the eighth wonder of the world.

My grandmother always told me, “Practice makes perfect.”

The more you do something, the better you get at it. In Wall Street speak, we call that a learning curve. As a disruption investor, I’ve never met a learning curve I didn’t like. And for manufactured goods, it’s like an economic superpower.

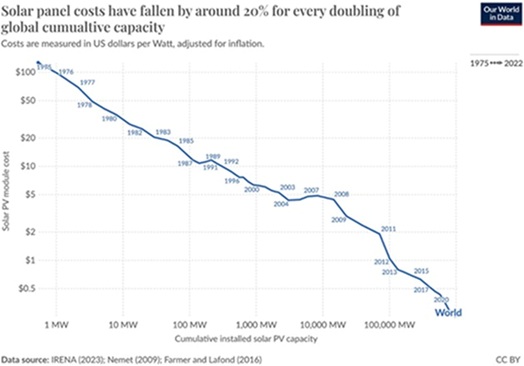

Solar panels are made in factories, which allows for constant iteration and improvement.

This “made in a factory” magic means each time global production of solar panels doubles, the cost to produce them drops by around 20%–30%.

That’s how, in the last 50 years, the price of solar modules has declined from $106 to $0.38 per watt—a 99.6% decline! And the plunge in solar costs continues to accelerate. In 2023 alone, prices nearly halved.

Source: Our World in Data

This virtuous cycle is relentless: Lower prices lead to more demand, which leads to more production, which leads to further learning and even lower prices. It’s a beautiful hockey stick curve that underpins solar energy’s disruption.

Many people still have an outdated image of solar. But sun power is no longer some hippie dream. It’s about cheap energy, and who doesn’t want a fatter wallet? We’re in an “energy-starved” world, and cheap, abundant energy is the foundation of everything we want for the future.

Bottom line: Solar is an unstoppable megatrend.

Regardless of who’s in the White House, solar will continue to grow fast in the US and throughout the world. The counterintuitive bullish setup we have for solar stocks with the new administration simply adds to the story.

- Okay, Stephen… how do I play the solar megatrend?

First, let me tell you what not to buy: the Invesco Solar ETF (TAN), the largest solar ETF.

TAN holds many of the world’s best solar businesses. It also has a lot of junk.

Just like biotech and cyber, solar is a stock picker’s market. Unfortunately, many investors recognize solar is a disruptive megatrend to bet on… but won’t make a dime because they choose the wrong stock.

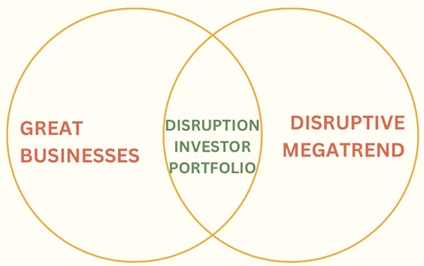

Our investing framework boils down to a simple tool you learned in school: the Venn diagram.

|

As the chart below shows, the first circle in the diagram represents great businesses: companies that consistently grow their revenues and make boatloads of cash.

The second circle symbolizes disruptive megatrends: fast-growing, world-changing trends.

Where these two circles overlap is the “sweet spot:” great businesses profiting from megatrends. Only stocks that hit the sweet spot in the middle can make it into the Disruption Investor portfolio. (Upgrade here.)

Over three decades’ worth of collective investing experience taught my partner Chris Wood and me that if you pick great businesses profiting from disruptive megatrends… the rest takes care of itself.

For example, while the TAN ETF fell 4% year-to-date, the solar business we own in our Disruption Investor portfolio has jumped 50%.

Stephen McBride

Chief Analyst, RiskHedge

PS: Keep an eye out next week for important content from my trading colleague, Justin Spittler. He’s been working on a way for you to capitalize on all the volatility in today’s markets, and you’ll be hearing more from him soon. Have a great weekend.