This market has something for everyone…

On Friday, four of the 11 major sector groups recorded their highest weekly closes ever.

This group includes financials, industrials, consumer staples, and healthcare stocks.

In other words, more and more stocks are participating. That’s a hallmark of a healthy bull market.

I don’t see this ending anytime soon. In fact, I think basic materials stocks are the next group to break out to new highs.

The “materials” group includes companies that sell steel, aluminum, fertilizer, and other raw inputs.

If these stocks are performing well, it’s hard to argue that the global economy is falling apart.

So, we’re going to pick up shares in one of the sector leaders today: Southern Copper Corp. (SCCO).

Southern Copper is an $83 billion mining company. It’s also one of the strongest stocks within the sector.

Over the past year, SCCO has rallied 36%. It’s also up 25% on the year.

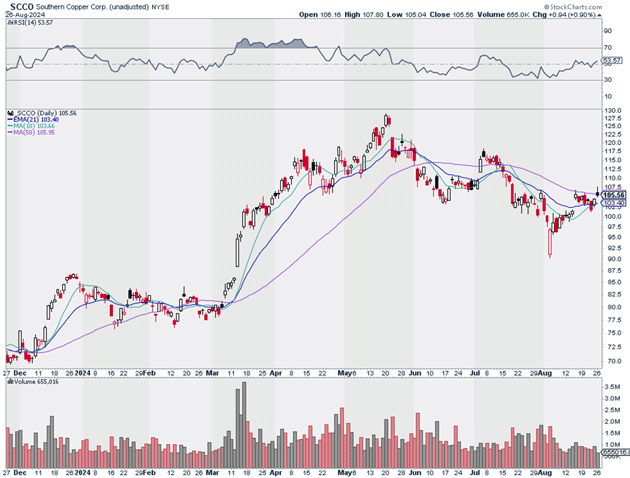

We’re picking up shares in SCCO today because it appears to be setting up for its next leg higher. As you can see below, SCCO has already reclaimed its short-term moving averages and is likely a day or two from reclaiming its 50-day moving average:

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

I suggest picking up shares in SCCO today.

I believe SCCO could hit $140 over the next 12 months.

Exit your position if SCCO closes below $97. That gives us a risk-reward ratio of 4:1 on this trade.

Action to take: Buy SCCO at current market prices.

Risk management: Exit your position if SCCO closes below $97.

Justin Spittler

Chief Trader, RiskHedge

PS: With so many sectors participating in today’s bull market, you may be wondering where to put your money amidst all the noise. In my RiskHedge Live trading room, I’ll show you where the best opportunities are shaping up in real time—no experience required. Here’s how to join.