Two weeks.

Six cities.

25,000 thousand miles from my new home in Abu Dhabi.

RiskHedge publisher Dan Steinhart and I recently wrapped a whirlwind trip across America.

We met 40 leading innovators, including at least six billionaires.

The innovators we met were working on everything from supersonic jets… to nuclear microreactors… to kamikaze drones and more.

The #1 topic on everyone’s mind was… artificial intelligence (AI).

It’s been three years since ChatGPT kicked off this disruptive megatrend. Investors are suffering from AI fatigue.

I hear questions like, “Isn’t the boom over?”… “Aren’t we in a bubble?”… “Isn’t this dot-com all over again?”

It’s easy to be down about AI right now. It sounds smart. But as we like to say: Pessimists sound smart; optimists make money.

One thing I’ve learned over the past decade is that disruptive megatrends can last

longer than you can stay interested.

- The one chart I keep coming back to is…

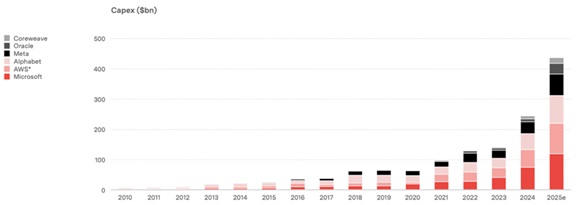

How much big tech companies are spending building AI infrastructure. As you can see, that number keeps going up and to the right:

Source: ChatGPT

This firehose of money continues to hand out profits to investors in AI infrastructure names. If you just looked at this chart, you’d think AI is long in the tooth. But look under the hood, and you’ll see new winners are being minted all the time.

That’s because the AI trade keeps evolving.

Every few quarters, Wall Street realizes there’s a new choke point in the system… and whichever companies sit at that choke point suddenly become the hottest stocks in the world.

The first wave of winners was obvious: GPUs. When the world ran out of graphics processing chips, Nvidia (NVDA) exploded more than 1,000%. It was the only company supplying the shovels in a gold rush.

Then AI hit its next limit: power. Training giant models requires enormous amounts of electricity. That pushed utilities—one of the dullest sectors in history—to the top of the performance charts in 2024.

Next came memory. As models grew from billions to trillions of parameters, the system needed far more high-bandwidth memory. Micron Technology (MU) and SK Hynix surged as AI companies bought every memory chip they could produce.

If you zoom out, the pattern is crystal clear. When AI hits a bottleneck, money floods into the companies that remove it.

It helps to think of AI like a python swallowing a pig. The bulge moves slowly through the system, from one bottleneck to the next. First chips, then power, then memory… and now, data flow.

The tidal wave of AI spending doesn’t hit one corner of the market and stop. It keeps rolling on, lifting up entire sectors investors had written off decades ago. That’s why you’re seeing previously forgotten, unfashionable stocks suddenly roar back to life.

We’re nowhere near the end of the AI megatrend. Look closely, and you’ll see the next group of winners is already starting to emerge.

- Fiber optic stocks are surging…

In the last six months, Coherent Corp. (COHR) jumped 120%, Ciena Corp. (CIEN) soared 153%, and Lumentum Holdings (LITE) surged 310%.

These dusty leftovers of the dot-com era are suddenly some of the best stocks in the entire market.

Training today’s top AI models requires wiring together tens of thousands GPUs into one giant supercomputer.

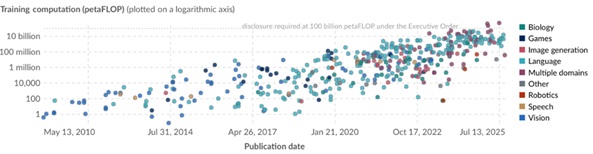

Compute needs are up 1,000,000,000,000% (1 billion percent) since 2010:

Source: Epoch AI

We can make GPUs faster. We can crank out more of them. We can flood them with electricity.

But none of it matters if the information can’t move fast enough between chips.

“Bandwidth” is the real bottleneck in AI right now.

Copper wiring, the backbone of electronics for 150 years, has maxed out. It can’t push data fast enough between chips for next-gen AI.

That’s where fiber optics shine.

- Optical cables always lived outside the data center:

Think submarine cables. Coast-to-coast fiber. And telecom towers.

AI is dragging optics inside the data center. Into the racks. Into the network fabric. Even into links between GPUs.

This shift from long-haul plumbing to the core of the data center is the most important development in the AI buildout today.

|

For years, fiber was a boring, cyclical business with terrible margins and terrible customers. Most investors skipped this industry.

But fiber optics do one thing extraordinarily well: Instead of sending data as electricity over copper wire, fiber optics turn data into laser light and shoot it down glass threads at the speed of light.

If you want tens of thousands of GPUs to act like one brain, the data between them must move right now—not a few milliseconds later.

Nvidia just announced its latest and greatest racks will rip out copper and use optical fiber instead.

- Fiber-optic stocks will shine in the next stage of the AI buildout.

Data centers are starting to hit size limits: power, cooling, even available land. At some point, you simply can’t cram any more hardware under one roof.

The next wave of AI infrastructure won’t be one giant data center.

It will be clusters of smaller data centers, spread over a region. And they’ll be linked together so they function like one unified machine. Insiders call this “multi-site” training.

And to make this work, you need a new type of fiber cable called coherent optics.

Coherent optics read the light signal in the fiber more carefully. Instead of just measuring how bright the light is, they also look at its shape and timing. That extra detail lets you push far more data through the same strand of glass. Up to 10X more.

Companies with real strength in coherent optics are the ones that will lead from here.

Today, optics are the most undervalued group within AI infrastructure.

The mistake people are making is treating this like 2000 again—when we overbuild fiber, which led to a crash. The reality is that we’re going to rearchitect the whole data center around optics.

The market still thinks the AI story is about GPUs and model wars. That was Phase 1.

The next phase is about the invisible glass threads that let thousands of those GPUs act like one brain.

I wouldn’t be surprised if fiber optic stocks become the best-performing group of 2026.

I go into more detail about the role coherent optics will play in the AI megatrend—and three other underrated “plumbing” sectors that will matter most in Phase 2 of the infrastructure buildout—in our latest Disruption Investor issue, published yesterday.

Members can catch up on their new issue here.

If you’re not a member and would like to join, go here to sign up.

Stephen McBride

Chief Analyst, RiskHedge