Chris’ note: Has superinvestor Warren Buffett been reading RiskHedge?

Earlier this month, Buffett’s investment firm, Berkshire Hathaway (BRK.A), held its annual shareholders meeting. The whole financial industry looks forward to this big event every year. Investors and reporters from around the world flock to it to hear Buffet’s words of wisdom.

Buffett hit on the usual topics: interest rates… inflation… the US economy…

But it was what he said at the very beginning that caught our attention:

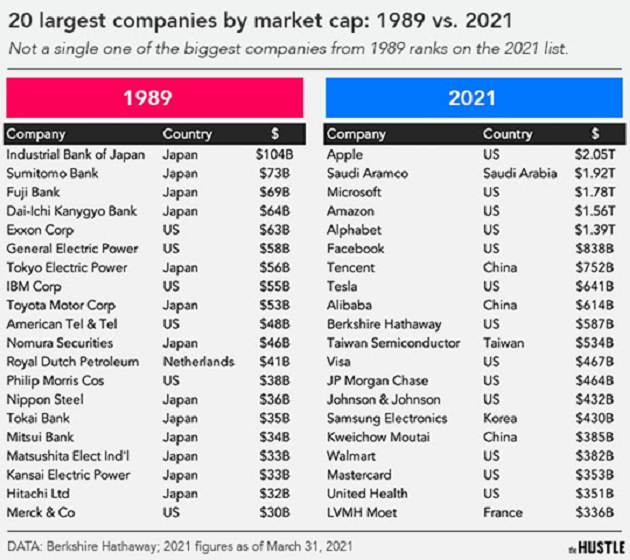

He turned back the clock to 1989 and showed a list of the world’s 20 biggest companies back then. And he pointed out how ZERO of them remain in the world’s top 20 companies today.

Source: The Hustle

Source: The Hustle

“We were just as sure of ourselves—and Wall Street was—in 1989 as we are today… But the world can change in very, very dramatic ways,” Buffett said (emphasis added).

If you’ve been reading RiskHedge for long, this idea should sound very familiar. But Buffett typically doesn’t say things like this...

Berkshire’s famed for its disciplined “value” approach to investing. It buys large stakes in great businesses like Coca Cola (KO), holds them forever, and often reinvests growing dividends.

But his comments acknowledged the power of disruption investing. In other words, betting on the companies poised to upend entire industries and invent the future.

In today’s special guest essay, RiskHedge Chief Analyst Stephen McBride shares more about this “open secret”…

The most profitable “open secret” in investing…

By Stephen McBride, editor, Disruption Investor

In today’s essay, I’ll share a powerful “open secret” that, if used correctly, could double, triple, or even quadruple the profits you collect in the stock market.

This “open secret” informs every money decision I make. It gets to the heart of what Buffett admitted during his recent shareholders meeting.

And it’s what led to RiskHedge readers collecting peak gains of 954% on advertising disruptor The Trade Desk (TTD)...

A quick 247% gain in eight months on cybersecurity disruptor OKTA (OKTA)...

And a 220% gain (and counting) in disruptive chipmaker ASML Holdings (ASML).

- This valuable information is available to anyone... but hardly anyone seems to realize its importance:

I’m going to show you three little lists. Please look them over carefully.

Heck, print them out and keep them at your desk. They’re that important.

Together they the hold the key to getting and keeping wealth through investing in disruptive trends.

If you can commit this concept to memory… I mean really sear it into your brain so it becomes second nature… you should accumulate hundreds of thousands of dollars more in investing profits over your lifetime.

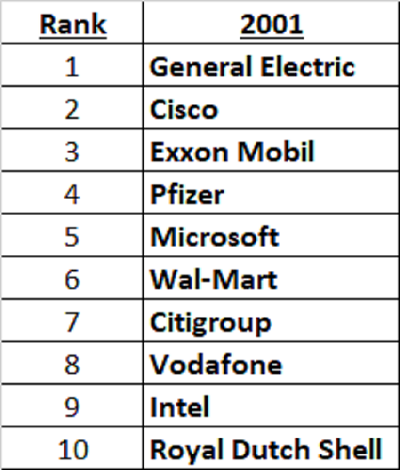

This first list shows the 10 largest public companies on earth—ranked by market cap—in early 2001:

You probably recognize most of these stocks.

In 2001, they were the best of the best. The biggest of the big.

They were household names that had conquered their industries and handed investors big profits.

Now I’m going add a second column.

It will show the same rankings a decade later—in early 2011.

You see what happened?

Seven of the top 10 stocks—all those in red—were displaced.

Only Exxon Mobil, Royal Dutch Shell, and Microsoft survived.

And even these three “survivors” posted terrible returns.

Microsoft fell 15% between 2001 and 2011. Exxon and Shell underperformed the market.

But you REALLY did not want to own the stocks in red.

You see, most of those “losers” in red weren’t merely leapfrogged by “up and comers”…

Many of their stocks collapsed.

From 2001–2020, GE stock plunged 79%... Citi collapsed 89%... and Vodafone fell 56%.

In fact, the seven “losers” in red lost roughly -11% on average between 2001 and 2020.

Meanwhile the S&P 500 more than tripled.

Imagine losing 11% of your money over 20 years while the market triples?

There’s a phrase for that: financial disaster.

Now let’s add one more column for 2021:

As you can see, this time only two of the 10 survived.

And once again… the losers tanked.

Averaged together, the eight losers lost over -20% from 2011 to 2021.

The S&P 500 gained over 200% in that time.

Now, if you were investing back in 2011, the overwhelming likelihood is that you owned some of the money losers on this list.

Remember, they weren’t obscure penny stocks…

They were eight of the 10 largest stocks on earth!

Even if you didn’t buy them intentionally, you probably owned them.

After all, these were the biggest, most popular, most written-about stocks.

Unfortunately, many mutual funds, index funds, ETFs, and retirement plans were stuffed with these losers.

- Now, imagine a fourth column labeled “2025.”

You now know that large, dominant companies rarely stay on top.

Based on this fact, which is confirmed by 20 years of market data...

How many of today’s top 10 do you think will still be on the list in 2025?

Wouldn’t you agree that at least seven or eight of those stocks will perform poorly going forward?

That is a powerful piece of information.

It means most of the biggest and richest companies on earth are typically bad investments.

Glance up at the 2021 list once more. You’ll find it reads like a “Who’s Who” of the most popular US stocks today.

Apple. Microsoft. Alphabet (Google). Facebook. Tesla.

These are the stocks everyone pays attention to. They’re the stocks your barber or taxi driver brag about owning. CNBC anchors go on and on about these stocks seven days a week.

Yet, as you now know, the evidence is clear: You’re best off avoiding most of today’s most popular stocks.

Seven or eight of the ten are likely to tread water, at best, over the next couple years.

More likely, they’ll lose money.

I’ll repeat: Owning the most popular, most talked about, and largest companies in the world is a money-losing strategy.

- But you can flip this great danger into your great edge.

It comes down to the life cycle of disruptive businesses.

You want to sell the tired old giant companies that have already peaked and are sure to fall.

And you want to buy the “rising stars.”

In other words, you want to own the stocks that will top the list in 2025.

Leading up to 2021, the 10 stocks that top the 2021 list were profit-making machines. From 2011–2020 they all posted gains. A perfect 10 for 10.

And several produced big gains. Amazon (AMZN) leapt well over 1,000%. Microsoft surged 500%+. Google (GOOG) soared 400%+.

But they are not the stocks you want to buy today.

My job as RiskHedge’s chief analyst is to help you find the next crop of disruptors set to dominate the world over the next decade.

I recently wrote about three disruptors I believe will do just that in this briefing.

Go here to get the key details on each one.

Regards,

Stephen McBride

Editor — Disruption Investor