The market is red hot.

The indices are grinding higher. Artificial intelligence (AI) stocks are surging. Even left-for-dead sectors are rising from the ashes.

This sort of strength makes some traders nervous, like the party must end.

I couldn’t disagree more. The evidence points toward stocks finishing the year strong…

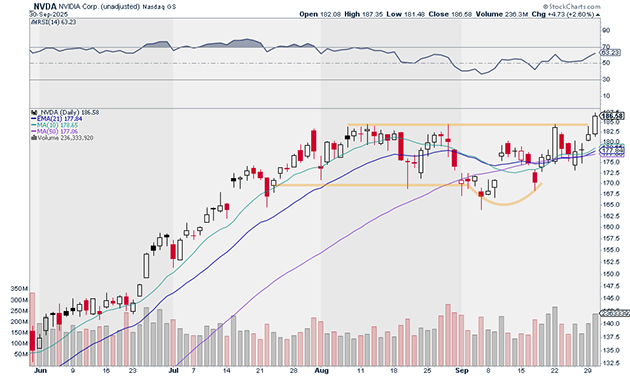

Yesterday, the VanEck Semiconductor ETF (SMH) finished at new all-time highs yet again, thanks to a big breakout by Nvidia (NVDA)—the world’s largest chipmaker.

Source: StockCharts

Source: StockCharts

This is super bullish.

Semis are easily the most important industry group. They’re the bellwethers of the modern economy and the AI trade—this cycle’s defining narrative.

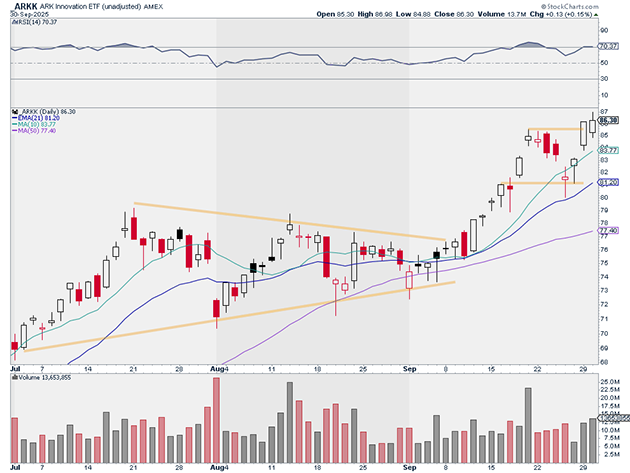

But what we’re seeing is FAR from a narrow, tech-driven rally. Many different kinds of stocks are working, including speculative growth.

Just look at the recent performance of the ARK Innovation ETF (ARKK). It ripped to new three-year highs yesterday:

Source: StockCharts

Source: StockCharts

And that’s just one example of money moving further out of the “risk curve.”

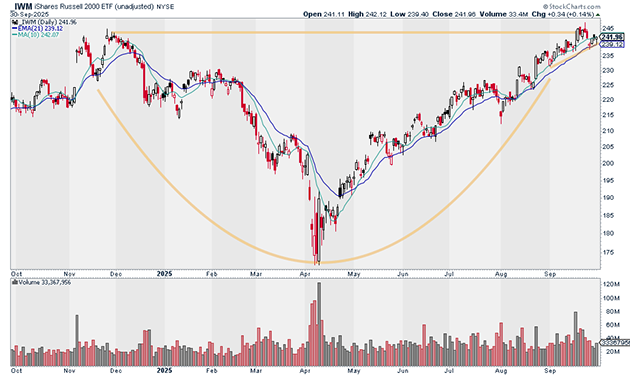

Small caps have been performing well and look to just be warming up. The iShares Russell 2000 ETF (IWM) is climbing out of a base that dates back to late 2024:

Source: StockCharts

Source: StockCharts

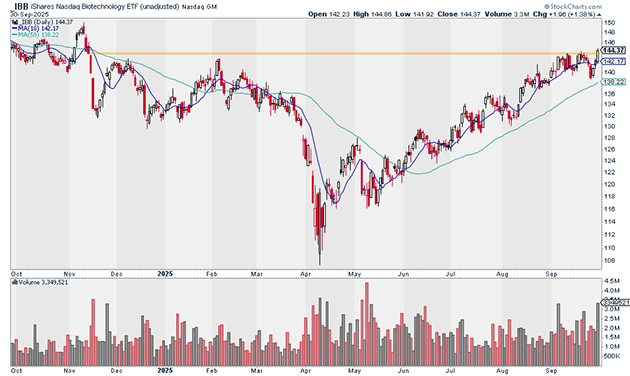

Biotech stocks are also breaking out. Yesterday, the iShares Biotechnology ETF (IBB) hit 10-month highs on big volume:

Source: StockCharts

Source: StockCharts

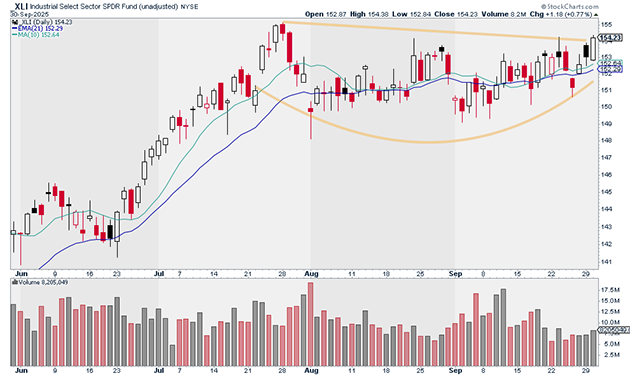

Then there’s industrials. The Industrial Select Sector SPDR Fund (XLI) is on the verge of a big breakout:

Source: StockCharts

Source: StockCharts

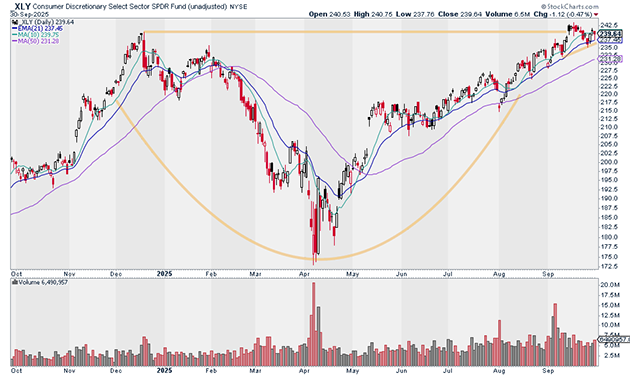

The Consumer Discretionary Select Sector SPDR Fund (XLY) is also setting up for a big move. In fact, it’s on the cusp of breaking out of a base that dates back to late 2025:

Source: StockCharts

Source: StockCharts

The takeaway from these charts is obvious: participation is broadening. This is a sign of a healthy market, not one on the skids.

In my Express Trader advisory, we’re continuing to buy into strength in some of the markets hottest themes.

My latest trade, issued yesterday, is a speculative bet on the data center theme that should move in step with AI stocks. It looks excellent on all time frames and could be on the verge of a breakout.

To access it, go here to join Express Trader today.

Justin Spittler

Chief Trader, RiskHedge