Jeff Bezos said the question he got most was, “What’s going to change in the next 10 years?”

Bezos built Amazon’s (AMZN) trillion-dollar empire by answering the exact opposite question: What won’t change in the next 10 years? People will always want a great choice at great prices.

For investors, thinking about what won’t change is a shortcut to finding great moneymaking opportunities.

And the one thing I know for sure that’s here to stay is Uncle Sam’s spending habits.

I had high hopes for Elon Musk’s DOGE and the energy around getting Washington “fit.”

But the US government’s spending plan for the next year—aka the “Big Beautiful Bill”—just passed the House. Now, it’s moving to the Senate.

If it gets voted through, it’ll add another $3.8 trillion to the national debt over the next 10 years.

We can debate whether this is good, bad, or ugly another time. But we’re investors. Our job is to make money.

And if all this debt gets you down, I have good news. Here’s the easiest way to make money from Uncle Sam’s spending addiction...

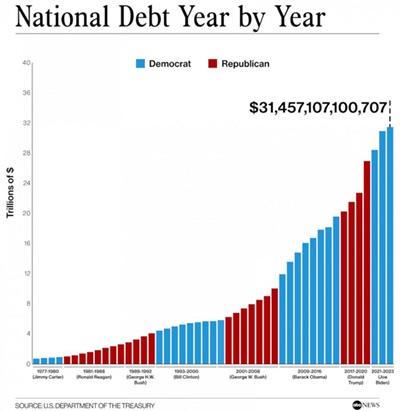

- This isn’t a “Trump” thing.

Every president, Republican and Democrat, in my lifetime (and yours) has added to America’s national debt:

Source: ABC News

All the talk about cutting spending has been just that: talk. Politicians are incentivized to spend other people’s money. And that won’t change any time soon.

People have been crying wolf about the US national debt for decades. Remember Henry Ross Perot and his charts back in 1992?

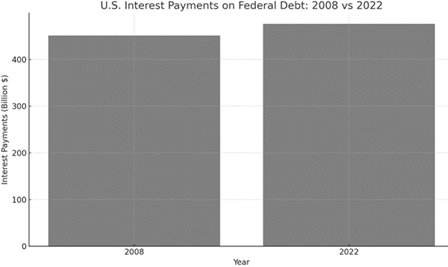

Let me say something a little controversial. The amount of debt doesn’t matter. Neither do deficits. What matters is how much you’re paying out in interest to service that debt.

Case in point: National debt tripled between 2008 and 2022 and yet interest payments barely budged.

Source: Created by ChatGPT

This right here is why all the doomers screaming about Uncle Sam going bankrupt were wrong.

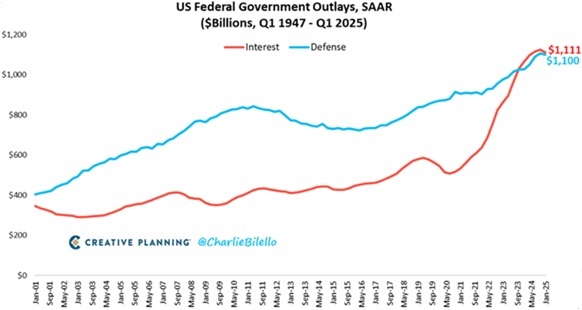

But as you know, the world of zero interest rates is over. Bad for homebuyers. Really bad for Washington.

The US government now pays out roughly $3 billion in interest expenses per day. This year, for the first time ever, we’ll spend more money servicing the national debt than on defense. Not the kind of records I like to see broken.

Source: @CharlieBilello on X

Interest payments doubled in just four years. At this pace, a third of all tax revenue could go just toward interest payments by the end of the decade.

Friends, we’ve hit what they call a “tipping point.”

- There’s a right and a wrong way to think about this…

“Oh, no. America is headed for bankruptcy. Sell everything and hide out in a bunker.” Please don’t be this guy.

America can’t go broke because it controls the money printers. Let’s again think about what won’t change. Next time there’s a crisis, politicians will turn the money printers on full blast.

|

Wall Street has a fancy term for this: debasement.

And this is why you must own assets.

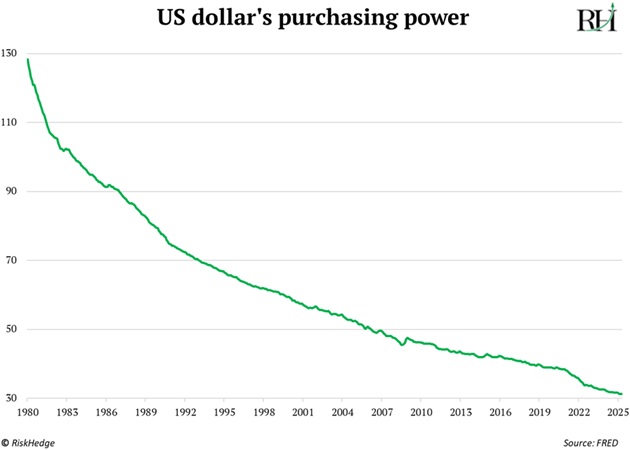

Just like your morning coffee and grocery bill are priced in dollars, so too are stocks, crypto, and gold. When Uncle Sam prints money, it debases the value of the US dollar.

USD down, assets up.

If you’re sitting in cash, debasement constantly eats away at your hard-earned savings, making them worth less each passing year.

The government’s own numbers show the dollar has lost 66% of its value over the past 40 years. A one-way trend if ever I saw one.

But it’s a massive tailwind for investors.

If you think US government debt is a problem and are concerned about debasement, buy stocks! But that’s not all...

- “Okay, Stephen. So how should we invest?”

Buy assets that politicians can’t print.

They can’t make gold out of thin air.

This is why the yellow metal has jumped 25% since January and is on track for its best year since 2010.

Gold has historically been the go-to hedge against currency debasement. I think everyone should own at least a little gold.

But gold isn’t helping you get ahead. It’s just helping you not fall behind.

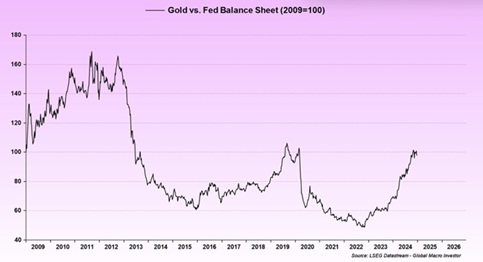

My friend Julien Bittel, Head of Macro Research at Global Macro Investor, ran the numbers and found gold has basically been flat in “real” terms since 2009 when compared to how much money we’ve printed:

Source: @BittelJulien on X

- You’ve got to own stocks and…

Crypto.

Stocks—especially great disruptive businesses like we own in Disruption Investor—have kept pace with debasement and then some.

But crypto has been the fastest horse in the race. Bitcoin (BTC) is simply the greatest debasement hedge on the planet. It’s soaked up all the printed money to become the best-performing asset in the history of the world over the past decade.

Heck, even gold is down 99.99% compared to bitcoin since 2012!

Financial guidance I’d give to my son:

First, you’ve gotta own stocks.

And son, please just own a little crypto. The great thing is that when you own an asset that can 10X or more in a year, you only have to own a little to make real money.

Stephen McBride

Chief Analyst, RiskHedge

Editor’s note: With crypto prices on the rise, you might be wondering how to play the boom the right way. In Stephen’s premium crypto advisory, RiskHedge Venture, he targets tiny, early-stage cryptos with great potential. Not “meme” coins, but real businesses making real money.

You can learn more about his strategy and how to join by clicking here.