The strength in the S&P 500 is impressive.

Stocks are now less than 2% away from new highs after clawing out of a correction.

In presidential election years, stocks tend to chop into Memorial Day, then rally in the summer.

It looks like 2024 could follow this playbook.

Let’s get after it…

- My neighbor Sarah was 23 when she was diagnosed with brain cancer.

Unfortunately, she just passed away. I know her dad and can’t imagine the pain of burying your only daughter.

It’s hard to hear things like this and not feel a little down. We all know someone who’s been affected by cancer.

This is why the revolution happening in biotech right now is so crucial. We all but eradicated once-deadly diseases like polio and smallpox.

Now we must do the same for cancer. And we may be closer than you think.

In the past few weeks, we’ve gotten at least three major announcements about cancer vaccines.

The latest comes from Moderna (MRNA) and Merck (MRK), which designed a jab to tackle melanoma—the deadliest form of skin cancer.

Patients who took the jab during trials were half as likely to die or have their cancer come back after three years compared to normal treatments. That’s huge! We’re talking about potentially saving hundreds of thousands of lives.

We’re going to make more progress against cancer in the next five years than we have in the past 50. And it’s all thanks to mRNA (messenger RNA) technology.

Remember, “mRNA” is the tech that helped scientists develop a COVID vaccine in record time.

Please, don’t hate mRNA because of how governments + big pharma forced the COVID vaccines on us while minimizing the risks and exaggerating the benefits.

mRNA really is a game-changing tech with incredible promise. For cancer, it can prime our bodies to seek and destroy solid tumors not easily cured with surgery, and without the nasty side effects of chemo.

|

It’s only in the trial phase, so I don’t want to jump the gun. But the results are extremely promising. We’re talking about potentially saving half of all people who would have died from melanoma.

What’s even more promising is mRNA vaccines for pancreatic… colorectal… metastatic… brain… and lung cancer are all showing positive results in trials, too. What if mRNA is the “skeleton key” that helps us cure every cancer under the sun?

I often worry about getting sick and not seeing my kids (and grandkids) grow up. Maybe you do, too.

It’s great to see these breakthroughs that could one day mean all you have to do to beat cancer is get a shot in your arm.

Biotech companies are achieving things people didn’t think were possible even a decade ago. Some will fail. Others will succeed beyond our wildest imaginations.

Investors must pay attention to this industry. We own two world-class biotech companies in Disruption Investor. Upgrade here.

- “Do you think there’s a chance to make money investing in electric vehicles?”

A Disruption Investor member asked me this question in our monthly “Ask Me Anything” call last week.

My answer: Not any time soon.

Electric vehicles (EVs) are a disruptive megatrend, and the technology is far superior to gas-powered cars.

There are just 20 moving parts in an EV engine, compared to roughly 2,000 for the average gas guzzler. That makes them much cheaper to run and maintain.

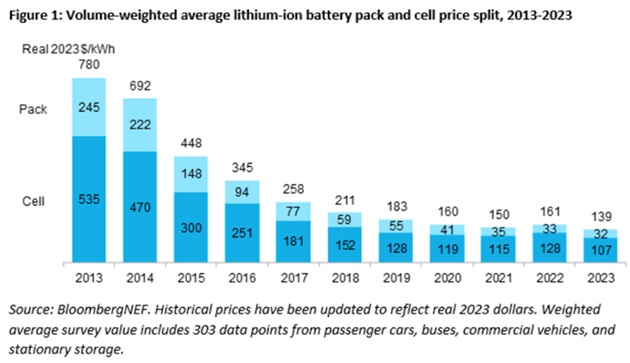

And EVs will only continue to improve as the cost of batteries (the most expensive part of the car) keeps dropping.

Did you know battery costs have plunged 80% in the past decade?

Source: Clean Technica

All great. But none of it matters to us as investors. Because selling cars is one of the worst businesses on the planet.

To make money in a fast-growing trend, you need to buy into a great business profiting from it.

There are no great EV businesses. Ford (F) lost nearly $65,000 for each of the 72,000 EVs it sold last year.

And Tesla (TSLA) got absolutely hammered after reporting a drop in sales and earnings a few weeks ago.

Tesla stock has plunged 60% since late 2021:

Put EVs in the “too hard” pile for now. There are easier ways to make money.

- Meet Stargate…

The $100 billion artificial intelligence (AI) “supercomputer” Microsoft (MSFT) and ChatGPT creator OpenAI just announced.

Stargate is going to be the world’s largest data center, spanning a hundred acres of land and using up to 5 gigawatts of energy.

That’s enough to power 3.75 million US homes for a whole year.

Stargate isn’t expected to launch until 2028. But the most important thing for investors is these companies are ploughing billions of dollars into AI now.

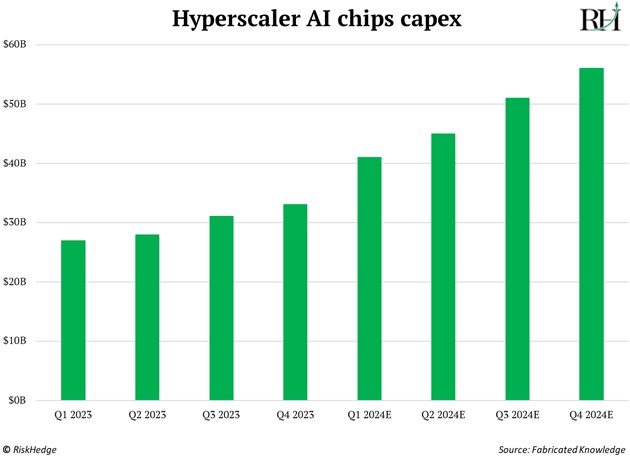

The big takeaway from recent big tech earnings is these giants are locked in an AI arms race.

Microsoft… Amazon (AMZN)… Google (GOOG)… and Facebook (META) are on track to spend over $180 billion on AI chips… servers… racks… optical wires… and cooling fans this year.

Remember, this is the largest infrastructure project in history.

Big tech will plough more money into AI than Uncle Sam spent putting a man on the moon or developing atomic bombs. And it’s not even close.

Would you rather own the companies spending all this money… or those receiving it?

There are few no-brainer choices in investing. Investing in the companies capturing the hundreds of billions of dollars of guaranteed AI chip spending is one of them.

Nvidia (NVDA) has already been a big winner here. We took profits on it back in February and are now reinvesting in other AI winners in Disruption Investor. Go here to see how you can access the full portfolio.

- Today’s dose of optimism...

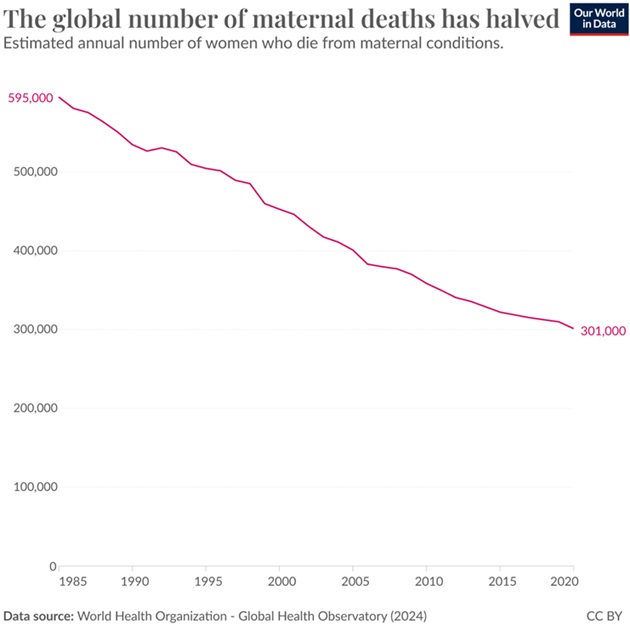

The number of mothers dying during or shortly after childbirth has been cut in half over the past 40 years:

Source: Our World in Data

We can thank innovation for that.

Special drugs to stop bleeding…

Medication to control blood pressure…

And antibiotics to fight infection.

Have a great weekend. See you Monday.

Stephen McBride

Chief Analyst, RiskHedge