Well, it happened.

Stocks have fully recovered from this year’s “mini crash.”

Yesterday, the Invesco QQQ Trust (QQQ) recorded its highest all-time close ever, topping its previous record set in February.

That alone is encouraging. But I’m even more encouraged about what I’m seeing below the surface.

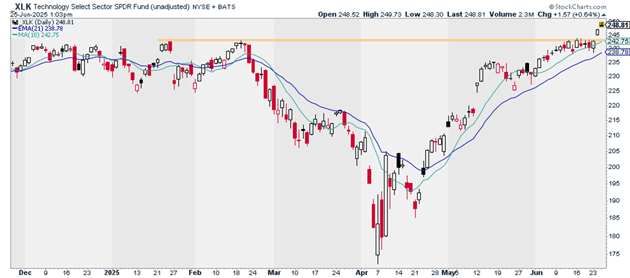

Let’s start with the market’s most important sector: technology.

The Technology Select Sector SPDR Fund (XLK) also recorded its highest daily close ever yesterday:

Source: StockCharts

Source: StockCharts

This is bullish. Tech makes up 31% of the S&P 500 and 62% of the Nasdaq 100. As it goes, so does the market.

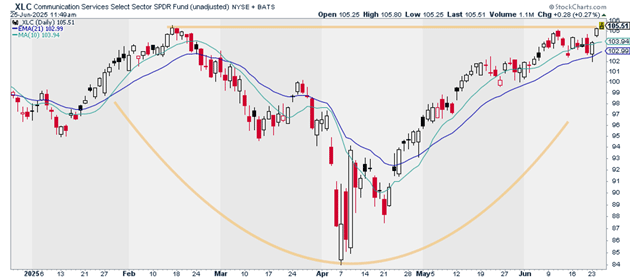

And it’s far from the only sector on the run.

Today, the Communication Services Select Sector SPDR Fund (XLC) is hitting new all-time highs. This group includes giants like Meta Platforms (META), Alphabet (GOOG), and Netflix (NFLX).

Source: StockCharts

Source: StockCharts

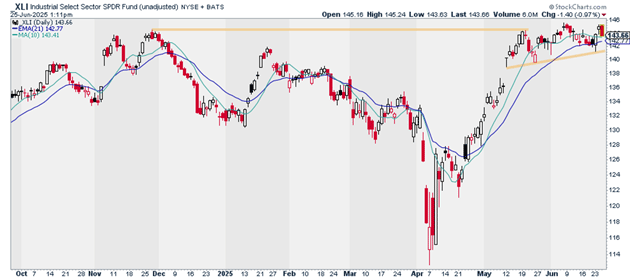

The Industrial Select Sector SPDR Fund (XLI) is also on the verge of a major breakout…

Source: StockCharts

Source: StockCharts

These three sectors have one thing in common: They’re all “risk on” groups. When they’re performing well, it’s a great sign for the indices and often a signal to go on the offensive.

The question is, what stocks should we be buying right now?

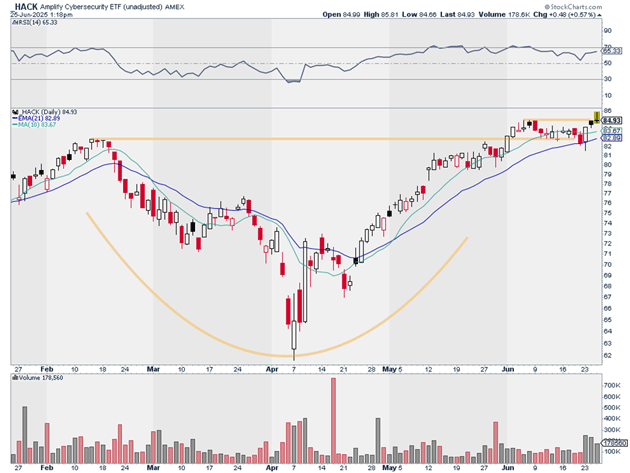

There are two main areas I’m focused on. The first is cybersecurity stocks.

The chart below shows the performance of the Amplify Cybersecurity ETF (HACK). As you can see, it’s starting to climb out of a multi-month base:

Source: StockCharts

Source: StockCharts

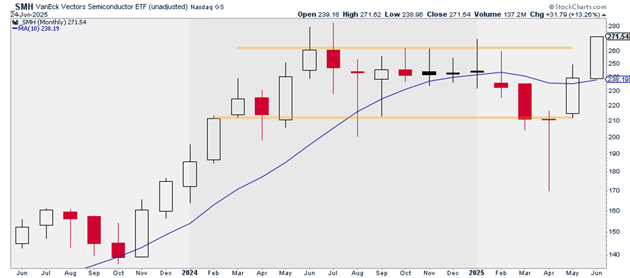

I also love what I’m seeing out of semiconductors. Below, we’re looking at the monthly chart of the VanEck Semiconductor ETF (SMH).

SMH is starting to climb out of a one-year base. In fact, it’s on track to print its highest monthly close ever.

Source: StockCharts

Source: StockCharts

That would be an incredibly bullish signal for both semis and the market as a whole.

In my RiskHedge Live trading room—where I share my top trades in real time with members—I recently recommended two cyber names and two semi names. If you’d like to join us in RiskHedge Live and be part of a great community of traders, go here.

Justin Spittler

Chief Trader, RiskHedge