Nervous yet?

The US election is right around the corner...

The conflict in the Middle East appears to get worse by the day...

And another major hurricane is about to make landfall in Florida.

At the same time, the Volatility Index (VIX), US dollar, and interest rates have been rising over the past few weeks.

In other words, there’s plenty for investors to be worried about.

And yet, you wouldn’t know it by looking at the major indices.

The S&P 500 and Dow Jones Industrial Average are both trading less than 2% off their all-time highs. The Invesco QQQ Trust (QQQ) has also bounced back strongly.

What’s going on here?

Are investors being complacent? Or is this market just incredibly resilient?

I’d argue it’s the latter. During bull markets, stocks climb what’s known as a “wall of worry”... meaning they keep climbing higher despite bad news.

So, this is perfectly normal. In fact, it makes me more bullish about the coming months for stocks.

|

I just released my first-ever on-camera walkthrough of the proprietary indicator I use to make money in the markets. Watch it here. |

As a trader, I look at price action because it’s objective and cuts out the noise.

Several leading groups have broken out to new record highs lately, including industrials, financials, communications stocks, software, cybersecurity, and mid-caps. And that’s just to name a few.

If the market was headed off a cliff, these sorts of groups wouldn’t be hitting new highs. In other words, price—the only thing that truly matters—confirms we’re in a bullish environment.

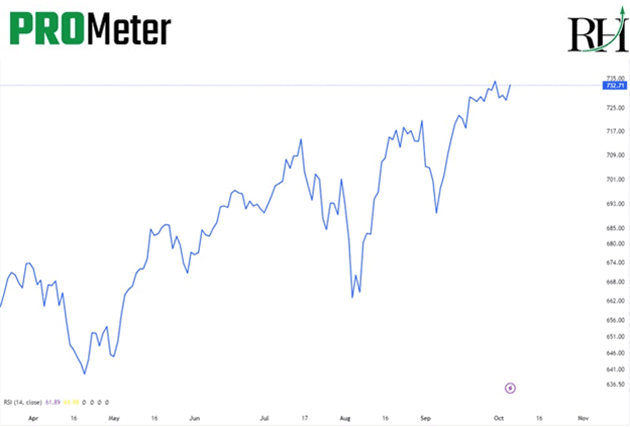

My proprietary PRO Meter—my north star for my new Express Trader letter—is saying the same thing.

Simply put, the PRO Meter helps me gauge whether we’re in a strong or weak market environment by comparing the performance of “risk-on” sectors with “risk-off” sectors. It’s effectively a ratio, depicted as a line on a chart.

When this line is rising, it means risk-on groups are outperforming risk-off sectors. This is the sort of environment where we “put our foot on the gas.”

When it’s trading sideways, it indicates indecision.

When it’s falling, that tells us to exercise caution.

Source: TradingView

In short: It’s time to buy stocks in “risk-on” groups like technology, financials, and communications.

Every Monday in Express Trader, I use the PRO Meter to gauge where the market is likely headed… and then I recommend the three strongest stocks to buy.

I’ve made it super simple because so many traders make it more complicated than it needs to be.

If you’re interested in joining us, go here to start getting my weekly trades.

Justin Spittler

Chief Trader, RiskHedge