Bitcoin (BTC) has broken out.

It’s spiked 10% over the past week and is now trading at $120,000—its highest price ever.

If you missed this move, I wouldn’t sweat it.

Everything I’m seeing tells me crypto is just getting started. At the end of this essay, I’ll show how to take full advantage of what lies ahead.

But let’s first rip through some charts.

Starting with bitcoin... which just broke out of a multi-week base a few days ago. That alone is bullish. But it’s hardly the only reason I see crypto headed much higher from here.

Source: StockCharts

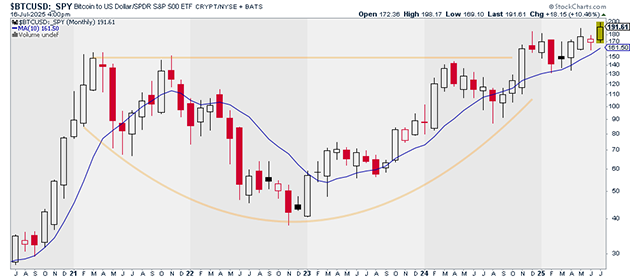

This next chart compares the performance of bitcoin with the S&P 500 (SPY). When this line is rising, it means that bitcoin is outperforming US stocks. We can see this ratio is just starting to climb out of a base that dates back to 2021.

Given that we’re looking at a multi-year pattern, bitcoin should provide alpha for the foreseeable future. Not bearish, folks.

Source: StockCharts

Bitcoin is also outperforming the Invesco QQQ Trust (QQQ), gold, and US Treasuries. It’s the strongest major asset on the planet.

And it’s hardly alone. Ethereum (ETH)—the second-largest crypto currency—has surged 53% over the past month. It’s now trading at its highest level since January.

Ethereum is higher beta than bitcoin. So, the fact that it’s outperforming is evidence of strong risk appetite in the crypto space. Even more reason to be bullish.

Finally, the Total Crypto Market Index—which measures the market value of the entire crypto market—recorded its highest weekly close ever on Friday. Contrary to popular belief, assets that hit new highs tend to reach even greater highs.

The million-dollar question is: What do you do with this information? Well, there are more ways than ever to trade crypto.

You can buy bitcoin, Ethereum, or other cryptocurrencies. You can get exposure to the asset class through the iShares Bitcoin Trust ETF (IBIT) or the iShares Ethereum Trust ETF (ETHA).

You can also buy crypto stocks like Coinbase (COIN)... bitcoin mining stocks… or Treasury assets that accumulate crypto like MicroStrategy (MSTR).

In my premium trading room RiskHedge Live (upgrade here), we’ve aggressively added to crypto over the past few months. We own actual crypto. We’ve bought the ETFs. And we’re long crypto stocks such as COIN and Robinhood (HOOD).

Justin Spittler

Chief Trader, RiskHedge