Today, we’re buying a stock in the world’s most universally hated industry…

Not tobacco, alcohol, or firearms…

Coal.

Coal isn’t just another “unsexy” industry. Many folks think coal’s destroying the planet.

Of course, hated stocks can have their perks…

And trading the right hated stock at the right time can be very profitable.

Which brings me to our Trade of the Week: US-based coal company Warrior Met Coal (HCC).

HCC is dirt cheap. It trades at a trailing price-to-earnings (P/E) ratio of 3, and a forward P/E ratio of just 7. You’d be hard-pressed to find a cheaper stock.

Of course, most cheap stocks are cheap for a reason. Their underlying businesses are poor.

But that’s not the case here.

Warrior operates an incredible business. Last quarter, the company’s sales grew 35% from the same period a year ago, while its earnings jumped 24%. Warrior also enjoys impressive 36% net profit margins.

In other words, you have the opportunity to pick up shares of a hyper-efficient business for a fire-sale price.

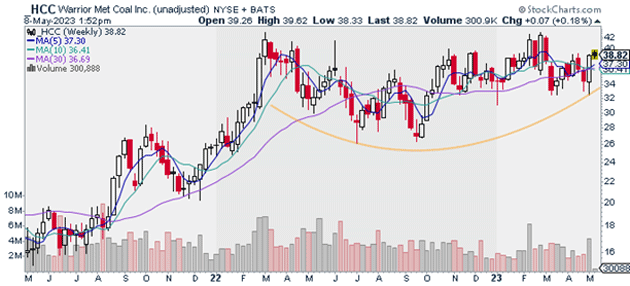

Warrior’s chart is also very compelling.

As you can see below, HCC is in a strong uptrend. It’s rallied 49% since the start of 2022. The S&P 500, for perspective, is down 13% over the same period.

But that doesn’t mean we’re chasing HCC here. As you can see, HCC has spent the past year building out a huge base:

Source: StockCharts

Source: StockCharts

Consolidation patterns like this often serve as launch pads for multi-month, or even multi-year, rallies. And I believe it’s only a matter of time before HCC climbs out of this pattern.

Just understand that coal stocks are notoriously volatile. So, I suggest managing your risk two ways with this trade.

First, I recommend buying a half position in HCC. If I’m right, you won’t need to invest a lot of money to make serious returns. I’m targeting $60 for HCC over the next 12 to 18 months. That gives us a potential upside of 55%, and a risk-reward ratio of 3:1 on this trade.

Second, I suggest using a stop-loss at $33.

Action to take: Buy a half position in HCC at current market prices.

Risk management: Exit your position if HCC closes below $33.

Justin Spittler

Chief Trader, RiskHedge