Not every trade needs to be “sexy.”

It’s no secret stocks at the forefront of big, exciting megatrends receive the most attention.

Today, the trend most people can’t stop talking about is artificial intelligence (AI).

Everyone is looking to ride the AI wave to riches. As a result, high-profile AI stocks like Nvidia (NVDA) and Microsoft (MSFT) have been doing incredibly well lately…

But as I’ll show you in today’s Trade of the Week, not every trade needs to be “sexy” in order to be profitable.

“Boring” consumer staples stocks, in particular, have also been on fire recently.

These companies sell stuff people need rather than things they want. Think toothpaste, shampoo, frozen pizzas, and other basic goods.

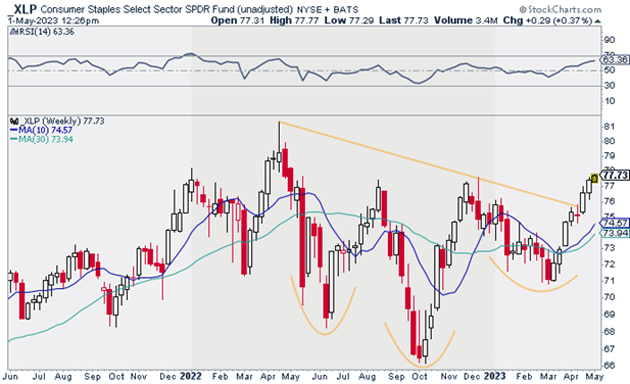

The chart below shows the performance of the Consumer Staples Sector ETF (XLP), which invests in a basket of consumer staples stocks.

XLP recently broke out of an inverse “head-and-shoulders” pattern it spent months building. In the process, it broke out of a downtrend it’s been in since last May.

Source: StockCharts

Source: StockCharts

Since then, consumer staples stocks have stormed higher.

But that’s not the only reason I like this group…

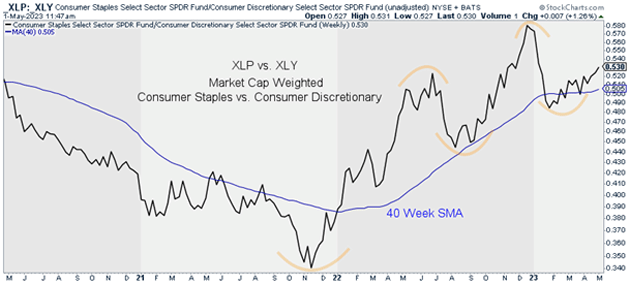

The chart below compares the performance of XLP with the Consumer Discretionary Sector ETF (XLY), which invests in companies like Amazon (AMZN), Tesla (TSLA), Nike (NKE), and Starbucks (SBUX).

When this line is rising, it means companies selling “needs” are outperforming companies selling “wants.”

We can see this ratio has been rising since late 2021. Since then, it’s put in a series of higher lows and higher highs. It’s also reclaimed its rising 40-week moving average (in blue).

Source: StockCharts

Source: StockCharts

This tells me consumer staples stocks will likely continue to outperform consumer discretionary stocks…

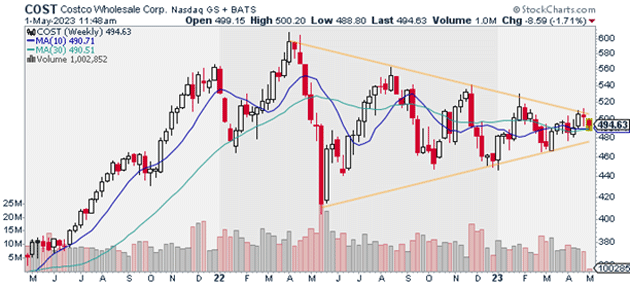

Making right now the perfect environment to buy my top trade of the week: wholesale club retailer Costco (COST).

COST bottomed in May… well ahead of the indices. Since then, it’s put in a series of higher lows.

It’s also trading back above its 10- and 30-week moving averages. This tells me COST is still in a longer-term uptrend.

Source: StockCharts

Source: StockCharts

Costco’s weekly chart has also been getting very tight. This tells me it could be on the verge of a major move higher.

I suggest buying COST at current market prices, and I’m targeting $600/share over the next 12 months. That’d be about a 21% move higher from today’s prices.

Exit your position if COST closes below $465. That gives us a risk-reward ratio of 3:1 on this trade.

Action to take: Buy COST at current market prices.

Risk management: Exit your position if COST closes below $465.

Justin Spittler

Chief Trader, RiskHedge