It’s a global market of stocks.

Many traders forget this. They only trade and pay attention to US stocks.

As a result, they’re not seeing the big picture.

It’s a costly habit that can lead to missing out on huge opportunities. It can even lead to crippling losses.

I mention this because many traders are pointing out that the S&P 500 (SPY) and the Invesco QQQ Trust (QQQ) are both below their 200-day moving averages.

Therefore, stocks are doing poorly.

But it’s a great big world, and international stocks have been red hot.

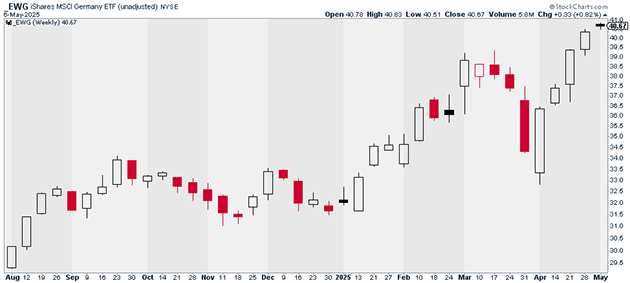

Over the past month, the iShares MSCI Germany ETF (EWG) has rallied 23% and broken out to new all-time highs:

Source: StockCharts

Source: StockCharts

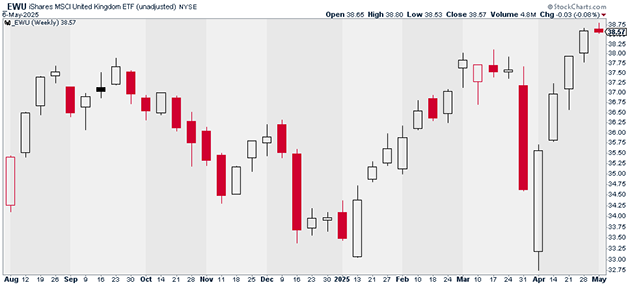

The iShares MSCI United Kingdom ETF (EWU) has climbed 18% off its recent lows. It’s broken out to 10-year highs:

Source: StockCharts

Source: StockCharts

The iShares MSCI Italy ETF (EWI) and the iShares MSCI Austria ETF (EWO) have also been on a tear. They’re hitting new seven- and eight-year highs, respectively.

Asian stocks are also en fuego.

The iShares MSCI Singapore ETF (EWS) has surged 24%, and it’s back at record highs:

Source: StockCharts

Source: StockCharts

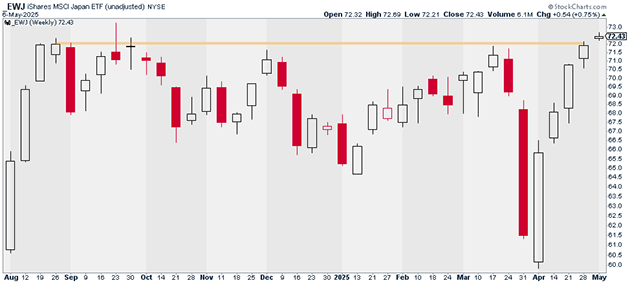

Meanwhile, the iShares MSCI Japan ETF (EWJ) is on the verge of breaking out to 14-year highs after running up 21% over the past few weeks:

Source: StockCharts

Source: StockCharts

This is great news if you own international stocks. But it’s also encouraging for US stocks.

The United States is still the world’s largest and most important market.

If the global economy were really headed off a cliff, would we be seeing international stocks breaking out to new all-time and multi-year highs left and right? I really doubt it.

In my latest issue of Express Trader—my premium advisory where I recommend the three strongest trades to make every week—I wrote why the current market environment resembles the early stages of a near bull market.

Our three current positions are holding up well, with our top one up 80% in a little over a week as of this writing. To make sure you get my next premium Express Trader picks, go here.

Justin Spittler

Chief Trader, RiskHedge