Something big just hit the energy markets.

Yesterday, Cameco (CCJ) inked a transformational $80 billion partnership with the U.S. government and Brookfield to roll out a new wave of American nuclear reactors using Westinghouse technology.

It’s just the latest in a string of blockbuster energy deals.

You see, it’s no secret that AI energy demand is skyrocketing.

According to Goldman Sachs, AI data centers will use as much electricity as Japan by 2030!

Hyperscalers like Microsoft (MSFT), Amazon (AMZN), and Oracle (ORCL) are desperate for energy.

And that’s where nuclear comes into play… Cameco is the world's top publicly traded uranium producer.

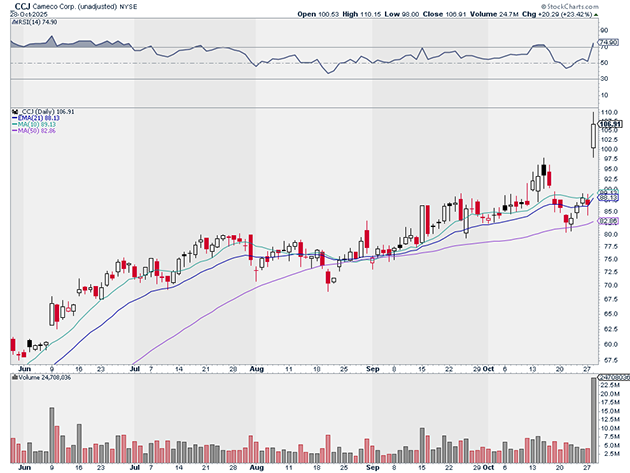

Shares of CCJ surged 23% higher on the news, on the highest volume in years.

Source: StockCharts

Source: StockCharts

CCJ is now up 108% in 2025. It’s easily the year’s top performing large-cap energy stock.

The news also sparked an industry-wide rally. Uranium Energy Corp. (UEC) spiked 14% on the news. Uranium Royalty (UROY) soared 19% on the news, while the Global X Uranium ETF (URA) jumped 8%.

You might be wondering if it’s too late to buy uranium stocks. Take a look at this chart. It shows the performance of the URA.

URA has been performing exceptionally since 2000. But it’s just starting to climb out of a massive base.

Source: StockCharts

Source: StockCharts

Subscribers of my premium RiskHedge Live trading room are well-positioned to capitalize on this megatrend. We recently picked up shares of CCJ, UEC, and Energy Fuels (UUUU)—the three uranium leaders.

If you’d like to join us, go here.

Justin Spittler

Chief Trader, RiskHedge