Story stocks are back in a major way.

These aren’t the sort of stocks I usually discuss.

Most aren’t profitable. Some haven’t even made their first sale.

They rarely trade on fundamentals. Instead, they move on news, hype, and animal spirits.

And yet, they can be the most explosive stocks in the market when the conditions are right.

We saw that play out in December, when many story stocks went parabolic into the end of 2024.

It appears the time for story stocks has returned…

Last week, quantum computing stocks went to the moon.

D-Wave Quantum (QBTS) led the way, surging 53% over the week. QBTS has now surged 154% this month alone!

And it’s not the only one... Fellow quantum names IonQ (IONQ) and Arqit Quantum (ARQQ) spiked 31% and 36% last week, respectively.

On Friday, nuclear stocks joined the party after the White House signed several executive orders related to nuclear energy.

Lightbridge Corp. (LTBR) soared 42% on the day. Oklo (OKLO) surged 23%. And Centrus Energy Corp. (LEU) skyrocketed 21%.

The enthusiasm carried through the long holiday weekend. Many nuclear names are already up double-digit percentages this week. Several are breaking out to multi-year highs.

Space stocks—another speculative group—have also woken up.

Yesterday, Rocket Lab (RKLB) surged 13% on news. Industry peers Redwire Corp. (RDW) and Satellogic (SATL) spiked 23% and 14%, respectively.

These themes have nothing in common other than one thing: They’re all story stocks. They’re the types of names that perform well when risk appetite is rampant.

At this stage, I wouldn’t be surprised if other thematic stocks also take off soon. One group I’m watching very closely is the electric vertical takeoff and landing (eVTOL) aircraft stocks, or what I call the “flying taxi” stocks.

This group has run alongside space, nuclear, and quantum stocks in the past.

Today, Joby Aviation (JOBY) is up 26% on news that Toyota just became the company’s biggest shareholder after investing $250 million. That’s good for a 15% stake, and the company plans to invest another $250 million.

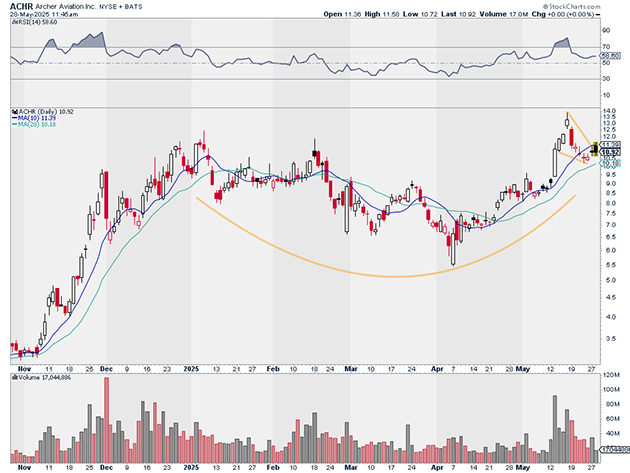

But I wouldn’t chase JOBY here. Instead, I like the setup in Archer Aviation (ACHR) much more. ACHR is the industry leader and has been a much stronger stock than JOBY lately:

Source: StockCharts

Source: StockCharts

If you’re going to play ACHR (or any other story stock), my suggestion is to treat them as speculations. Use small position sizes. Don’t put all your eggs in one basket. And exercise patience.

Last thing: With all the volatility in the markets, I see a lot of opportunities opening before us. So, I’ve been working on a way to help you take advantage of it.

More details coming soon... Stay tuned...

Justin Spittler

Chief Trader, RiskHedge