“I see dead people.”

That line from The Sixth Sense is one of the most iconic movie quotes of all time.

Well, to shamelessly steal that line... “I see dead companies.”

And I see them in some of the hottest sectors right now, like nuclear, robotics, and drones.

Investors piling into stocks in these industries are making a huge mistake.

- Drones are transforming warfare before our eyes.

Over 70% of the causalities in Ukraine are caused by killer flying robots.

That’s one of the reasons drone-maker AeroVironment (AVAV) has more than doubled in the last five months.

Drones = disruptive. TRUE.

Drone stocks = good investment. FALSE.

AeroVironment’s drones are bulky and fixed-wing. They’re built for the old world where drones were mostly used for reconnaissance over long distances. And each of its Switchblade drones costs upward of $50,000.

But the flying robots transforming the battlefields of Ukraine are tiny quadcopters that cost as little as $1,000.

Small and cheap beats big and costly.

Source: Defence Blog; sUAS News

Startups like Neros and Flyby Robotics are making drones that are smaller, cheaper, and smarter. They can swarm, fly on their own, and be built at scale for a fraction of the cost.

I’ve been lucky enough to chat with the founders of this next generation of drone startups. Many of them have already deployed this tech in the Ukraine and elsewhere. Talking to these founders, you quickly realize legacy drone-makers like AeroVironment are toast.

Cheap, flexible drones are the future. That’s what militaries will buy.

- Some of the hottest stocks in the world right now are…

Companies building a new breed of small nuclear reactors (SMRs).

Oklo (OKLO) has tripled this year. NuScale Power Corp. (SMR) has doubled.

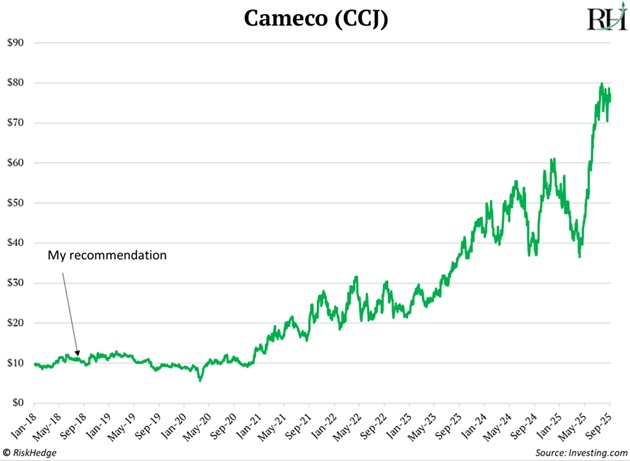

You won’t meet a bigger supporter of nuclear energy than me. I first wrote about profiting from nuclear back in 2018, recommending Cameco (CCJ).

The stock’s surged 580% since then:

Microreactors like Oklo and NuScale are building the future of nuclear energy. They’ll make the world’s safest, cleanest, most reliable energy source even better.

Oklo, NuScale, and Nano Nuclear Energy (NNE) might be the only publicly traded SMR companies. But they aren’t going to win the SMR race.

In the past year, I’ve visited the factories of several leading microreactor startups, including Valar Atomics and Aalo Atomics. I’ve chatted with the founders of many others.

|

These fast-moving startups are going to wipe the floor with the more arthritic Oklo and NuScale.

Where’s the proof? NuScale’s flagship project in Idaho was meant to be the world’s first SMR. But it died last year after costs almost doubled to $9.3 billion. That’s after burning through 2 million engineering hours and $500 million just on licensing paperwork.

Meanwhile, Valar, Aalo, and others are racing to turn on America’s first SMR by July 4, 2026.

- Something always felt “off” about robotics stocks.

I’d hear robots were taking over the world and being deployed everywhere…

Yet, when I dug into the financials of the largest robotics companies, they were barely growing. Huh?

Robotaxi leader Waymo just hit the milestone of 100 million fully autonomous miles on American roads.

Flying robot startups like Zipline are delivering burritos (and everything else) to happy customers across America.

Amazon (AMZN) now employs more robots than humans in its warehouses!

You can believe robotics are disrupting the world… while also understanding buying industrial automation stocks like ABB Ltd. (ABBNY), Fanuc (FANUY), and Yaskawa (YASKY) is a bad move.

These are the biggest robotics companies in the world. By default, they’re seen as leaders in the field.

But when you talk to startups working on the frontier of robotics, you learn a little secret: These are industrial dinosaurs.

The real future is being built by startups creating artificial intelligence (AI)-native robots. Machines that learn tasks in hours, not months. And that can “update” like your iPhone.

Once these robotics startups ramp up manufacturing, the old guard will get steamrolled.

- “Okay, Stephen. So which stocks do I buy?”

To quote Kenny Rogers, “You’ve got to know when to hold ’em, know when to fold ’em.”

The best drone, nuclear, and robotics companies aren’t yet public. And that’s a good thing. These are early-stage startups that shouldn’t have to worry about the constant scrutiny of the public markets.

But if you own legacy stocks across these disruptions, I recommend folding ’em.

These stocks could keep getting bid up as investors get excited about drones, robotics, and nuclear transforming the world.

But they’re not the long-term winners.

I see dead companies.

Stephen McBride

Chief Analyst, RiskHedge

PS: In my latest issue of Disruption Investor, published yesterday, my co-editor Chris Wood and I put together an “ETF” of the three strongest companies that stand to profit from what we’re calling Phase 2 of the AI boom.

Phase 1 was about big tech plowing enormous sums of money into AI models. But Phase 2 is about where the next trillion dollars of AI spending comes from…

If you’d like to learn about the three shifts powering Phase 2 of the AI boom—and get the three stocks in our AI “ETF”—go here to sign up for Disruption Investor today.