Justin Spittler here. Today, I’m handing the reins to Chief Analyst Stephen McBride, who explains how you can profit from the “biggest lie in America”…

How to cash in on the biggest lie in America…

What’s one of the surest ways to make money investing?

Find a big lie that everyone believes...

Bet against it...

And wait for the truth to come out.

For example, have you seen the movie The Big Short?

It tells the story of a few clever investors who made a killing betting on the US housing collapse in 2007–8.

As crazy as it sounds now, in the mid-2000s, most folks believed that US house prices “never go down.”

A handful of investors figured out this was a huge lie… and placed bets to profit on the housing collapse.

When it all came crashing down, they walked away with over a billion dollars’ profit.

- There’s a new big lie floating around about US housing today...

I’m sure you’ve heard this “fact” before:

Today’s generation of young adults, known as “Millennials,” aren’t like their parents. They don’t want to buy a house and spend 30 years paying it off. In fact, they don’t want to buy houses at all. Instead, they’ll rent for life.

Like all believable myths, there’s a grain of truth to it.

A 2016 Pew Research study found more than two-thirds of Americans under 35 rent. And of the 46 million renters in the country, roughly half were Millennials.

Young folks will never buy houses like their parents did, the story goes, which will keep a cap on house prices forever.

In Ireland where I’m from, this is what you call “malarkey.”

What did you do after you graduated college? If you’re like me, you probably moved to a city, found a job, and rented a place.

Research from the University of Minnesota tells us most Americans in their 20s rent instead of buying a home. And it’s been this way for 60 years.

In other words, our 20s are peak “renting” years. Every generation of Americans follows this path.

But then you get married… and start thinking about having kids. And what comes soon after? Buying a home.

- Millennials tricked everyone into thinking they were different.

Record levels of student debt forced many young folks to put off buying a home. And many Millennials graduated college into a job market that had been decimated by the 2008 financial crisis.

This pushed Millennials to wait a little longer to buy their first homes.

But the average Millennial isn’t a kid anymore.

Pew Research data shows the average age of a first-time homebuyer is 31. Last year, the average Millennial turned...

31!

Which means we’re just kicking off this massive trend.

- Millennials are finally growing up and buying houses...

According to the National Association of Realtors, one in three homebuyers today is a Millennial.

As you may know, Millennials are the biggest generation in US history—bigger even than Baby Boomers. And they’re hitting prime homebuying age right now.

The largest generation in history is piling into the housing market... and hardly anyone believes it!

In fact, on a recent earnings call, America’s largest homebuilder, DR Horton, quipped: “Over 40% of our buyers are under 34.”

According to Apartment List’s Homeownership report, Millennials led all generations in homebuying last year. The Millennial homeownership rate has climbed to 47.9% from 40% just three years ago, according to the report.

Think about it like this… the ‘08 crisis forced Millennials to put adulthood on the back burner. It disrupted the natural ebb and flow of the “next generation” starting life.

Now Millennials are hitting prime homebuying age, and they’re piling into the market in record numbers.

- This housing boom has YEARS left to run.

Remember: The ‘08 crisis turned off a lot of ordinary Americans from investing in housing.

It shattered the confidence of homebuilders, too.

Builders have been sitting on their hands for the past 12 years. And it’s created a serious housing shortage in America today.

There’s currently only one million homes for sale across the entire US, according to the National Association of Realtors (NAR). That’s the lowest number since NAR started tracking data in 1982.

In other words, there are fewer homes for sale in America today than at any time since Ronald Reagan’s first term as president… at a time when a whole generation of homebuyers will soon flood the market!

It would take less than two months to sell every existing home on the market. In December, the average property was snapped up in just 21 days, an all-time record.

For example, the CEO of internet realtor Redfin, Glenn Kelman, recently told CNBC: “I’ve never seen such low inventory. In Austin, people are bringing lawn chairs to open houses because the wait is so long. In Salt Lake City, wait lists are 90 people deep.”

This won’t come as a surprise to longtime RiskHedge readers. As housing expert Barry Habib told me last year, “The most important driver of home prices is supply and demand.”

Today, supply is tighter than it’s ever been. And with record numbers of house hunters entering the market, it all but guarantees the housing boom has years left to run.

- I'm "pounding the table" on homebuilder stocks.

The cure for America's housing woes is simple: Homebuilders MUST build more houses.

As I mentioned, builders have been very cautious over the past decade. But now they’re finally ramping up.

Earlier this year, the number of new home “starts” shot up to their highest level since 2006.

Even after this bump, housing “starts” are still lower than they were in 1959! Yet, the number of Americans has doubled over the past 60 years.

In short, homebuilders have to build tens of millions of new homes over the coming decade. This will make them look like fast-growing tech startups.

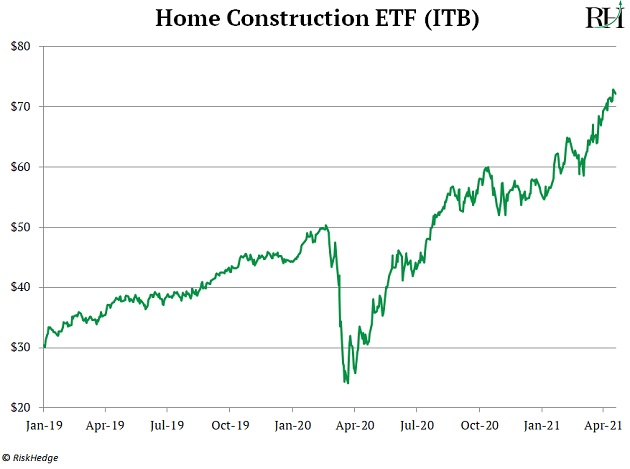

The iShares US Home Construction ETF (ITB) has doubled since I first wrote about this opportunity in early 2019:

I expect that homeownership rates for young folks will surge to new heights over the coming decade. This will continue fueling the largest housing boom ever.

If you’re not invested in this trend yet, now’s the time to put your money to work.

Stephen McBride

Editor — Disruption Investor

P.S. Please understand: Millennials buying homes is just one tiny part of a much bigger story. My research shows we are now at the tipping point of what I’m calling a “Millennial Melt-up”… one that has the power to transform the entire economy.

Not only that: The coming Millennial Melt-up could very well be your last best chance to rack up extraordinary wealth in the next 24 months.

If you act now... You could see 5X, even 10X your money as 75 million Millennials with trillions in new wealth become an unstoppable force for change.

Because this opportunity is so big, I recently put all my findings in a new briefing, free to read here. (It also details my top 3 ways to cash in on this monumental shift.) Go here to check it out.