It’s my #1 trade idea this week in the face of the ongoing banking crisis...

And I’ll share everything you need to capitalize in a second.

But first, I want to welcome you to my new letter, Justin Spittler’s Trade of the Week. I’m glad you’re here.

Every Tuesday, I’ll send you my top trade idea for the week. And I’ll explain it in plain English so you can easily take advantage. I’ll always include clear instructions on how to manage risk.

We’re launching this letter now because the world seems to be experiencing huge changes on a weekly basis. Markets have been extremely volatile. This volatility creates fear and uncertainty for those who don’t know how to deal with it.

But for traders, it creates opportunity. In this letter, I’ll show you these opportunities and how to play them.

Trading is a journey, and I’m glad you’ve joined me. You can “opt out” at any time by managing your email preferences here.

With that, here’s your trade of the week...

We’re in the middle of a bank crisis.

A couple weeks ago, Silicon Valley Bank (SIVB)—which was America’s 16th-largest bank and a massive player in the venture capital world—closed its doors after many people pulled their money out all at once.

Signature Bank (SBNY) was shut down by the US government due to “contagion” fears.

And Swiss bank Credit Suisse (CS) was acquired by UBS over the weekend.

These stocks fell 37%... 63%... and 68%, respectively, in a matter of days.

And those are just the highlights…

Many other major banks, including First Republic Bank of San Francisco (FRC), have seen their share prices fall off a cliff.

All these banks are struggling for the same basic reason.

Interest rates have gone parabolic. The Fed—by raising rates at the fastest pace in half a century to fight inflation—finally broke something.

Things have gotten so bad that governments around the world are pumping liquidity into their banking systems in the hopes of stabilizing an increasingly chaotic situation.

But the core problem remains…

Interest rates are too high.

And that brings us to the Trade of the Week... I suggest buying the iShares 20+ Year Treasury Bond ETF (TLT), which invests in longer-term Treasury bonds.

Historically, long-term Treasurys have acted as a safe-haven asset… meaning they’ve performed well during periods of market turmoil. But that hasn’t been the case lately.

Last year was the worst year for bonds since 1871! This was due to sky-high inflation and the Fed raising rates.

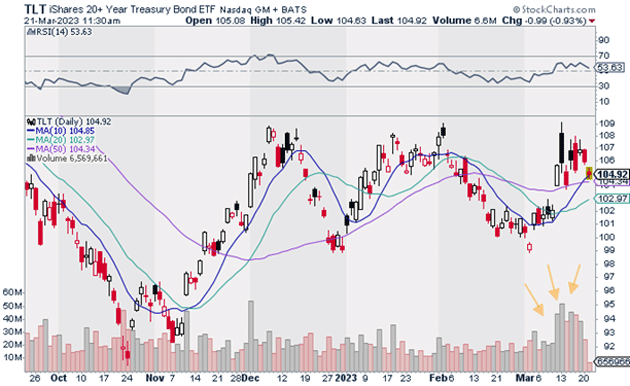

I think both of those factors have run their course. And bond prices seem to agree. They’re behaving much different lately, as you can see below.

TLT has put in a series of “higher lows” since October. And buying volume (bottom vertical bars) has spiked considerably.

Source: StockCharts

And more important, TLT closed above its 200-day moving average for the first time since December 2021.

This is a great, low-risk opportunity to buy TLT. We have a clear line in the sand to know if we’re wrong: $100.

If TLT closes a day below $100, I’m out. I think TLT could surge to a minimum of $122, giving us a nice risk-reward ratio of 3:1 on this trade.

Action to take: Buy TLT at current market prices.

Risk management: Exit your position if TLT closes below $100.

Justin Spittler

Chief Trader, RiskHedge