I called the bottom in bitcoin (BTC).

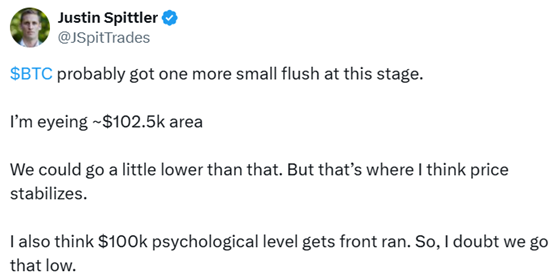

Here’s what I wrote on X on June 4:

The next day, bitcoin bottomed right around $100,300. Bulls front-ran the $100,000 psychological level just as I thought they would.

Was this dumb luck? As a trader, I get lucky all the time. But this wasn’t one of those instances.

Today, I’m going to tell you exactly what led me to make this call.

Let’s start with the bitcoin chart.

Below, you can see that bitcoin’s rising 50-day moving average was trading just above $100,000 during last week’s pullback. That was a major level I expected bulls to defend.

Source: StockCharts

Source: StockCharts

I was also watching a major level—the January inauguration weekly closing highs—around $102,500.

I knew there was a chance that bitcoin flushed below this critical level, but I was confident it wouldn’t stay below it long.

There were other factors that told me bitcoin’s dip would be shallow and short-lived.

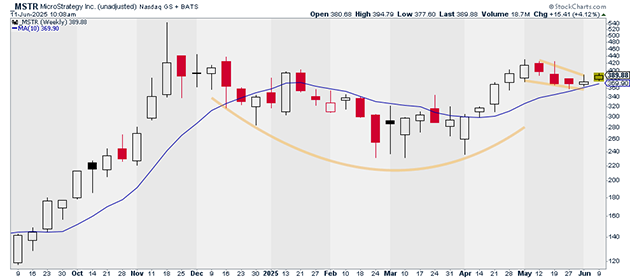

For one, MicroStrategy (MSTR)—one of the largest bitcoin stocks—was also holding up very well last week. It wasn’t selling off with bitcoin, and it was holding its rising 10-week moving average:

Source: StockCharts

Source: StockCharts

Finally, Ethereum (ETH)—the second-largest cryptocurrency—was showing strength relative to bitcoin.

Typically, money doesn’t rotate into riskier assets before a major pullback. Instead, it takes shelter in safer assets. Ethereum is riskier than bitcoin.

So, this told me there was a sign of “risk appetite.” That wouldn’t be occurring if bitcoin was headed much lower.

In my RiskHedge Live trading room, I recommended a specific crypto play that’s showing a ton of strength. If you’re not in the room already, you can access RiskHedge Live for a special, limited-time price here. I’d love to have you on board.

Finally, with a membership to RiskHedge Live, you’ll also get my dedicated crypto report to help get you up to speed in this booming space.

Justin Spittler

Chief Trader, RiskHedge