It’s not a bull market without semis.

Semiconductors are the stock market’s most important industry.

They’re the brains of the modern world. They go into everything, from phones to cars to refrigerators.

If they’re performing well, it’s usually a good sign for the broader market and economy.

Semis are also mission-critical to artificial intelligence (AI)—today’s defining megatrend. Without them, AI applications like ChatGPT would be impossible.

Finally, the group is home to some of the biggest, most important stocks. Nvidia (NVDA) is the world’s largest publicly traded company, with a market value of nearly $3.5 trillion. Broadcom (AVGO) is the world’s seventh-largest publicly traded company. And Taiwan Semiconductor (TSM) is the world’s 10th biggest.

Last summer, semis topped out well ahead of the major indices. Since then, they’ve been huge underperformers.

But that’s starting to change in a big way. The VanEck Semiconductor ETF (SMH) has rallied 46% since early April. And it looks like semis are headed even higher from here.

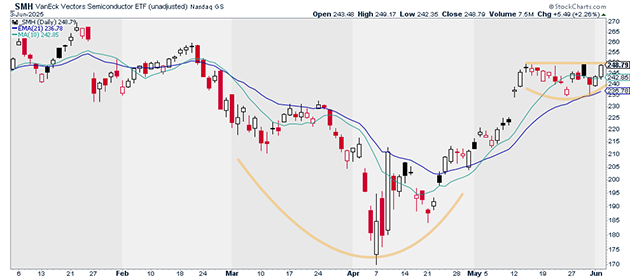

As we can see below, SMH has spent the past three weeks building out a mini base. A successful breakout of this cup-and-handle pattern would be bullish for both semis and the broader market.

Source: StockCharts

Source: StockCharts

There’s a strong chance that it will happen. After all, AVGO—today’s semi leader—has already broken out to new all-time highs. That’s a very good sign for the group.

And AVGO isn’t alone. This morning, Kevin Gordon—Senior Investment Strategist at Charles Schwab (SCHW)—pointed out that 42% of the stocks in the S&P 500 Semiconductor Index are now trading above their 200-day moving averages.

Earlier this year, not a single semi name was trading above its 200-day.

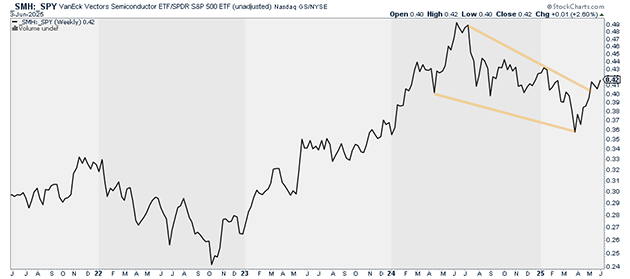

Semis are also on the verge of breaking out on a relative basis. Check out this chart below. It compares the performance of SMH with the S&P 500 (SPY).

When this line is rising, it means semis are outperforming. We can see that this ratio is just starting to break out of a multi-month downtrend. This suggests that semis are re-entering a period of outperformance.

Source: StockCharts

Source: StockCharts

My suggestion is simple. If you don’t already own semis, now is a good time to consider getting involved.

Also, if you're enjoying this weekly letter and are ready to take the next step in your trading, check this out.

You'll see how to join my trading room at a temporary discount to get my premium trades as they unfold, and start trading on "easy mode" today.

Plus, we just added a leading semi name to the portfolio earlier today.

Justin Spittler

Chief Trader, RiskHedge