One of the most important scientific breakthroughs of the 21st century… I’m watching this new public company closely… Should you buy stocks ahead of the Santa Claus rally?… Plus, the group of stocks you can’t ignore...

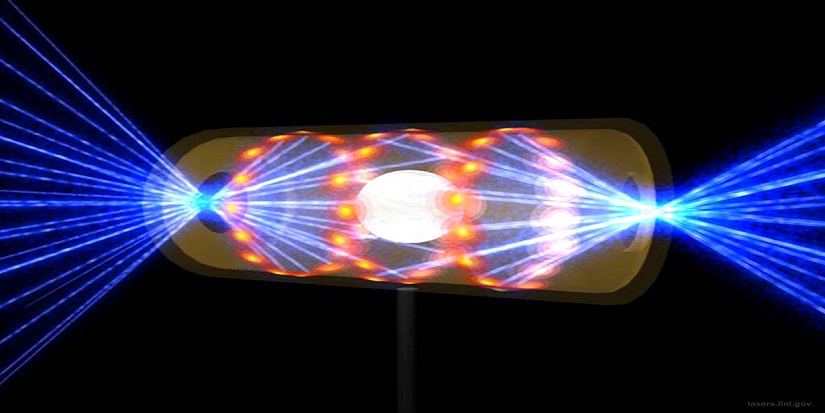

1) Outside of maybe quantum computing, of all the disruptions I follow, none has the potential to transform the world like nuclear fusion…

It’s the holy grail of energy. And scientists just made a historic breakthrough.

You see, today’s nuclear power plants run on fission—but fusion is much more powerful. It happens when atoms’ nuclei collide, generating vast amounts of energy. It’s what powers the sun and stars.

As you can imagine, recreating fusion on Earth and harnessing its energy would be revolutionary. Scientists have been dreaming about it since the dawn of the atomic age.

Once started, the fusion reaction is basically self-sustaining. It needs little fuel to keep going. Just a small cup of the hydrogen fuel could power a single house for hundreds of years.

Fusion is the closest thing to a limitless energy source. Like fission, it’s a “green” solution because it doesn’t produce any greenhouse gases. But unlike fission, nuclear fusion reactors wouldn’t produce harmful radioactive waste that sticks around for thousands of years.

The problem is past fusion experiments never worked. Reactions weren’t powerful enough to sustain themselves for more than a few seconds. And they always ended up consuming more energy than they produced.

But that all changed last week…

2) On December 13, scientists from the Lawrence Livermore National Laboratory made a huge announcement…

They created the first fusion reaction with a net energy gain. The energy output was about 120% of the input.

In short: Fusion power is no longer just a dream.

We’re now one step closer to an endless, low-cost, clean energy source. And the implications are huge. Fusion, if it can scale, will put oil and other dirty energy sources out of business. It’ll force millions of investors to a take a hard look at the dividend-paying utility stocks in their portfolio they consider “safe.” It’ll create vast sums of wealth for investors who get in early on the right companies.

We’re still years away from all of that. But fusion is the ultimate disruption—no investor can afford to be behind the curve on this.

3) Here’s an exciting new public company in the nuclear tech space I’m following...

The company designs and manufactures small modular reactors (SMRs). As the name suggests, these are nuclear fission reactors, just a lot smaller.

SMRs offer many benefits. Perhaps the biggest one is they can be mass produced in a factory rather than assembled on site... saving construction time and costs. They’re also safer, produce less waste, and require less fuel than traditional reactors.

According to Energy Monitor, “Power plants equipped with SMRs are designed to refuel every 3–7 years, compared to 1–2 years for conventional plants. Some SMRs are even designed to operate for up to 30 years without refueling.”

Now, if you haven’t heard of SMRs, don’t worry. While they’ve been in development for several years, none are up and running today. According to the International Atomic Energy Agency, “there are about 50 SMR designs and concepts globally” and “four SMRs in advanced stages of construction in Argentina, China, and Russia.”

The company that can successfully “figure out” SMRs and make them a reality has an enormous opportunity... as do investors. And I’ve got my eye on NuScale Power Corp. (SMR), a leader in the space that just went public in May.

NuScale made history in 2020 by becoming the first company to receive approval from the US Nuclear Regulatory Commission (NRC) for its SMR design. NuScale says no other competitor has even submitted for NRC approval, a process that typically takes three years to approve.

NuScale has over 450 patents and is already valued at $2.3 billion.

And while its first SMRs won't hit the market for a few years... This is a stock that will move based on deals. I still think it's a little early to invest in NuScale now... but it’s on my short list.

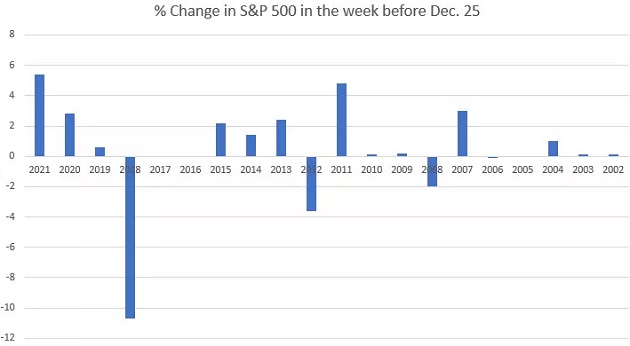

4) With Christmas around the corner, you’re sure to hear about the “Santa Claus rally...”

In market lore, stocks are supposed to climb in the weeks before Christmas.

There are many theories for why. People investing their holiday bonuses... professionals going on vacations and leaving the market to perma-bullish retail investors... an overall feeling of optimism and happiness on Wall Street...

But here’s the truth: The Santa Claus rally is something you can safely ignore.

Over the last 20 years, the average return for the S&P 500 in the week leading up to Christmas is only 0.385%. Basically flat.

See the outcomes for yourself…

Source: Investopedia

Returns are all over the place. The best result was in 2021, where stocks rose 5.4%. The worst year was 2018, when stocks fell 10.7%. And only 13 of the 20 years had positive returns.

Not exactly a convincing track record.

5) High-quality dividend stocks are crushing the market.

Check out Merck (MRK), it’s up 36%…

Source: StockCharts

Source: StockCharts

Look at McDonald’s (MCD), it’s just shy of reaching new all-time highs…

Source: StockCharts

Source: StockCharts

Same with Pepsi (PEP)…

Source: StockCharts

Source: StockCharts

Stocks are suffering their worst year since 2008, but you wouldn’t know it from looking at these names. That’s because high-quality dividend stocks are one of the rare groups that do well during high inflation.

These companies sell necessities like food, drinks, and pharmaceuticals. Stuff people will buy no matter the price. It makes it easy for these companies to pass inflation in costs on to buyers.

Dividend stocks are outperforming the market, they provide nice cashflow, and can protect your wealth from inflation.

If you’re interested in dividend stocks, I recommend following Mauldin Economics’ Kelly Green. Kelly has years of experience researching and writing about income-producing dividend stocks. She’s great at locating off-the-radar names paying strong, stable income streams (4X the average yield of the S&P 500).

On Wednesday, I’ll sit down with Kelly to talk more about today’s opportunity in quality dividend stocks.

In the meantime, you can learn more about Kelly and her strategy here.

What tech trends or ideas would you like to hear more about? Let me know at chriswood@riskhedge.com.

Chris Wood

Editor, Project 5X

In the mailbag...

Today, readers share their thoughts on ChatGPT, the scary-realistic AI we wrote about last week:

The real threat is that students (elementary, high school and yes, even college/grad school) will stop doing their own research and writing and just rely on ChatGPT to do their homework/take their exams. That seems to me to be a much bigger threat than outclassing Google. Imagine the high school teacher who receives 25 papers all identical and perfect!! Who’s learning anything? That’s the real threat in my opinion. I’d be interested in your response. —Judith

Chris’s comment: That’s definitely a risk. But one easy fix is to require students to cite their sources for a research report. With ChatGPT you have no idea where the answer is coming from so there’s no way to source it. That’s not a fix for all cases. But the rest of the fix could be the simple fact that the bot is often wrong. So why would students rely on it? I recently read about a site for coders that banned users from sharing advice from ChatGPT because many of the thousands of answers programmers were posting from the system were wrong.

Hey Chris, you forgot to mention that the conversational replies from this bot are not necessarily truthful. —Gary

Chris’s comment: You’re absolutely right. The bot can certainly be inaccurate and just plain wrong. To me, ChatGPT is really just a cool toy at this point.

I am a long-term reader. Thanks for your market inputs. Very valid analysis that Google is the premier AI company and has tons and tons of AI gunpowder. It has plenty of arsenal to deploy yet. Having said that, I (still) don’t agree with the conclusion reached. When I envision it, it won’t be a single death, but rather a death with a thousand cuts. Many companies will emerge which will do parts of search better using tools provided by GPT. Some will answer math questions better, others will make biology easy, while some will produce nice code. Google's use will eventually be limited to the search for the best tool to answer a particular question. So a huge change in wing for Google over the next decade and a half. It won’t be quick. It will happen slowly first, and then quickly. —Omer

I have seen this before in technology in hardware, whether it translates into software, I am not sure but I suspect it might. The installed base and business is so large and profitable that introducing the next generation would ruin your base income flow so you need to migrate but it takes too long. So a next generation solution, doesn’t have that problem, they can attack now. If their solution is revolutionary enough, they can become dominant.—KB