“This may be the single best investing entry point in a generation”… 3 criterion of market-beating stocks… Microsoft’s REAL profit story (that’s being overlooked)… The closest thing to “free money” you’ll ever find…

Chris Wood here. Today, I’m bringing in our friend Keith Fitz-Gerald to “talk shop” about the markets, including what to expect for the rest of 2023 and how to play it.

If you don’t know Keith, he’s a well-respected and highly visible personality with 42 years of market experience and a list of media appearances a mile long. I highly recommend his daily e-letter Morning! 5 with Fitz, which cuts through the noise with actionable investing and trading ideas. It’s become a “must read” for me every morning. And you can get it every morning too—for free—by going here.

With that, here’s Keith:

Chris Wood: Keith, first off, I appreciate you joining us and sharing your wisdom with RiskHedge readers today.

After one of the worst years for investors in decades, stocks are on the rise. What’s your take? Are we almost “in the clear,” or do you see a lot more pain ahead?

Keith Fitz-Gerald: Of course, Chris, my pleasure. Thank you for having me!

Keith Fitz-Gerald: Of course, Chris, my pleasure. Thank you for having me!

The situation reminds me very much of 1949, 1979, and 2008. In fact, the parallels between my research now and what happened back then are downright startling.

Then, as now... inflation raged, recession loomed, rates rose, housing crumbled, government spending rampaged, and the financial markets got crushed.

People gave up—yet each time, the markets came roaring back to life when most people least expected ‘em to.

I think we’re there again.

My research leads to one inescapable conclusion: 2022’s selloff—while vicious, unsettling, and no fun whatsoever—has crushed markets to the point where we are on the cusp of what may be the single best investing entry point in a generation.

You can buy great companies “on sale” and years from now, at the neighborhood BBQ, laugh about being smart enough to do it. If you’re a dividend investor, you can use lower prices to boost profit potential, decrease risk, and magnify compounding without lifting a finger. If you’re a trader, you can practically shoot fish in a barrel when it comes to harnessing the volatility most investors fear.

The way I see things, “This is truly your Warren Buffett moment.”

But, that said, prepare for some rough sledding in the near term...

Chris: Go on...

Keith: I believe markets will remain under pressure until mid-2023 as global deleveraging continues. Earnings will continue to slow, which means there will still be more margin compression and lower IPO activity ahead as capital market conditions remain unsettled.

At some point—my thinking is June—the Fed will pivot or at least decelerate rate increases and, in doing so, drive a pronounced upside pivot capable of pushing the S&P 500 higher in the second half of the year. At which point, both of those things will change as money comes roaring off the sidelines and FOMO takes over. We’ve gotten a taste both in recent weeks, in fact.

People frequently ask me “how high,” and that’s a tough call right now because there’s a lot we don’t know. So, let’s just say high enough to make a material difference in every investor’s wealth. Tesla, for example, more than doubled in just a few weeks recently.

Chris: I think you’re spot on. My “script” also includes stocks climbing higher. And I expect the second half of the year to be better than the first. So, what type of stocks are you eyeing?

Keith: What’s really critical here, and I tell this to our readers all the time—is that we invest in companies that make “must have” products vs. companies that make “nice to have” products. So that’s the first criterion. The second is that they have visionary CEOs, because those are the people who work true magic in any type of market. And the third criterion is that the fundamentals are solid and there’s some sort of economic moat that gives the company a distinct advantage over its competitors.

People hear that term and they immediately think Buffett, but my definition is a lot more specific… they’ve got to be able to protect margins AND still have the capacity to change consumer behavior. It’s really a very short, super selective list.

For example, I think Big Tech will return to the head of the class. In fact, one of my top choices is a company you hear me mention during my TV appearances frequently: Microsoft (MSFT).

It’s arguably one of the most important companies that has ever strode the face of the Earth. People thinking in terms of software are missing the bigger and, I submit, far more profitable picture.

The company has deep legacy contracts with most of the world’s Fortune 500, massive investments in AI, medicine, and all sorts of other things that most investors don’t even consider... but should.

Then, of course, there’s ChatGPT. Forget all the hoopla about AI… it’s a Google killer, pure and simple. What’s more, MSFT will integrate some version of it into every product set it makes—and that, in turn, will drive unprecedented profits for a decade. Perhaps more.

But here’s the thing—and I know you know this—knowing what stocks to buy isn’t enough.

These days, you’ve got to know how and why if you really want an edge. Tactics like Dollar Cost Averaging and its lesser-known cousin, Value Cost Averaging, will be your best friends as a way to control risk while accumulating shares. Learning a few basic options strategies can help, too.

Dividend reinvesting will be equally critical, just not for the reasons people expect.

Chris: Let’s unpack that a bit for RiskHedge readers...

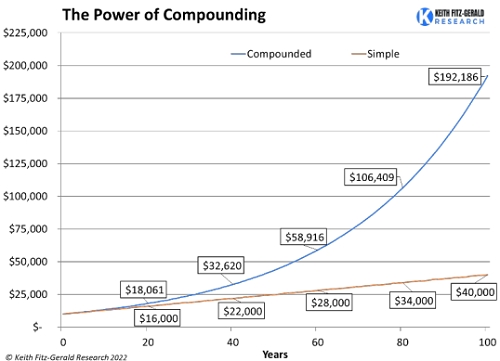

Keith: Absolutely. So, many people think about dividend reinvesting as something like watching paint dry. They don’t realize that reinvesting dividends boosts profit potential over time, lowers risk, and dramatically magnifies compounding. It also ensures discipline by helping you keep your emotions in check. That’s especially important when we see crazy market swings and many investors who lack a plan and discipline simply panic.

People get scared of the recessionary bogeyman and sell out, using the latest headlines as justification for their actions. That feels good, but counterintuitively, it damns many to terrible performance over time.

What many investors fail to realize despite their best intentions is that the markets have a pronounced upside bias over time.

In other words, that means folks are running for the hills at the precise moment they could (and arguably should) maximize profit potential and make decisions that will benefit them years from now.

Chris: Folks are sitting and waiting, trying to time the market, which you and I both know is a losing game.

Keith: EXACTLY.

The probability of correctly timing the markets just 50% of the time:

0.000000000000000000000000000000000000000000000000000000000000000000000000 00000000000000000000000000000000000000000000000000000000000000000000000000 00000000000000000000000000000000000000000000000000000000000000000000000000 0000000000000000000000000000000000000000000000000000000000000000000000000

022883557%.

In fact, the odds are probably higher that Fed Chairman Jay Powell admits he’s as wrong, as I think he is when it comes to inflation, rates, and labor markets!

On the other hand, the odds that the S&P 500 will close higher 10 years from now are... wait for it... 92.36%.

Investing and reinvesting in down markets is the closest thing to “free” money you’ll ever find.

Chris: So, can you break down how reinvesting plays out over time?

Keith: Here’s an example that’ll help.

Imagine you own 100 shares of XYZ at $100 a share, for a total initial investment of $10,000.

Now, also imagine that XYZ has an annual dividend equal to 3%, paid quarterly, that stays that way for the life of your investment. And finally, imagine you’ve decided, come hell or high water, that you’ll stick to the plan and reinvest diligently, even though you know in advance that the price of the stock will go absolutely nowhere.

I know, 3% a year doesn’t exactly get the ol’ motor running, but hang with me a moment.

Coming into year two, you've got approximately $10,303.39 invested, and a 3.0% yield that translates to a 3.13% yield on cost. By year three, that’s $10,615.99 and a yield on cost that’s now jumped to 3.22%. By year four, that’s $10,938.07 working for you and a yield on cost of 3.32%.

Now push 20 years out: You’ll have accumulated $18,180.44 and $8,088.98 in cumulative dividends... or nearly 80.9% of your initial investment. Your yield on cost will have increased 78.3% to 5.35%.

Chris: That’s a powerful example that I think many investors take for granted.

Keith: It boils down to something I talk about with our readers all the time… you want to do everything you can to put the odds in your court. Through good times and bad. A lot has happened over the past 120 years: booms, busts, two world wars, pandemics, and more.

But the Dow rose 42,509% through it all. There’s simply no two ways about it. You’ve got to make sure your money is working as consistently and efficiently as possible if you want to earn the big bucks.

And that means harnessing down markets others fear. You may as well be playing roulette if you’re jumping from stock to stock, especially these days when Dark Pools, high-speed traders, and a rigged system make it harder than ever to turn a buck. The principle of Gambler’s Ruin will ultimately bleed you dry.

Buying into down markets, then having the discipline to keep your money earning money, will keep you tapped into the profit potential you deserve. Practically for “free.”

Corrections inevitably prove to be buying opportunities for those savvy enough to recognize the situation. Not part of the time, not some of the time… 100% of the time!

Chris: Great stuff, Keith. We’ll talk again soon.

And for readers who want more specific and actionable ideas from Keith, go here to start getting his popular e-letter, Morning! 5 with Fitz, tomorrow morning.

Keith: I’d be honored—thank you.

[Editor’s note: You should know we have a marketing relationship with Keith and his team. If you buy a product from Keith Fitz-Gerald Research, we may earn a commission. That said, we enter marketing relationships with very few publishers and only when we are comfortable with their management team and research.]

Chris Wood

Chief Investment Officer, RiskHedge