Artificial intelligence (AI) stocks are back with a vengeance!

It’s no secret AI was the investing story of 2023.

The technology took the world by storm. And global leaders like Nvidia (NVDA), Advanced Micro Devices (AMD), and Super Micro Computer (SMCI) all delivered triple-digit returns.

Heading into 2024, many traders thought AI stocks would take a back seat to other investing themes like energy, China, and even marijuana.

But that hasn’t been the case…

Yesterday, NVDA broke out of a multi-month slumber and surged 6.4% to new all-time highs. It wasn’t alone. We saw an across-the-board rally in AI stocks.

If you’ve been following my work, you’ve probably seen some big gains in your portfolio…

Over the past several months, I’ve recommended several AI stocks—including Arista Networks (ANET), which has surged 51% since I made it my featured trade in July.

We’re also long several leading AI names in my premium trading service, RiskHedge Live. Just last week, we added to our position in SMCI.

Yesterday, SMCI was the top-performing AI stock… spiking 9.6%.

I believe this is just the beginning for AI stocks, which is why I’m making Shopify (SHOP) my Trade of the Week.

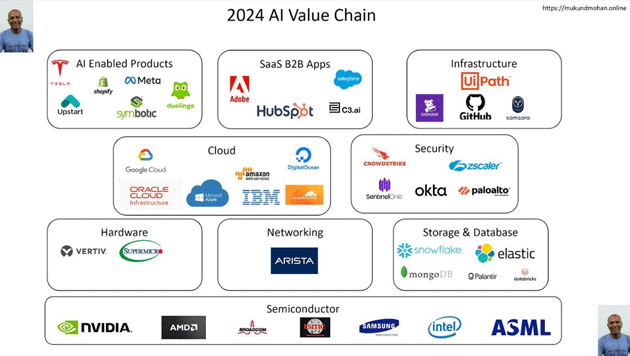

Shopify isn’t an AI infrastructure company like Nvidia, Arista, or Vertiv Holdings (VRT). Instead, it utilizes AI to improve the online shopping experience.

Source: Mukund Mohan

Source: Mukund Mohan

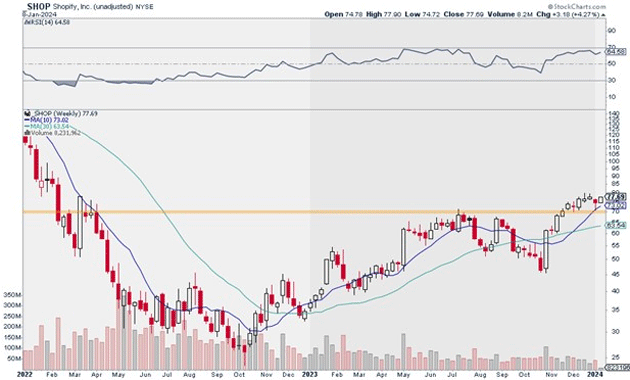

We’re picking up SHOP today because it looks poised for much higher prices in 2024. As you can see below, SHOP just recently flipped a key resistance level after breaking out a few weeks ago.

I believe this level will serve as a launchpad for SHOP:

Source: StockCharts

Source: StockCharts

I suggest buying a starter position in SHOP today. I believe it can hit $107 within the next 9–12 months.

Exit your position if SHOP closes below $69. That gives us a risk-reward ratio of 4:1 on this trade.

Action to take: Buy SHOP at current market prices.

Risk management: Exit your position if SHOP closes below $69.

Justin Spittler

Chief Trader, RiskHedge