Has the next great rotation begun?

As we all know, war has broken out between Israel and Iran.

This is a serious matter. And it’s having a big impact on global markets already, particularly energy.

The Middle East is the world’s most important oil-producing region. It accounts for about one-third of global production.

Last Friday, the price of oil jumped nearly 8% when news broke that Israel had attacked Iran. So far this week, oil has climbed another 2.6% higher.

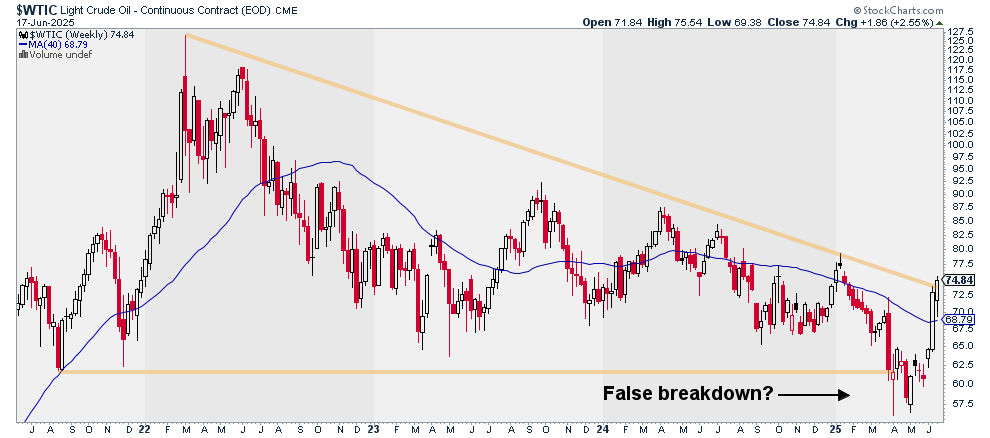

This is a big move for the world’s most important commodity. More important, oil is now on the verge of taking out some key levels.

As we can see below, oil is on the verge of breaking the downtrend that it’s been in since early 2022. If it does, that would set the stage for much higher oil prices.

Source: StockCharts

Source: StockCharts

Rising oil prices would have all sorts of repercussions for the stock market. But I want to focus on the bright side, i.e. the opportunity to make big money on energy stocks.

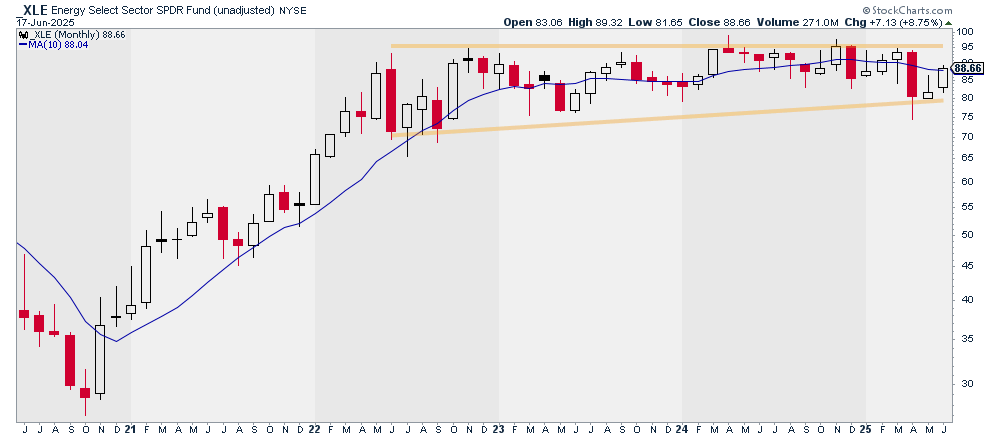

You could profit off rising energy prices with a fund like the Energy Select Sector SPDR Fund (XLE), which invests in a basket of energy stocks. But frankly, this chart doesn’t excite me yet.

It’s still rangebound, in part because its largest holdings—namely Exxon Mobil (XOM) and Chevron (CVX)—are holding back its performance.

Source: StockCharts

Source: StockCharts

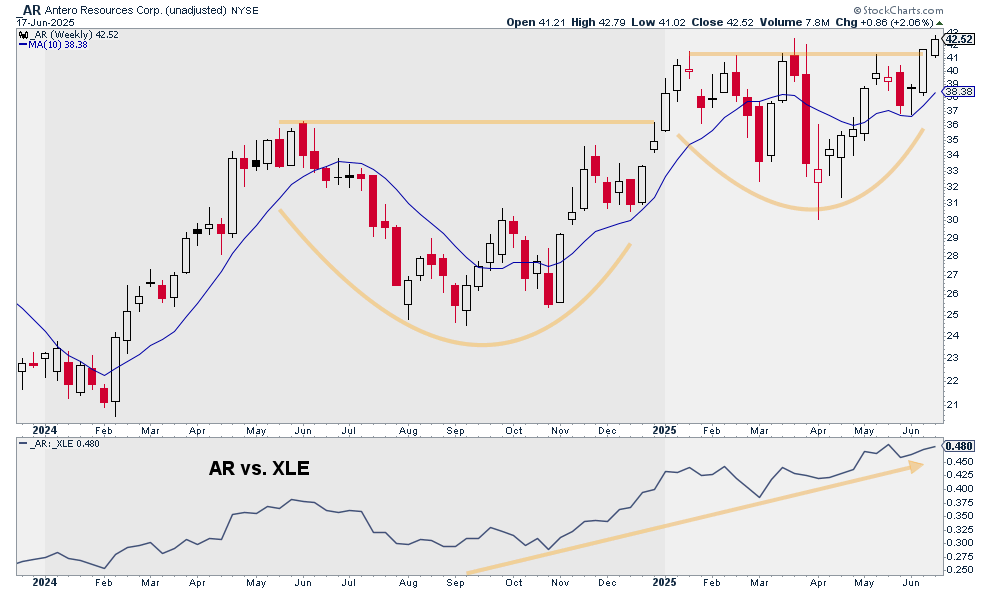

The good news is that we can do much better than buying XLE or laggards like CVX. I suggest looking at the sector leaders.

One of my favorites is Antero Resources (AR), a $13 billion oil and gas name. Last week, AR broke out of a multi-month base. It’s also on the cusp of breaking out of a large, nearly three-year old base.

Source: StockCharts

Source: StockCharts

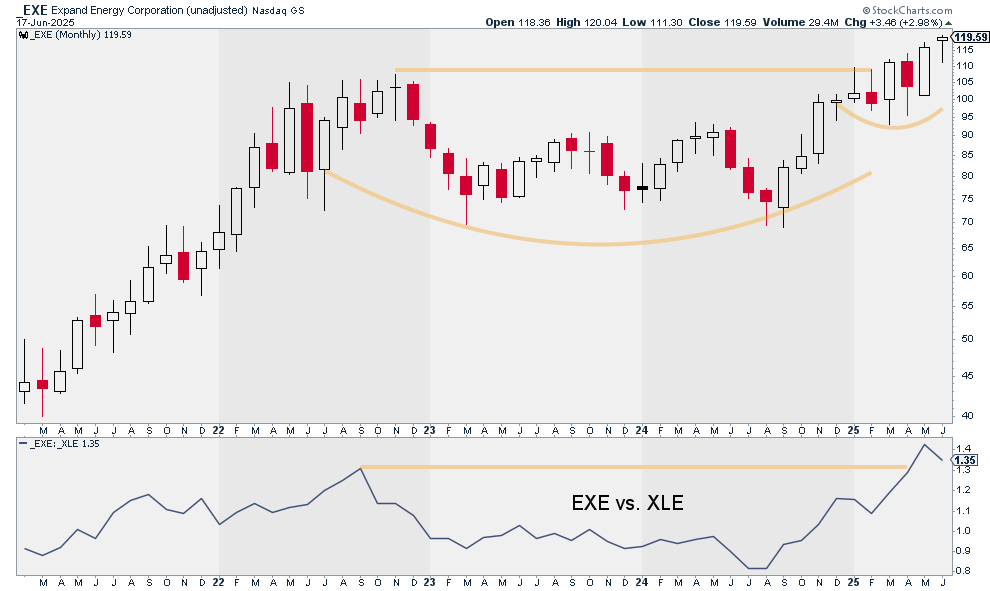

I also love what I’m seeing from Expand Energy (EXE). This $28 billion oil and gas stock recently broke out of a three-year base. Yesterday, it closed at new all-time highs:

Source: StockCharts

Source: StockCharts

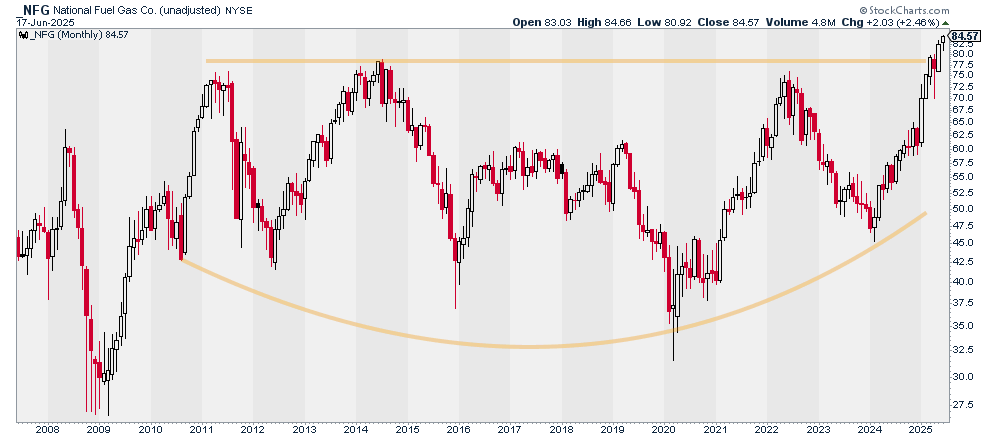

Last but not least, we have Natural Fuel Gas Co. (NFG). This $7.6 billion oil and gas name has one of the best charts in the entire sector. It just recently broke out of a decade-long base and is now trading at all-time highs:

Source: StockCharts

Source: StockCharts

All three of these names are proven outperformers. They’re running circles around XLE’s performance. They’re also all either breaking out or have already broken out of huge bases.

This tells me the best is likely yet to come.

Justin Spittler

Chief Trader, RiskHedge

PS: One last thing—can you answer a quick question for me?

We just wrapped up the RiskHedge Live special discount event, but many of you ultimately decided not to join the service.

Can you take 10 seconds of your time and tell me…

Why did you decide RiskHedge Live wasn’t for you?

Your feedback will help me understand how I can do a better job of helping you.

Thanks again for all your support.