Don’t get shaken out of your artificial intelligence (AI) stocks…

On Friday, US tech stocks got slammed after news broke that Alibaba Group Holdings Ltd. (BABA) is developing its own AI chips.

Alibaba is one of China’s leading tech companies So, the news was widely seen as a direct shot at America’s AI dominance.

Nvidia (NVDA) finished Friday down more than 3% on the news. Oracle Corp. (ORCL)—another AI leader—dropped nearly 6%. Many smaller AI players got hit even harder, with some plunging more than 8%.

If this sounds familiar, it’s because something very similar happened earlier this year.

In January, US AI stocks plummeted after the “DeepSeek breakthrough.” Basically, a Chinese startup built a high-quality AI model for a fraction of what it should cost.

The concern was that China could compete with the deep pockets of American big tech companies. The response by investors was to sell first and ask questions later.

Of course, the panic was short-lived. AI stocks snapped back once investors regained their senses.

Friday’s mini-panic should play out the same way.

Still, that doesn’t mean we should blindly buy this dip. Some of today’s leading AI stocks have broken key support. It will take them time to get back on track.

So, what should you focus on? That’s easy. The names displaying relative strength. Here are two of the strongest AI names getting my attention…

Celestica (CLS) is one of today’s top AI infrastructure stocks. It’s been a huge outperformer this entire cycle.

On Friday, CLS sold off with its peers. But it never broke support. It’s also rebounded in a big way. It’s easily one of the best-looking AI names following Friday’s scare.

Source: StockCharts

Source: StockCharts

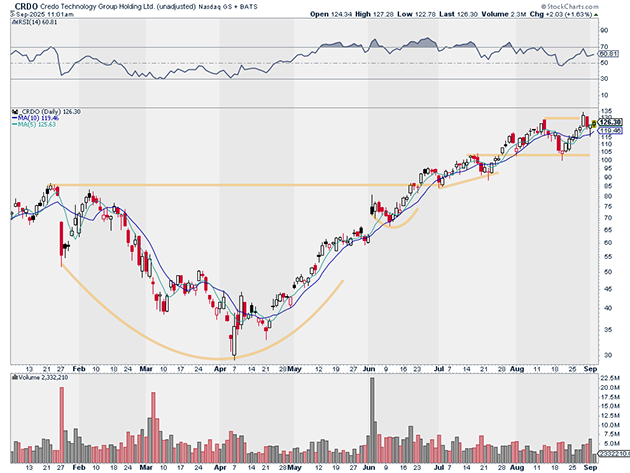

Credo Technology Group Holding Ltd. (CRDO) is another name displaying major relative strength. Like CLS, it sold off on Friday. But there was no follow-through to the downside.

That’s very encouraging. Stocks that rebound from selloffs first usually lead the recovery.

Source: StockCharts

Source: StockCharts

Justin Spittler

Chief Trader, RiskHedge

PS: Besides AI stocks, two strong names in my Express Trader portfolio are a leading social media company and a pure uranium producer. One just broke a multi-week downtrend… and the other looks to be setting up for its next leg higher.

You can access these names with a subscription to Express Trader. Join us here.