Stephen McBride

Stephen here, and welcome to the Crypto Learning Center.

This site should help you better understand the exciting world of crypto.

Below, you’ll find the most common questions I’ve received from my RiskHedge readers over the years. I strive to answer in simple, straightforward language—because I believe overcomplicated jargon holds many people back from truly understanding crypto.

Simply click the dropdown on each question to see the answer.

The dictionary definition of a blockchain says it’s a database that is not controlled by a central authority or middleman, rather it’s a network of independent, distributed computers.

What does this mean for you? In practice, blockchain allows people to do all kinds of things for themselves that they used to have to rely on a middleman to facilitate.

Take bitcoin. It’s a form of money that can be held, exchanged, spent, and kept track of in any quantity without needing anyone’s permission. No banks, no Wall Street, no government, no vaults needed. It is the only way to carry $1 billion in your pocket.

Bitcoin was only the first use of this new technology. It is being used in many other exciting ways to build new companies and entirely new business models. For this reason, blockchain has sparked the rise of a whole new asset class.

Blockchain is the fastest-growing technology in history—doubling the internet’s golden-age growth rate.

“Digital money” is only one use of this new technology. Blockchain represents a whole new way to launch and operate a business. It’s created an entirely new asset class: crypto businesses.

Many of the world’s most innovative companies are being built on the blockchain. Take Uniswap (UNI) for example. Think of Uniswap like the new Nasdaq. It’s a “stock market” for cryptos, built on the blockchain. It’s raked in over $1 billion in revenue since launching five years ago.

Ethereum (ETH) is a blockchain where anyone can create and launch “apps.” Ethereum collects fees from each transaction on its network. Ethereum hit $10 billion in cumulative revenue in seven years... reaching that milestone faster than Facebook and Microsoft.

Helium (HNT) used the blockchain to bootstrap a global wireless network without laying a single cable or building towers.

These are real businesses, making real money.

In traditional markets, there are all sorts of rules and barriers to investing in early-stage companies. You never even hear about certain opportunities unless you run in the right circles.

If you do hear about them, you have to be “accredited” to invest in most private companies. And you often need to invest a minimum of $50,000 or $100,000. So the average investor is left out in the cold.

Many of these rules are well-meaning to prevent unsophisticated investors from investing in what they don’t understand. But they’re barriers nonetheless. Cryptos knock down these barriers. Unlike the stock market, cryptos aren’t dominated by Wall Street. You can buy “tokens” (the equivalent of shares of stock) in many crypto startups for $1 or less.

Buying crypto is a new way to invest in early-stage disruptive companies. A way that doesn’t exist in the traditional stock market. The tradeoff for this freedom and access is responsibility. Research, connections, and risk management are even more important in crypto than the heavily regulated stock market.

Yes. Extremely volatile.

Stomach-churning sell-offs are normal. Even during a crypto bull market, periodic 20%+ drops in price are the norm.

The way to address this is by keeping your crypto investments small in relation to your overall portfolio. Investing only a small amount of money in each crypto allows you to sit tight through sell-offs… and stick around for the big gains that could follow.

You’ll need to set up a crypto account. Crypto doesn’t trade on the stock market, but it does trade 24/7. You can buy at any time, any day.

Before investing in crypto, it’s important to know the lay of the land. There are three main ways to buy and store crypto.

1. Crypto exchanges

The simplest way to invest in crypto is through a centralized crypto exchange, like Coinbase. A centralized crypto exchange is simply a website that allows you to buy and sell cryptos.

When you sign up for a crypto exchange, you can fund your account just like you would any ordinary stock brokerage account. But please note that the fees for most crypto exchanges are much higher than stock exchanges.

Coinbase is the largest and most reputable crypto exchange in the US. It has over 100 million registered users and offers over 200 different cryptos. It’s safe and regulated. It’s also very easy to use.

With Coinbase, there’s a flat transaction fee of $0.99–$2.99 depending on the size of the transaction, as well as a 1.5%–4% conversion fee depending on whether you use a bank account or debit card.

Keep in mind, you’ll also need to provide a picture ID in order to sign up. I also recommend using two-factor authentication (2FA) when logging into your Coinbase account as an added layer of security.

2. Hot wallets

Just like a regular wallet stores physical cash, a crypto wallet stores your tokens. A wallet puts you in complete control of your crypto. Using one means you’re not relying on a centralized exchange or anyone else to store your crypto and keep it safe.

There are two main types of wallets. “Hot” wallets and “cold” wallets.

Hot wallets are connected to the internet. Cold wallets are not. They both do the same thing: hand you control of your crypto.

The most popular hot wallet is MetaMask. It’s the hot wallet I use, along with over 30 million other crypto investors.

Think of a hot wallet like your online bank account. It’s an app you access on the internet.

3. Cold wallets

Think of a cold wallet like your own private safety deposit box. Unlike MetaMask, a cold wallet is a physical device you can hold in your hand. It looks like a USB drive. Cold wallets tend to cost around $100.

Buying a cold wallet is a must if you’re serious about investing in crypto. Cold wallets are safer than hot wallets for one simple reason: Cold wallets are not connected to the internet. They keep your private keys offline at all times, ensuring hackers can’t easily steal your crypto.

Cold wallets are the gold standard for protecting crypto.

Cold wallets are very secure when used correctly. The two most popular brands of cold wallets are Ledger and Trezor. I prefer Ledger for its ease of setup and use. You can check out Ledger’s full product lineup at ledger.com.

YES. Definitely get that.

Remember, Coinbase is a centralized exchange. It’s easy to leave your cryptos on an exchange like Coinbase. Unfortunately, doing so comes with risks because when you leave your crypto on Coinbase, you’re granting custody over your crypto to Coinbase.

This is similar to how banking works. When you deposit your cash in the bank, the bank takes custody of your cash. But there’s one huge difference: Banks are backed by government guarantees. If the bank gets robbed or hacked, you’ll get all your cash back.

Coinbase and other crypto exchanges don’t have that luxury. If they’re hacked or somehow lose access to your tokens, your money may be gone forever.

That’s why I urge you to store your crypto in a cold, offline crypto wallet. As I mentioned, I prefer Ledger for its ease of setup and use. You can check out Ledger’s full product lineup at ledger.com.

That’s correct: Crypto wallets hand you control of your private key.

There are public keys and private keys. A public key is like your bank account number. When someone sends you crypto, they send it to your public key. Your public key isn’t a secret, and it doesn’t need to be.

Your private key IS a secret, and it’s crucial that you keep it a secret. You should NEVER share your private key with anyone. A private key is like your bank account password or the PIN to your debit card.

nyone with access to your private key has complete control over your crypto.

A private key is simply a long string of letters and/or numbers. You must protect those characters as if they were bars of gold. Some people lock their private keys in safes or bank deposit boxes. Others save them on encrypted USB sticks. In short, storing your crypto in a wallet gives you total control over your assets. It is the most secure way to store your crypto. I consider it a “must.”

Never share access to your wallet with anyone. Never store your private key or your passwords to your crypto accounts in vulnerable places like your email.

Keep your password and seed phrase written down on physical paper. Don’t digitize them in any way. Don’t store them in a password manager; don’t take a picture of them on your phone; don’t save them to your computer. My suggestion is to write them down on multiple pieces of paper and store them in different locations, in case you lose access to one.

I don’t know your financial situation or your risk tolerance. So I can’t answer that question for you. As a general rule of thumb, I suggest putting no more than 5% of your investable assets into crypto.

Above all else: ***DON’T INVEST ANY MONEY INTO CRYPTO YOU CAN’T AFFORD TO LOSE.***

Only invest money you’re willing to speculate with. Don’t invest your mortgage money or your kids’ college money. There are many cryptos with exciting stories and profit potential that may compel you to “bet the farm.” PLEASE DON’T DO THIS. Please respect the fact that crypto is the most volatile asset class on the planet.

Here’s a quick test to determine if you’re investing too much in a crypto position. Before you buy, ask yourself: What if this position loses 50% of its value by next week? If this would stress you out, you’re investing too much.

In volatile assets like crypto, you need “staying power” to remain invested while prices are swinging around. The best way to have staying power is to keep your position sizes small.

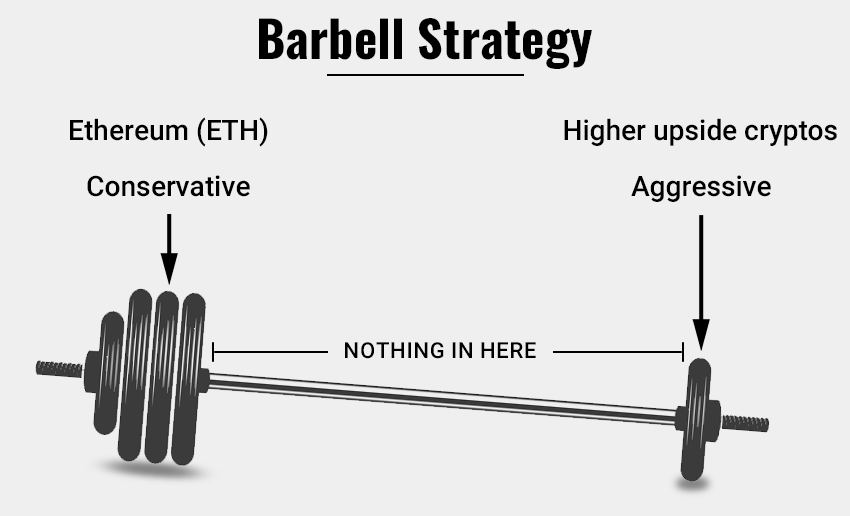

While I can’t tell you exactly how to allocate your portfolio, I suggest adopting the “barbell strategy.”

The barbell strategy is a portfolio construction tool that strikes the right balance between risk and reward. It does so by investing in two distinct types of assets, on both extremes. On one end, you have “safer” assets.

On the other, you have “higher upside” assets. Just like a barbell, you’ll load it on either end, with nothing in the middle. This will allow you to potentially earn higher returns… while the “safe” portion cushions potential losses. (I put “safer” in quotes because crypto is an early-stage technology, and no crypto has a comparable level of safety to financial assets like government bonds, cash, and certain groups of stocks.)

Here’s how it works: You would put the majority (75% to 90%) of your crypto investments in the safer portion. The other 10% to 25% would be allocated to higher-upside assets. So, your crypto portfolio would resemble a lopsided barbell:

In my RiskHedge Venture crypto advisory, I recommend investing 75% of your crypto allocation to “safer” and bigger cryptos, like Ethereum and Solana. Then, I recommend putting the remaining 25% into higher-upside tokens.

Please note: Crypto is just one asset in an overall portfolio. I recommend putting around 1% to 2% of your total assets into crypto—and definitely no more than 5%.

Dozens of real crypto businesses produce millions of dollars in cash flows each day. That means we can determine their value like we would a stock.

You can compare how much revenue Ethereum rakes in each year to its market cap to get an idea of how “expensive” or “cheap” it is—just like a stock. I evaluate crypto opportunities just like Warren Buffett assesses a stock. I analyze the underlying business.

It’s important to understand that almost no one else views cryptos as businesses, yet. The vast majority of crypto investors have a trading mentality. They aim to find a hot crypto… ride it higher… then jump quickly to the next hot trade. This can be a profitable strategy. But it’s rarely as profitable as identifying a great crypto business very early on and holding it as it flourishes.

Here are some basic questions my team and I first ask when we’re evaluating a crypto:

I recommend small, lesser-known cryptos with high upside potential in my crypto advisory RiskHedge Venture, which is now open to select new members.

Copyright © 2024 RiskHedge. All rights reserved.