When will stocks bottom out?

This is the #1 question investors are asking.

It’s been a rough year for growth stocks specifically. They’ve been in a bear market since February… and many have gotten crushed in recent weeks.

When the market gets like this, it’s easy to assume the worst. Many people think the selling will never end.

But volatile times like this often present the best buying opportunities. And right now, shares of many of the world’s fastest-growing companies are trading at steep discounts to where they traded just weeks earlier.

You should never buy a stock just because it’s down a lot. But we may be seeing early signs of a market bottom.

Today, we’ll look at why a major buying opportunity may be setting up. I’ll also show you the best way to take advantage of it.

But let’s first look at what’s been going on with the stock market.

-

Lately, consumer staples stocks have been leading the market…

This industry sells toothpaste, shampoo, laundry detergent, and other items people can’t live without.

It’s certainly not the most exciting space to invest in. But lately, consumer staples have been market leaders.

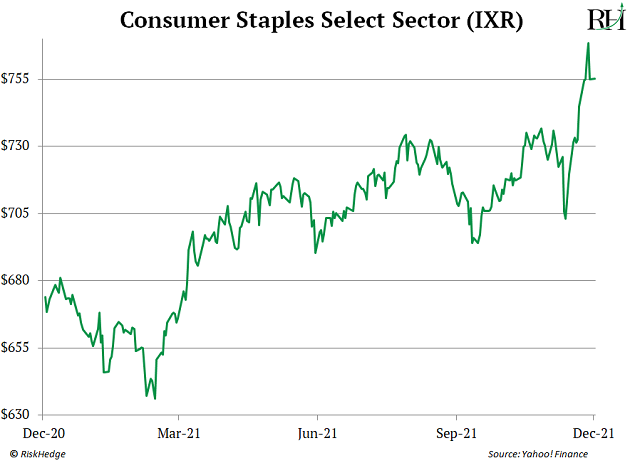

The chart below shows the performance of the Consumer Staples Select Sector Index (IXR). This fund invests in companies like Coca-Cola (KO), Procter & Gamble (PG), and Walmart (WMT).

You can see that IXR has been on a tear lately. In fact, it recently closed at a record high.

This is a positive if your portfolio is heavily weighted towards consumer staples stocks. But it’s also a red flag for the overall market.

You see, people don’t stop buying shampoo or laundry detergent during a financial crisis or recessions. Because of this, consumer staples stocks are widely viewed as “defensive” investments. Investors buy them when they see trouble on the horizon.

The “good news” is that IXR sold off on heavy volume on Friday. At this point, it would be bullish for the rest of the market if that money started to rotate into risky stocks. And that may be starting to happen.

-

Biotech stocks bounced hard on Friday…

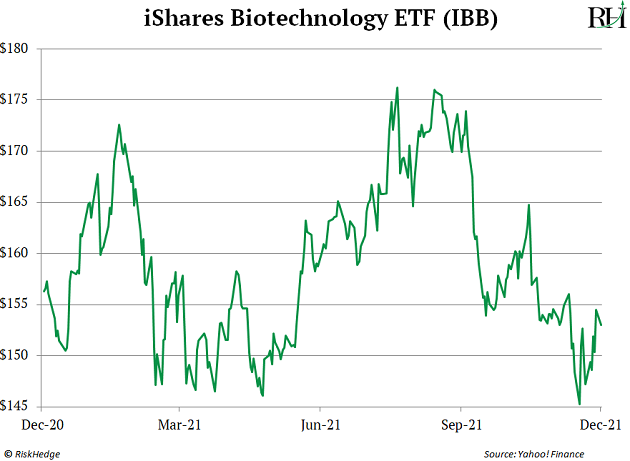

You’re looking at the performance of the iShares Nasdaq Biotechnology ETF (IBB). This fund invests in a basket of biotech stocks.

You can see above that biotech stocks have been under serious pressure for most of 2021. According to Market Ear, biotech stocks have been falling since February. That’s the longest drawdown for the industry in over five years!

During that time, IBB has fallen 37%. And it’s underperformed the S&P 500 by 56%. This is the definition of a bloodbath.

However, IBB rallied nearly 3% on Friday on heavy volume. It reclaimed its 10-day and 20-day moving averages in the process. And it printed a “bullish engulfing” candle, which we often see in market reversals.

-

Genomics stocks also jumped on heavy volume on Friday…

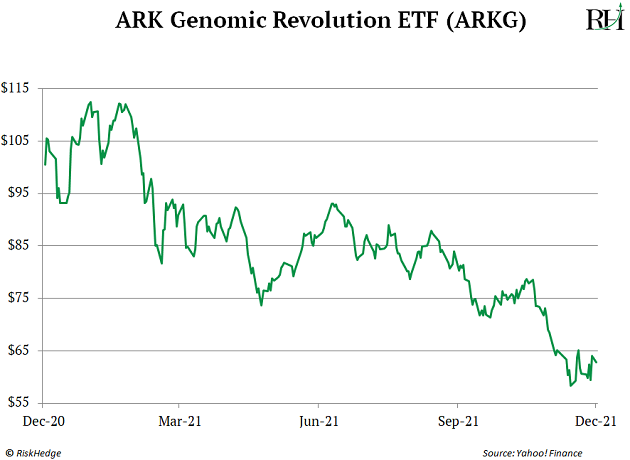

This chart shows the performance of the ARK Genomic Revolution ETF (ARKG), which invests in a basket of genomics stocks.

ARKG jumped nearly 8% on huge volume on Friday. And like IBB, it’s printing a bullish engulfing candle, while also reclaiming its short-term moving averages.

This is a big ideal, even if you don’t have exposure to these industries.

Biotech and genomics stocks are riskier than investing in online shopping, software stocks, and especially consumer staples companies.

Many companies in these fields haven’t even generated their first sale yet. Some haven’t even completed development of their first drug.

Because of this, biotech and genomics are considered great measures of risk appetite. They’re often the hardest-hit industries during market pullbacks, as we’ve seen recently. They also often deliver some of the biggest gains during rallies.

In other words, it would be a hugely bullish indicator for the rest of the market if these two industries started to carve bottoms and rally from these levels.

Still, you must remember something…

-

One day doesn’t make a trend…

Heck, one week doesn’t make a trend.

So, I wouldn’t go bottom fishing in biotech and genomics stocks just yet. Instead, wait for confirmation, such as a series of higher lows.

That could take weeks or even months. It’s crucial to exercise patience right now.

But if you’re looking to put money to work soon, I’d suggest focusing on stronger industries… like software stocks.

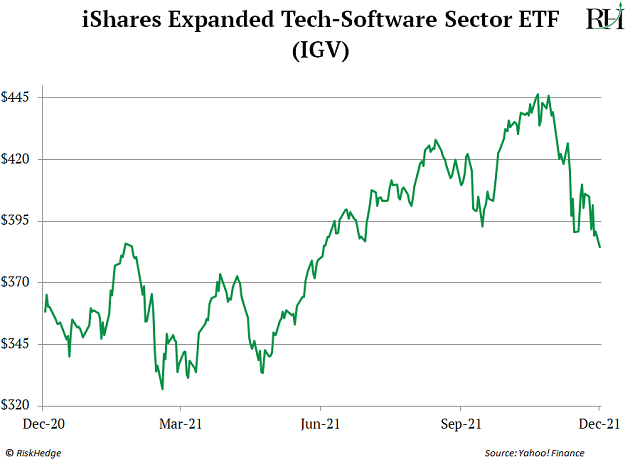

This chart shows the performance of the iShares Expanded Tech-Software Sector ETF (IGV) this year. IGV invests in a basket of software stocks like Adobe (ADBE), Salesforce (CRM), and Microsoft (MSFT).

You can see that software stocks have gotten slammed in recent weeks. But they’re still in a long-term uptrend.

IGV is currently battling to reclaim its 200-day moving average. And, we’ve seen huge trading volumes at this key level.

This tells me institutional money is buying the dip on software names. And those aren’t investors we want to bet against.

I want to see IGV decisively reclaim its 200-day moving average before moving in.

Justin Spittler

Chief Trader, RiskHedge