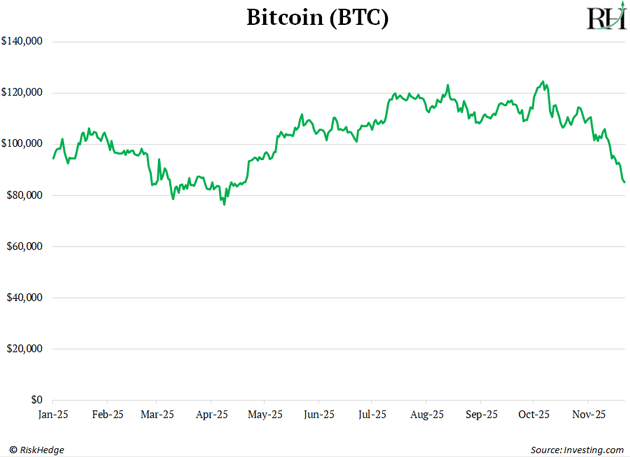

Bitcoin (BTC) keeps sliding.

It’s sitting at around $83,000 as I write this.

BTC has shed more than a third of its value since tagging $126,000 just a month ago.

A big reason for this selloff is folks selling crypto to front-run the four-year bitcoin cycle.

The cycle predicts 2026 will be a terrible year for crypto.

-

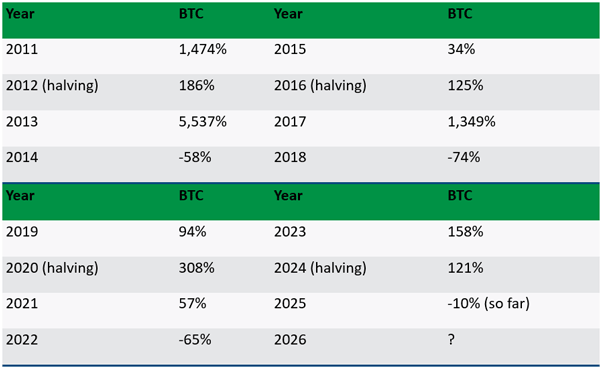

“3 up, 1 down.”

That’s the pattern bitcoin and crypto prices have historically followed.

This four-year cycle was a pattern so predictable, you could set your watch to it—as this table of bitcoin’s annual returns shows:

Source: RiskHedge

Source: RiskHedge

As you can see, bitcoin drops +60%, on average, in year three after the halving.

If history repeats itself, now would be the time to run for the exit.

But it’s not what I recommend you do. In fact, it’s the opposite. This pullback is a buying opportunity.

|

The four-year cycle everyone is worrying about is dead. And in a good way.

-

January 11, 2024…

The day bitcoin’s cycle broke.

What happened that day? The first bitcoin ETFs started trading in America.

Bitcoin was always a fringe asset. To buy it, you had to set up a crypto wallet, wire your money to a dodgy-looking exchange, and pray it didn’t get hacked. And it was almost impossible to own in your retirement account.

Too much work for most.

Now, you can buy bitcoin as easily as Apple (AAPL) or Tesla (TSLA).

ETFs kicked open the door to Wall Street money. And billions poured in almost immediately.

BlackRock’s (BLK) bitcoin ETF—the iShares Bitcoin Trust ETF (IBIT)—became the fastest-growing ETF ever. In less than two years, $72 billion poured into it. It’s the most successful ETF launch in history, and it’s not even close.

For comparison, the largest gold ETF—the SPDR Gold Trust (GLD)—has been around for over two decades and is a $141 billion fund.

I bet IBIT surpasses GLD in 2026.

-

Hello, infinite bid…

The fact that anyone can easily buy BTC and Ethereum (ETH) through an ETF fundamentally changed crypto markets forever.

The “infinite bid” from wealth managers represents the single largest tailwind in crypto’s history.

When crypto was mostly retail, psychology orbited the bitcoin halving. In 2020, people literally threw “halving parties.” It became a self-fulfilling loop.

Crypto is now substantially owned by pro investors who are theoretically less prone to wild speculation, like the four-year cycle. Though I’ll let you in on a secret: Many whom I know are still degenerate gamblers.

Advisors don’t dump their clients’ money because bitcoin dropped 15% on a random Tuesday. They follow quarterly review cycles, annual rebalances, and long-term retirement plans. That means steady, repeatable buying pressure—something crypto has never had until now.

What this means is the blow-off tops and brutal 80% crashes we’ve grown accustomed to will likely transform into steadier uptrends punctuated by more modest corrections.

The traditional four-year cycle is likely dead, in a good way. Less manic boom. More sustainable accumulation.

Pull up a bitcoin chart pre-ETF vs. post-ETF, and it’s night and day. It looks more like the S&P 500 than “internet casino money.”

This transition mirrors financial market evolution. The early stock market had full-blown panics every other year, while modern markets have crises every 20–30 years.

Crypto is following the same maturation curve, just compressed into a shorter timeframe.

-

This steady flow of money didn’t exist in crypto…

Until the ETFs arrived.

When tens of millions of Americans get paid every other week, they buy stocks on autopilot through their retirement accounts. This creates continuous demand for stocks, which puts a floor under prices.

Now, the world’s largest asset managers—including BlackRock, Fidelity, VanEck, and others—are telling their clients to buy and hold BTC in their 401(k)s.

A teacher in Alabama buying a bitcoin ETF through her 401(k) isn’t timing halvings.

The floodgates have opened. Billions of dollars of Wall Street’s money are pouring into crypto for the first time ever.

There’s $8 trillion sitting in 401(k) plans today. If crypto captures just 1% of 401(k) assets, that’s $80 billion worth of fresh capital entering the market.

-

I expect new bitcoin all-time highs in the next six months.

This pullback is nothing out of the ordinary. It’s the sixth time BTC has dropped +20% since 2023. And thanks to the infinite bid, each of those was a buying opportunity.

On average, bitcoin was up 68% six months from the low.

These washouts are how the market resets. Weak hands get shaken out… savvy investors buy crypto at a discount… and the next leg higher begins.

Stephen McBride

Chief Analyst, RiskHedge

PS: We’re preparing our biggest sale in over a year on my flagship advisory, Disruption Investor. In short, you can unlock VIP access and get up to one year free. Click on this link and you’ll be automatically added to the VIP list. Then, our team will let you know the minute the sale goes live.