Bitcoin (BTC) mining stocks aren’t what they used to be.

For years, miners were just levered bets on bitcoin. When BTC ripped higher, these stocks went parabolic. When BTC crashed, they got obliterated.

But that story is old news.

Today’s best bitcoin mining stocks aren’t really even “miners.” They’re artificial intelligence (AI) infrastructure stocks.

Let me explain…

Training large AI models requires endless racks of GPUs, cheap electricity, and industrial-scale cooling.

Bitcoin miners already have access to this specialized infrastructure. They're set up perfectly to run massive data centers.

But why pivot to AI? Simply put, it’s a better business.

Mining bitcoin has become brutally competitive in recent years. Profit margins are razor-thin. Energy costs keep rising. And the rewards that miners receive get cut in half every four years.

Bitcoin is also hyper-cyclical, making mining bitcoin a boom-and-bust business model.

At the same time, AI is exploding. Companies like OpenAI, Meta Platforms (META), and Google (GOOG) are scrambling to find places to plug in GPUs. They’ll pay top dollar for access to the very same infrastructure miners already control.

Miners are simply following the money. Instead of grinding away for bitcoin, they’re pivoting their facilities to serve the booming AI market.

Investors have taken notice of the companies making this pivot.

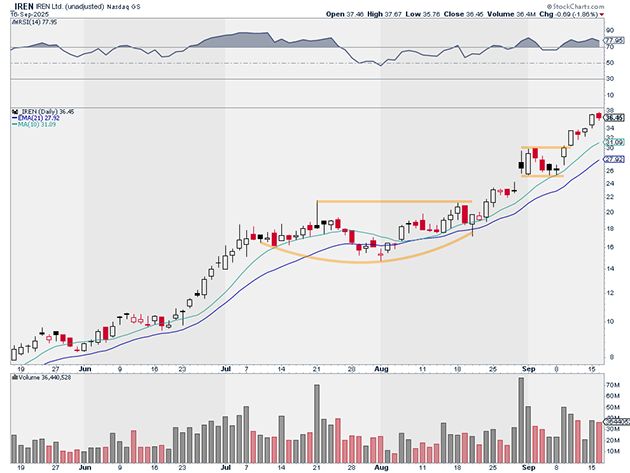

IREN Ltd. (IREN)—one of the first bitcoin mining stocks to shift its focus to AI—has surged 271% higher this year, and nearly 400% over the past year. It’s one of the strongest stocks in the entire market.

Source: StockCharts

Source: StockCharts

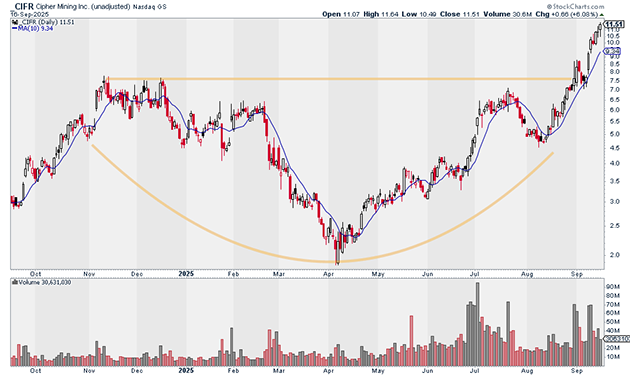

Cipher Mining (CIFR) has also benefited massively from the transition to AI. It’s surged 148% this year alone and is up 269% over the past 12 months.

Source: StockCharts

Source: StockCharts

Applied Digital Corp. (APLD) has also rallied 154% since the start of the year.

Source: StockCharts

Source: StockCharts

These are incredible moves. But I still see all three of these stocks heading much higher in the months ahead.

You see, the market still hasn’t caught on to this shift. Many folks still view bitcoin mining stocks as “miners” rather than AI infrastructure plays. They don’t realize these businesses are reinventing themselves before our eyes.

In fact, CIFR still has a 22% short interest, while APLD has a 30% short interest. They are hated stocks.

Justin Spittler

Chief Trader, RiskHedge

PS: If you want my best breakout trades every week, my new Express Trader might be perfect for you. It’s a quick-reading, no-nonsense way to help you own the three strongest stocks every week.