** The Trade Desk hits “reset” on its shares

** The #1 trait of all great megatrends

** Bigger than streaming? Our analysts share their top investing ideas

Today could potentially be the most profitable RiskHedge Report I’ve written.

That’s because our top 3 analysts are about to share their #1 “sure thing” money-making ideas for the next 5–10 years.

As you’ll read, these are earlier-stage opportunities that could produce 10,000%+ cumulative gains as they transform the world... just like the rise of “streaming video” did.

First…

One of our “hall of fame” disruptor stocks just hit another big milestone.

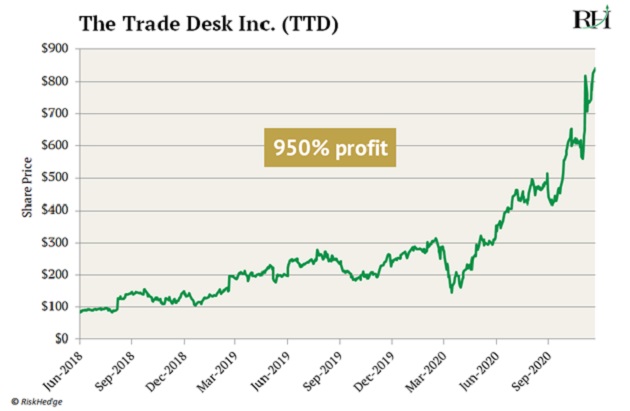

I’m talking about The Trade Desk (TTD)—which Chief Analyst Stephen McBride recommended in June 2018 before it soared as much as 950%.

Shares of the digital advertising pioneer just got a whole lot cheaper... in a good way.

Last week, the stock did a 10–1 split.

A stock split, if you’re not familiar, is a simple process that reduces the price per share of a stock.

Stock splits are typically used by extremely successful companies when their shares shoot through the roof. Both Apple (AAPL) and Tesla (TSLA) split within the past year when their stock prices got “too high.”

The Trade Desk had exploded from $70/share to over $600/share in the last couple years. For folks who own the stock, this is a great “problem” to have. RiskHedge readers who bought the stock on Stephen’s first rec have nearly 10X’ed their money.

But for folks who don’t yet own the stock, a very high share price can be a barrier. Some small investors couldn’t comfortably afford to buy a share of TTD for $620.

That’s why management chose to split the stock to reduce the share price to $62—where anyone can afford it.

-

If you’ve been following RiskHedge over the past year, you know TTD isn’t a standalone winner...

It’s been at the forefront of one of today’s most lucrative megatrends:

The unstoppable growth in streaming video.

The great thing about truly huge megatrends, like streaming’s takeover of regular TV, is they can hand out winner after winner after winner.

Take ROKU (ROKU)—which Chief Trader Justin Spittler recommended in February 2020.

Roku operates the #1 operating system for streaming. The stock is up 179% since Justin’s recommendation, compared to a 27% gain for the S&P 500 over the same time frame.

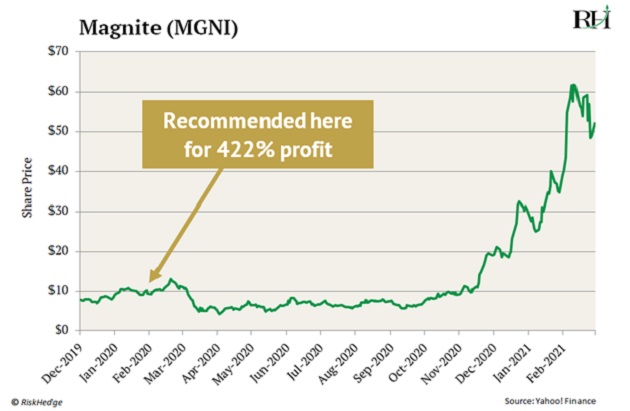

Tiny disruptor Magnite (MGNI) was a big streaming win, too.

Our microcap expert Chris Wood identified MGNI early on as a hidden gem in the “dynamic” advertising space.

Readers of Chris’s Project 5X advisory recently cashed out of Magnite for a nice 422% profit:

And that brings me to the crux of today’s issue:

What’s the NEXT streaming?

What’s the NEXT great megatrend that will throw off doubles... triples... quadruples... even 10-baggers?

I asked our top 3 analysts this question. Here are their answers.

Our Analysts Reveal the “Next Streaming”…

Stephen McBride: The 2020s will be the “clean energy” decade.

In 2008 America got less than 2% of its energy from clean sources like solar, wind, and hydro. Last year that number had jumped to 12%. What’s behind clean energy’s rise?

The price of renewables has fallen off a cliff. The cost to produce electricity using solar panels has plunged 90%+. This rapid fall means solar is now cheaper than oil in many cases.

Electric batteries like the ones you’ll find in a Tesla have also plunged in price. Bloomberg’s latest analysis shows the price of lithium-ion batteries is $137 per kilowatt-hour. That’s down from $1,200 per kilowatt-hour in 2010.

These achievements are bringing back something we haven’t seen in many decades... cheaper energy. These huge price declines have opened up a world of opportunity for clean energy stocks.

We’re also seeing historic breakthroughs in other renewables. New research from MIT shows that a compact nuclear fusion reactor is “very likely to work” after a major scientific breakthrough.

Geothermal energy is also being transformed. There’s enough energy in just a few miles into the Earth’s crust to power the world for centuries. Disruptors like Eavor and Sage Geosystems are figuring out new way to “mine” heat deep in the Earth, which can then be used to generate clean power.

Renewable energy will be the “zeitgeist” of the next decade. And there will be dozens of ways to profit from this disruptive megatrend.

Justin Spittler: The most exciting megatrend for the next five years is, without question, virtual reality (VR)/augmented reality (AR).

Together, these technologies will change how we work, learn, shop, entertain ourselves, and interact with loved ones.

But don’t take my word for it.

Apple (AAPL) CEO Tim Cook recently called AR the “next big thing.” Apple—the largest and richest company on earth—is investing heavily to build out its own VR/AR hardware.

And it’s not the only tech giant that’s made these technologies a top priority.

Facebook (FB) is trying to corner the market by gobbling up smaller disruptors in the space. Microsoft (MSFT) has developed AR technology for the US military. And Snap (SNAP) has centered its entire business around AR. Most recently, it shelled out $500 million to acquire an AR display component supplier.

Chris Wood: I agree with Justin. But AR is more exciting than VR. More profitable, too.

In my microcap service Project 5X, we’ve already realized a 399% gain in tiny AR disruptor Kopin (KOPN). I think many more gains like this are coming.

Just think about what AR smart glasses can do…

These devices overlay digital information onto what you see in the real world. You’ve likely seen this depicted in movies when a fighter pilot locks onto an enemy jet. Or when Tony Stark’s Iron Man helmet overlays vital information onto his field of view.

AR smart glasses don’t create their own reality like a Virtual Reality headset does. Instead they augment reality.

Companies are interested in AR smart glasses because they improve worker productivity, efficiency, and safety.

Take Boeing, for example. Workers in its factories now use AR smart glasses to assemble complex wire harnesses for airplanes.

Before AR smart glasses, workers had to follow instructions from a paper, laptop, or tablet. Using these glasses they can call up the schematics and use voice controls to navigate the instructions.

Boeing says the AR glasses have boosted productivity by 25% and reduced error rates to nearly zero. Every company on earth wants its workers to be more productive. Higher productivity equals higher margins, better pay, and bigger profits, which lead to higher stock prices.

Imagine a repairman fixing a powerline. An AR headset allows him to call up instructions without having to juggle a manual or papers. It allows him to answer and talk on his phone without fumbling around.

Using the camera, he can share a live feed of what he sees with a colleague. Everything he needs is available in his field of view, so he can focus on the job at hand.

Global market intelligence provider IDC expects more than 21 million pairs of smart glasses to ship in 2022—a jump of more than 600% from the 3 million shipped in 2020.

You may not have heard this yet, but many analysts, including me and all the big tech companies, expect AR smart glasses to replace smartphones in the coming years. It’s just a matter of when.

That’s why every major tech company is now working on AR smart glasses. Google, Facebook, Intel, Amazon, Microsoft, and Apple are spending billions of dollars to develop these products.

***

Chris Reilly here again. If you enjoyed hearing from all our analysts on their #1 megatrends… I think you’ll love what we prepared for a tiny fraction of our readers (our records show you’re eligible).

In short: It’s an exclusive club we put together reserved for folks who are most serious about growing their wealth.

And a way to gain immediate “club-level” access to everything at RiskHedge.

Interested?

Then head over to this page, where I lay out all the details.

Chris Reilly

Executive Editor, RiskHedge