They’re calling it a “software Armageddon.”

Over the past few months, software stocks have fallen off a cliff.

The iShares Expanded Tech-Software Sector ETF (IGV)—a fund that invests in a basket of software stocks—has plummeted 29% since late September:

Source: StockCharts

Source: StockCharts

Salesforce (CRM)—one of the world’s largest and most important software stocks—has plunged 49% since December 2024.

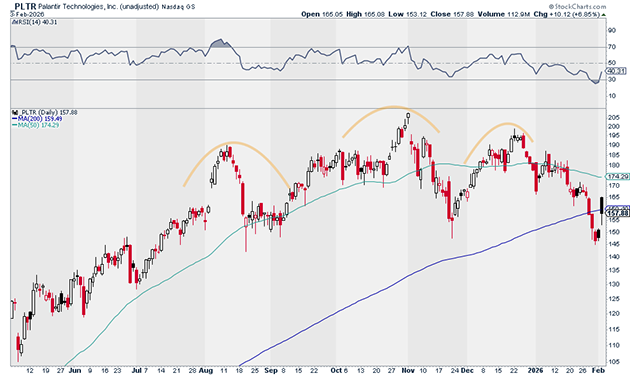

Even Palantir Technologies (PLTR)—the world’s most dominant software company—is trading 24% off its all-time highs. And by the looks of it, it could be headed even lower:

Source: StockCharts

Source: StockCharts

Keep in mind, it’s not like the market is in the middle of some nasty correction.

The S&P 500 (SPY) is trading just 2% off all-time highs, while the QQQ Trust (QQQ) is just 5% off its all-time highs.

So, what’s driving this reaction? Simple: artificial intelligence (AI).

Agentic AI—software that can plan, decide, and act on its own—has commoditized many software applications. This has led to a massive repricing of software stocks.

But that doesn’t mean software is going away. Far from it…

Yesterday, Nvidia (NVDA) CEO Jensen Huang sat down to talk with Chuck Robbins at Cisco System’s (CSCO) AI Summit. In the interview, he said:

Remember what software is. Software is a tool. There’s this notion that the software industry is in decline and will be replaced by AI.

You could tell because there’s a whole bunch of software companies whose stock prices are under a lot of pressure because, somehow, AI is going to replace them.

It is the most illogical thing in the world, and time will prove itself.

In other words, software stocks aren’t going to zero. In fact, a near-term bottom could be close.

Yesterday, IGV saw its highest trading volume of all time. That’s the sort of selling pressure we often see near capitulations (i.e. major bottoms).

Not only that, but the daily relative strength indicator (RSI) for IGV hit 18 today. That’s the lowest level since 2011!

At this stage, I wouldn’t be surprised if software puts in a huge bounce. Day traders can take advantage of these opportunities.

But, if you’re a swing trader like me, I’d focus on the names showing the most relative strength.

In my RiskHedge Live trading room, I just recommended one of the strongest names in software stocks. It’s still in a strong uptrend, unlike most of its peers. And it should perform well if this group rebounds in the coming weeks.

If you’re interested in joining us in the trading room—where I show you, in real time, what to buy, when to buy it, and when to get out—go here to learn more.

Justin Spittler

Chief Trader, RiskHedge