Crypto just capped off a huge first half of the year...

Bitcoin (BTC) rose 83%... Ethereum (ETH) rallied 61%... and dozens of smaller names are up triple digits.

Many of you have asked me: “Stephen, what’s the best way to manage my crypto portfolio… and how do I size my bets correctly?”

Today, I’ll show you how we’re managing our portfolio in RiskHedge Venture, my premium crypto advisory.

In RiskHedge Venture, we’re invested in cryptos of varying sizes. Our holdings range from “majors” like Ethereum with a $225 billion market cap… to “nano-caps” valued under $50 million.

I believe the strategy I’ll share with you is the optimal way to manage your crypto portfolio for the back half of 2023.

- It’s time to get the barbells out…

No, I’m not telling you to lift weights (although everyone should). I’m talking about adopting the tried and true “barbell strategy.”

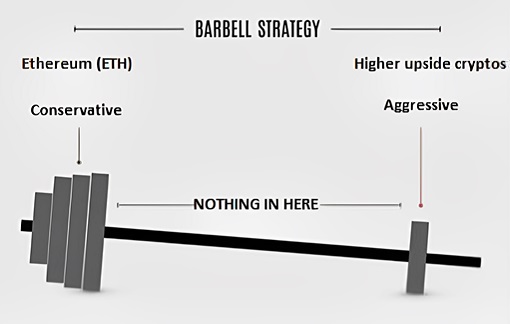

The barbell strategy is a portfolio construction tool that strikes the right balance between risk and reward. It does so by investing in two distinct types of assets, on both extremes.

On one end, you have “safer” assets. On the other, you have “higher-upside” assets. Just like a barbell, you load it on either end, with nothing in the middle.

This allows you to potentially earn higher returns… while the “safe” portion should cushion any losses.

You’ll invest the majority (75% to 90%) of your money in the safer portion. And you’ll put the other 10% to 25% into higher-upside assets.

In Venture, our crypto portfolio resembles a lopsided barbell:

We invest 75% of our crypto allocation into larger, “safer” cryptos like Ethereum.

I put “safer” in quotes because crypto is an early stage technology, and no crypto has a comparable level of safety to financial assets like government bonds, cash, and certain groups of stocks.

And we put the remaining 25% into tinier, higher-upside tokens.

But understand, crypto is just one asset in an overall portfolio.

You should only put a small percent, say 1% to 2%, of your investable assets into crypto.

Every crypto protocol, up to and including Ethereum, is the equivalent of an early stage tech start-up. When I say, “Invest 75% of our portfolio in ETH,” I specifically mean the money you’re allocating to crypto. Which, again, should be 1% to 2% of your total assets.

Here's why I believe this is hands down the best way to maximize crypto profits for the rest of 2023 and beyond…

The 75%: Ethereum

Longtime RiskHedge readers know Ethereum is my favorite crypto to hold for the long haul. And my research suggests Ethereum will outperform the vast majority of cryptos over the next year.

That’s why you want to skew your crypto portfolio heavily toward it.

#1: What the prices are telling us

When FTX collapsed in November 2022, bitcoin and most other cryptos hit new multi-year lows. Ethereum bucked the trend.

ETH bottomed out over a year ago and recently jumped back above its previous 2017 highs.

This is an important signal. If all the negative events in crypto over the past several months couldn’t drive ETH to new lows, what will?

This tells me the current crop of ETH holders has deep conviction and is here for the long haul. In other words, we’ve run out of ETH sellers. And prices usually bottom when you run out of sellers.

#2: Flight to safety

A lot of investors got burned in 2022. Many turned their backs on crypto, never to return.

Those who stick around will likely opt to put money to work in dominant cryptos with solid fundamentals, like Ethereum. From my conversations with crypto fund managers, ETH is the top choice for allocators putting chips back on the table.

A similar trend played out in past crypto downturns. Bitcoin as a percentage of crypto’s total market cap doubled during the last bear market. And I believe ETH will replace BTC as the go-to crypto asset this time.

#3: Fewer sellers, more buyers

Tokenomics is one of—if not the—most important driver of crypto prices. Tokenomics sets the rules for how a crypto token operates.

Ethereum switched to “staking” in September 2022 and now boasts some of the best tokenomics of any crypto.

It’s been 295 days since Ethereum made the big switch. The effects on its supply schedule are astounding.

Under the old “proof of work” system, 3.1 million ETH worth $5.9 billion would have been handed out to miners.

Most of these tokens would have been sold into the market, putting downward pressure on prices.

Instead, roughly 290,000 ETH have been burned and taken out of circulation. In other words, staking removed over $6 billion dollars’ worth of ETH sell pressure from the market.

That’s one of the two main ingredients for higher prices: fewer sellers.

The other is more buyers—and Ethereum’s switch to staking is achieving that, too.

Today, you can earn a 4%+ yield staking your ETH through Lido. That juicy yield is like dangling a big steak in front of crypto investors. What’s not to like about getting paid to hold ETH?

Ethereum’s “burn” mechanism is comparable to companies buying back their own stock. This creates even more buyers.

“Fewer sellers, more buyers” will fuel much higher ETH prices for the rest of 2023.

Ethereum is my largest personal holding and I’m buying more. These prices are incredible entry points for long-term investors.

My work suggests ETH can hit $10,000 in the next two years.

The 25%: Higher-upside cryptos

There’s a silver lining to the downturn we went through last year…

Many early stage cryptos now trade at ridiculously low valuations. And that’s our opportunity.

We have the chance to invest in protocols which continue to grow revenues and ship new products at “kingmaker” prices.

I compare it to snapping up cheap Amazon (AMZN) or Nvidia (NVDA) shares for pennies after the dot-com washout.

This is crypto’s opportunity zone.

I recommend investing the remaining 25% of your crypto portfolio into higher-upside cryptos. Every RiskHedge Venture holding besides Ethereum falls into this bucket.

Some of our holdings have sub-$50 million market caps. They’re the equivalent of nano-cap stocks.

I recommend dividing the “25%” side of your barbell among tinier, high-quality, higher-upside cryptos.

Stephen McBride

Chief Analyst, RiskHedge

In the mailbag…

On Wednesday, Stephen addressed four big artificial intelligence (AI) “lies” you might overhear at your next cocktail party. Here’s what one reader had to say in regard to a common AI concern—regulation:

“You’ve probably read Yuval Noah Harari on AI, but I think it’s worth mentioning his idea about regulating AI.

Very simply, he suggests that anything produced by AI must be labeled as such. As simple as that. So the reader (listener, observer) is aware of the source and can judge its merits accordingly.

It does seem to me that ChatGPT is the greatest act of plagiarism ever wrought upon every author, artist, musician, or other human creator to the extent that it uses the work of others for what it produces without attribution.

Of course, we all use the work of others in everything we produce intellectually or artistically, but we should be prepared to recognize our sources to the extent possible and give others credit where credit is due.

OK, that’s my two cents! I read your work regularly and benefit and profit from it in a variety of ways. Thank you for that.” —Greg

We also received several more comments about Stephen’s article on why he’s thankful for America. One reader said:

“Stephen, that was awesome. I rarely get choked up about anything, but this really got me, man. Thank you!” —Tony

Another wrote:

“Inspiring. Thank you. There is much that could be fixed, but I wouldn’t live anywhere else.” —John