The world is breaking out.

Stock markets across the globe are hitting new all-time highs.

My friend JC Parets from All Star Charts appeared on The Compound podcast last week and asked, “Why is no one talking about this?”

Stocks in India, Japan, Germany, and the UK—four of the world’s most important markets—are cruising to new highs.

The charts don’t lie:

Source: Optuma

Source: Optuma

Here are my three big takeaways:

#1: It might seem counterintuitive, but the data indisputably shows that new highs are a strong “buy” signal. Don’t fear record-high prices. They’re simply a stepping stone to more new highs.

#2: For the past 15 years, it’s been a complete waste of time for American investors to look outside of the US. All the greatest stocks were American.

Is that changing? I think so. In our 2024 forecast issue of Disruption Investor (get it here), I wrote why international stocks could surprise everyone and beat US stocks this year.

#3: Call BS on people who say a handful of big tech stocks are dragging markets up.

Tech makes up 1% of the UK stock market, yet it’s hitting new highs. India, Japan, and Germany have zero big tech stocks. There are many ways to make money that don’t involve buying stocks named Apple (AAPL), Amazon (AMZN), and Google (GOOG).

The bull market is broadening out. This is healthy.

The world seems like a scary place if you just watch the news (don’t watch the news). But ask: If the world was falling apart, would Indian stocks be hitting new highs?

Investing in great businesses profiting from megatrends is a surefire way to build wealth. In Disruption Investor, we’re taking a “best of the rest (of the world)” approach.

We’re not buying speculative Chinese stocks that can move 50% in a day. We’re investing in the highest-quality international stocks you can find.

And to be clear… having lived on four continents, I can confirm America is still the most innovative, resilient place on Earth. I’m 100% certain it will continue producing the most disruptive companies in the world.

But facts are facts. International stocks have a lot of catching up to do… and I think they’re setting up to make a multi-year run higher.

- This is the end of Apple as we know it.

ChatGPT creator OpenAI just launched “GPT Store.”

It allows anyone to create an AI “app” based on ChatGPT’s tech—no coding skills needed.

People are severely underestimating what a gamechanger this is.

Two predictions.

- This will jumpstart OpenAI’s growth into a $1 trillion company.

- It’s the beginning of the end for Apple.

I’m no fan of Apple stock. iPhone sales essentially topped out back in 2015. Apple’s revenues have been stagnant for two years.

GPT Store threatens Apple’s lone remaining growth engine.

Apple raked in $80 billion from its “services” business last year. App Store sales make up the largest chunk of this.

GPT Store will siphon off most of this revenue. It’ll start with a trickle… then swell into a flood.

Remember, GPT Store allows people to build apps without learning to code for the first time ever. Just type out what you want your software to do… and AI will create it for you.

In one demo, someone sketched out a website on the back of a napkin and ChatGPT built it for them.

Developers will flock to GPT Store because it’s better, faster, and cheaper.

When the market realizes Apple’s growth engine just blew out like that Boeing airplane door, the stock will head lower.

Apple’s best days are behind it. Invest accordingly.

- Social media is the new smoking.

Thanks for all your feedback on my two recent pieces on why smartphones + social media = a mind virus making our kids sadder, more anxious, less social, and dumber.

We can all now agree phones aren’t good. That’s new, and it’s important.

I’ll tell you a tragic (but true) story.

When heroin first flooded into Ireland in the ‘70s, nobody understood how dangerous it was. Gangs of teens started smoking it. Wasn’t long until the streets were filled with junkies falling around like zombies, and we all realized heroin addiction was a death sentence.

Similar deal with cigarettes.

Within some of our lifetimes, ads were telling us to take our doctor’s advice and “smoke a fresh cigarette:”

Source: Camel Cigarettes

Source: Camel Cigarettes

And as late as the 1980s, tobacco companies sponsored the Olympics!

Source: Neon Talk

Source: Neon Talk

I bet we’ll look back on the last decade of unbridled smartphone use—spending hours a day staring at these little glass screens—with distain and bewilderment.

Good news is, we’ve reached “peak smartphone.” The dangers are now known. Soon, it will become socially unacceptable to buy your young teen a smartphone. Flip phones will make a comeback.

Here are five practical ways to kick your phone addiction.

- Today’s dose of optimism…

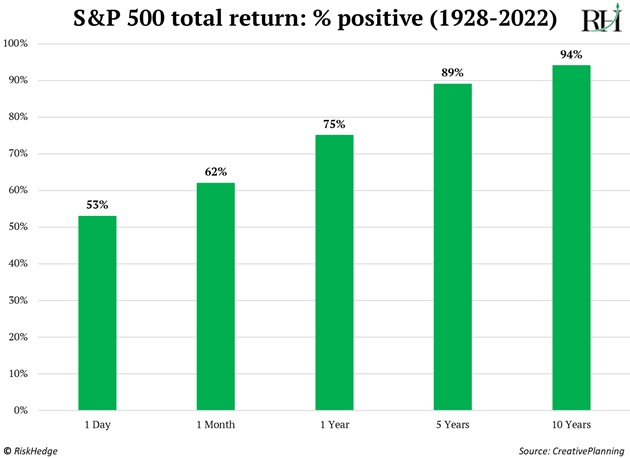

The stock market is the opposite of a casino in at least one important way: The longer you play with the right strategy, the higher the odds are you win.

That’s why I’m a long-term investor.

As you can see below, your odds of making money by holding stocks for one day are just 53%.

At one year, they jump to 75%.

And historically, if you had held the S&P 500 for 20 years… you’d have made money 100% of the time:

Have a great weekend. Talk to you Monday.

Stephen McBride

Chief Analyst, RiskHedge