There’s a new analyst at RiskHedge I want you to meet.

His name is John Pangere.

He doesn’t trade the way I do.

While I mainly focus on stocks (and occasionally crypto), John specializes in something most investors barely talk about… if they know about it at all.

See, John’s a warrants specialist.

If you’ve never heard of a warrant, think of it like a long-term option issued by a company. It gives you the right—but not the obligation—to buy that company’s stock at a fixed price before a certain date.

But the difference between warrants and options is that anyone can trade warrants. No special accreditation required. You can buy and sell warrants right in your regular brokerage account.

Because warrants are leveraged to stocks, if the stock goes up… the warrant often goes up a lot more.

When John showed me one of his recent trades, I had to double-check the numbers.

The stock gained 53%. But the warrant gained 300%.

Same company. Same time period.

So I asked John to walk me through exactly what was going on, and whether this is something everyday traders should be paying attention to.

Here’s our discussion…

***

Justin: John, I’d like to officially welcome you to the RiskHedge team.

We’ve been talking a bit behind the scenes, and you impressed me with how you approach the market. You’ve built a repeatable system around buying and selling warrants.

A lot of my readers have traded stocks for years. Some may even trade options. But I’m sure very few have ever touched a warrant.

What should readers know about warrants off the bat?

John: I like to think of warrants as a tool.

If you’re bullish on a stock, you can buy the shares. That’s what most traders are used to.

But if that company has a tradeable warrant attached to it, the warrant usually lets you control the same underlying stock for a fraction of the price. Because of that, the percentage moves can be much larger, both up and down.

Warrants aren’t magic. They’re just structured differently. And when you use them in the right setup, they can create asymmetric returns.

Justin: Let’s talk about that 53% versus 300% trade your members recently booked. What happened there?

John: That was a trade in an offshore drilling company called Valaris Ltd. (VAL).

The offshore drilling industry has gone through years of pain, and it’s just now starting to rise from the ashes. The fact is that the world wouldn’t survive without it. According to the IEA, offshore production accounts for about 30% of the world’s oil supply.

And here’s the key: There are only about 50 super-advanced drillships in the world. Valaris happens to own 12 of them.

After declaring bankruptcy in 2020, the company emerged with a fresh balance sheet and an eye on the future. And with a world-class fleet, Valaris turned its fortunes around by going from bankruptcy to billions in just a few years.

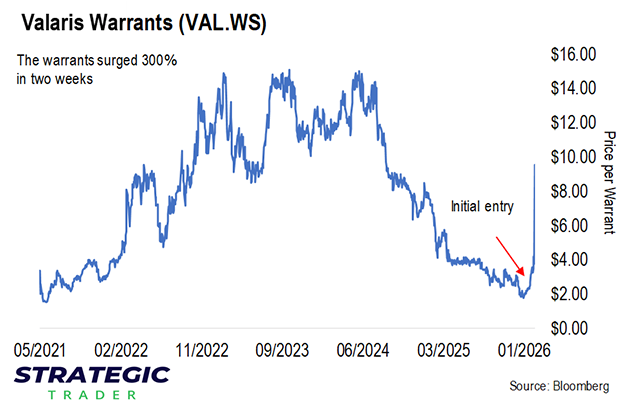

I told my members to buy VAL warrants on January 21. The thesis was simple: tightening supply, improving fundamentals, and a healthier company.

Then, last week, offshore drilling giant Transocean Ltd. (RIG) announced it was acquiring Valaris. It was quicker and easier than waiting years to build its own fleet.

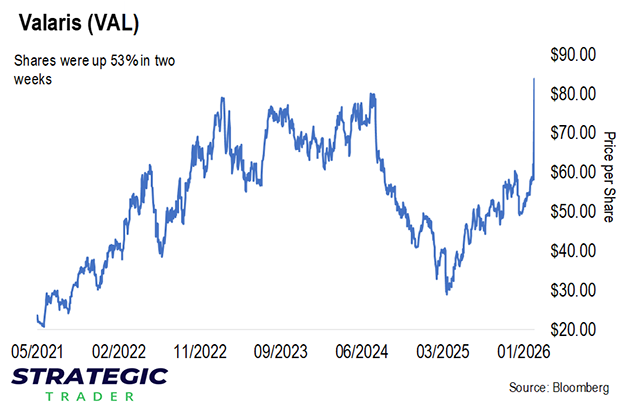

Shares of Valaris shot up immediately:

Source: Bloomberg

Source: Bloomberg

Just weeks after our initial buy-in, VAL shares had gained about 53%.

But the warrants crushed that return, gaining 300% over the same period:

Source: Bloomberg

Source: Bloomberg

Justin: Same thesis. Same company. Just a different trading vehicle.

John: Exactly. If you owned the stock, you did well. But if you owned the warrant, you did exceptionally well. That’s the difference warrants can make when your thesis is right.

Justin: So, just to be clear: This was about finding a stock you already had a bullish thesis on and playing it for more upside with its warrant.

John: Correct. If you already have high conviction in a setup, warrants can amplify your upside while committing less capital upfront. You can often buy warrants for under $1 apiece.

Justin: And that’s the part I think readers need to understand. This isn’t about replacing stocks. It’s about deciding how to structure a position.

So help us with that. If someone already trades stocks the way I teach—managing risk, position sizing, focusing on strong setups—where do warrants actually fit?

John: Think of warrants as a complement, not a substitute.

If you have a diversified portfolio of stocks, that doesn’t change. Stocks are still a great foundation.

But let’s say you identify a turnaround story, or a strong startup coming off the mat, or a company with a clear catalyst ahead. You’ve done the work. You have conviction.

At that point, you have two choices: buy the shares… or look at whether there’s a warrant offering a better risk/reward profile.

If it’s the latter, you still want to be selective. I have a strategy for finding the best warrant setups, and I filter every trade through that lense before I make a recommendation.

Justin: Okay, let’s switch gears for a minute. I have to ask: If the upside can be that much greater in warrants, why aren’t more people trading them?

John: Mostly because they don’t know they exist. Warrants are a niche corner of the market. They’re too small for Wall Street to care about. And most people assume you need special privileges to trade them.

Justin: But anyone can trade them once they hit the open market, right?

John: Right. You can buy and sell them just like stocks through your normal brokerage account. No special permissions required—unlike options.

Justin: That’s good to clarify. Because I think a lot of people assume this is some complicated, insider-only strategy. But really it’s just a tool most investors don’t understand.

John: Even if someone decides they prefer trading stocks, that’s perfectly fine. But once you understand how warrants work, and when buying them makes sense, you’ll start seeing situations where they can improve your risk/reward profile…and your returns.

Justin: Thanks, John. I think that’s a good place to leave it for today.

John: No problem. Thanks for having me.

Justin: And reader, if this is the first time you’re hearing about warrants... or if you’ve heard the term but never understood how they work... John put together a free guide that walks you through everything in plain English.

It’s called The Modern Warrant Playbook: From Dimes to Dollars.

In it, he breaks down his system for finding warrants with the best potential… and how to buy them, screenshots included.

If you’re curious about whether warrants could be a good addition to your portfolio, I’d encourage you to start there.

You can get your free copy of The Modern Warrant Playbook here.

Justin Spittler

Chief Trader, RiskHedge