Data center stocks have gotten crushed.

Yesterday, Nebius Group NV (NBIS) dropped 7% on earnings. CoreWeave (CRWV) sunk 16% on its report.

Many other stocks within the space plunged in sympathy, with some falling double-digit percentages.

These were among the market’s best-performing stocks.

Often, it’s a red flag when we lose a leading group… unless other stocks take their place.

And that’s exactly what’s been happening. New leaders are emerging.

Today, I’m going to share three of my favorite new leaders. Each of these stocks is climbing out of a huge base—and they’re doing so on volume.

Let’s start with Rivian Automotive (RIVN), a leader in the elective vehicle (EV) market. So far this cycle, EVs haven’t been a hot theme. They were more of a 2020–2021 thing. But that may be starting to change.

RIVN is already up 18% this week. It’s hitting its new 52-week highs on volume. And it’s breaking a downtrend that it’s been in for years. This sure looks like a change in character to me.

Source: StockCharts

Source: StockCharts

Next up, we have XPeng (XPEV), the “Tesla of China.” Shares of this EV company are up 25% on the week already. And like RIVN, this breakout has come on huge volume.

That tells me this move is likely the real deal.

Source: StockCharts

Source: StockCharts

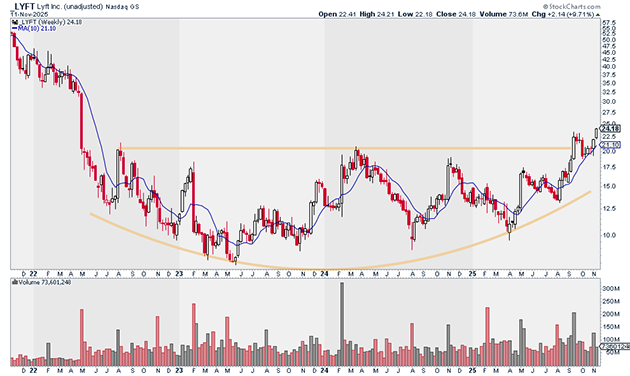

Finally, we have Lyft (LFYT). Shares of the ride-sharing company are up 10% on the week already. Yesterday, it recorded its highest daily close in over three years.

Source: StockCharts

Source: StockCharts

These aren’t just some of my new favorite names. They’re also a signal.

Think about it. These stocks aren’t exactly low-risk names. If they’re breaking out, it’s a good sign for the overall market.

And that’s one of many reasons why I’m not sweating the recent pullback in data center stocks. It’s evidence of rotation rather than the market going “risk off.”

In my Express Trader advisory, I just recommended two fresh breakout plays. Both are showing strong technical setups and should benefit from this ongoing rotation.

If you want to get ahead of where the money’s moving next, join me in Express Trader today.

Justin Spittler

Chief Trader, RiskHedge