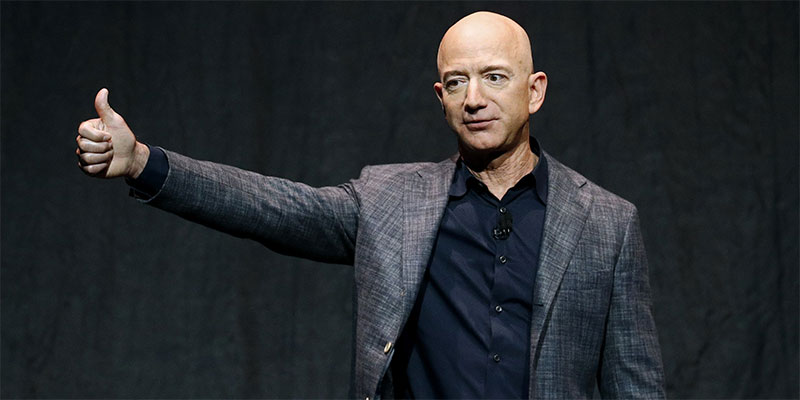

*** A lesson from Jeff Bezos

*** Crypto fundamentals are off the charts

*** Stephen’s top crypto for the next 10 years

In 2001, Amazon stock was in freefall.

Shares had plummeted over 90%.

From its peak of $113 in 1999, it plunged all the way to $6 a share.

And yet… founder Jeff Bezos wasn’t breaking a sweat.

He explained why, per CNBC:

I liked our business, and I liked the fundamentals of our business, but I also knew that the stock price was disconnected from what we were doing on a day-to-day basis…

…I had all the internal metrics on how many customers we had and I could see… People thought we were losing money.... I just knew it was a fixed cost business, and as soon as we reached a sufficient scale, we would have a very good business.

Bezos reminded shareholders to focus on the big picture… not on AMZN stock’s wild price swings.

|

FROM OUR PARTNERS. |

The business was stronger than ever. But the price wasn’t reflecting that.

Investors who recognized this disparity and capitalized on it made a fortune.

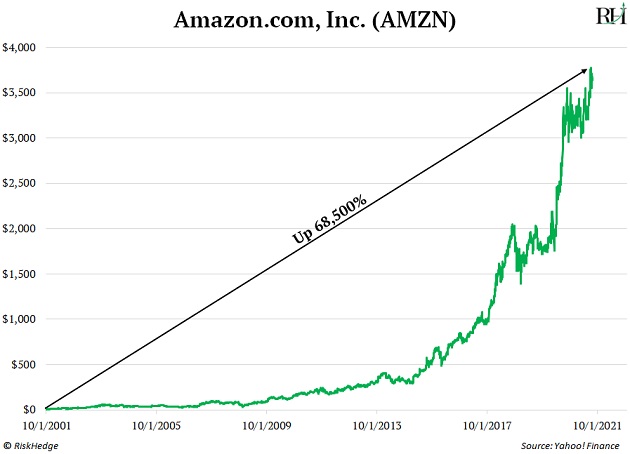

AMZN went on to soar 68,500% from its 2001 low…

…turning every $1,000 invested into $685,000.

And I’ll repeat what Bezos said above because it’s so darn important…

Bezos knew AMZN’s stock price was disconnected from the company’s fundamentals.

It wasn’t a time to panic. It was an opportunity to buy shares cheap… in order to profit from the company’s explosive growth for years to come.

Today, RiskHedge Chief Analyst Stephen McBride sees something similar taking place.

Not in stocks…

But in crypto.

-

In fact, he recently told Disruption Investor members: “I’ve never seen as big a gap between price and fundamentals than I see right now.”

I’m sure you know it’s been a rough few months for crypto. Over $1 trillion has been wiped off its total market cap since November.

Bitcoin, the world’s largest crypto, has fallen 15% this year.

Ethereum, the next largest crypto, is down 25%.

And many smaller names are down even more.

Stephen’s guidance?

Similar to Bezos back in 2000–2001.

Don’t stress over price swings. Instead, focus on the big picture.

Crypto FUNDAMENTALS are stronger than ever.

Just look at Ethereum’s latest “quarterly results…”

Of course, Ethereum isn’t a company, so it doesn’t have true “results” like a publicly traded stock. But as Stephen says, it is a real business, making real money…

And right now, the business is firing on all cylinders.

- Ethereum’s revenues hit $4.34 billion—a 17X surge compared to Q4 2020.

- Total transaction volume jumped 9X to $3.2 trillion in Q4 2021. Ethereum now handles more volume than Visa, Mastercard, and PayPal.

- MetaMask, the leading Ethereum wallet, has over 21 million monthly active users. That’s up from just two million at the end of 2020.

- Decentralized finance (DeFi) apps built on Ethereum have $115 billion in “assets under management.” That’s a 3X jump from $35 billion last January.

- Non-fungible token (NFT) art sales, most of which happen on Ethereum, soared over 50,000% to $36 billion last quarter, compared with $72 million in Q4 2020.

And yet…

Ethereum trades at roughly $2,700, the same price it was last September.

Of course, you can’t “chart” fundamentals like you can price. But according to Stephen, if you could, it’d look something like this:

The price is a roller coaster. That’s a given in crypto, the most volatile asset class on Earth.

But if you value Ethereum as a business, you’ll see it’s stronger than it’s ever been.

And it’s not just Ethereum. Stephen explains:

You see this incredible growth across quality crypto assets, like Helium (HNT). Helium is a crypto business building a new type of wireless network. Its hotspot routers reach about 200X further than a standard Wi-Fi connection.

Helium started last year with just 15,000 hotspots. That’s surged 35X over the past year to 520,000. Yet, Helium is trading at a 50% discount to where it was back in November.

Bottom line?

-

If you’re interested in investing in crypto, now’s the time—while the gap in price to fundamentals is so wide.

Stephen recommends Ethereum as his “slam dunk, no brainer” crypto rec. He told me—“If I had to buy and hold just one crypto for the next 10 years, it’s Ethereum, hands down.”

Ethereum is worth about $345 billion today. Bitcoin is worth roughly $765 billion.

Stephen predicts 2022 will be the year Ethereum overtakes bitcoin as the #1 crypto asset:

Bitcoin allowed anyone to send and receive money on the internet, without middlemen, for the first time ever. That’s revolutionary. But bitcoin is a finished product. All it’ll ever be is digital cash.

Ethereum, on the other hand, is a fountain of innovation. It’s the “base layer” on top of which programmers are building world-changing disruptive businesses.

Even better, Ethereum makes money from all this activity happening on its blockchain. Roughly $25 billion of value settles on Ethereum every day. It now collects $40 million in daily transaction fees. That’s 40X greater than bitcoin.

If you do buy some Ethereum, just remember one key idea.

Don’t stress over the day-to-day price swings. Have a long-term outlook. And keep the fundamentals front and center.

-

And if you’re after even more upside in crypto, you’ll need to look beyond Ethereum…

That’s where RiskHedge Venture, Stephen’s crypto advisory, comes in.

In Venture, Stephen targets tiny “Phase 2” cryptos that have the potential to appreciate by at least 1,000%. This means he’s not recommending bitcoin, or Ethereum—they’re far too large.

Most Phase 2 cryptos, some of which trade for less than a penny, don’t trade on popular crypto exchanges…

This means RiskHedge Venture readers can get in early—before most of the public knows these cryptos exist.

There are currently seven Phase 2 crypto recommendations in the RiskHedge Venture portfolio, and each one is a strong buy today according to Stephen.

If you’d like to discover more about Phase 2 cryptos and how to join RiskHedge Venture, click here.

Chris Reilly

Executive Editor, RiskHedge