NASA’s Orion splashes down… a new opportunity in small space stocks... why I don’t recommend Robinhood’s new IRA… in the mailbag: Are we “cancel culture guys”?

- Splashdown!

Yesterday at approximately 12:40 pm EST, NASA’s space capsule Orion landed in the Pacific Ocean.

It was a successful mission—a 25-day trip around the moon and back. And while no humans were aboard the spacecraft, it marked NASA’s first big step toward returning astronauts to the moon... and eventually Mars.

My dad was an aerospace engineer with a master's from Princeton and a focus on rocket science. He even worked on the original space shuttle for NASA when he was at Grumman. So, I grew up hearing insider stories about space programs.

In those days, getting to space was EXPENSIVE. Governments and big corporations were the only ones with enough money to do it. That’s changing fast. The costs of operating in space are plunging—opening up opportunities for investors to profit in earlier-stage disruptive space companies.

- I recently talked to a CEO whose company operates high-end satellites.

The level of detail these satellites can now capture is stunning. For example, it can watch a stockpile of coal from space and tell you how much has been removed since yesterday.

Imagine how this could transform supply chains and industries like food distribution, national security, and even commodities trading.

I’m researching the company as a potential recommendation for my Project 5X advisory. It’s just one of many exciting breakthroughs happening in space.

Others include mining asteroids, providing worldwide internet coverage, and zero-gravity manufacturing. In short, operating in the zero-gravity environment of space could help scientists discover new breakthrough drugs, technologies, or manufacturing processes.

When I was growing up, you could barely imagine something like this because the costs were so high. Plunging costs have opened up a whole new world of possibilities.

A wave of new opportunities is here in small, disruptive space stocks.

- Robinhood breaks the mold again… but I’m not biting.

Robinhood—the trading app popular with young investors—is offering something new.

Last week, Robinhood announced it will offer a 1% match on every dollar put into its new retirement accounts.

I’ll hand it to Robinhood’s marketers: This is a good idea. It should attract the millions of investors who don’t have access to matching retirement contributions through their employers.

But given Robinhood’s reputation, I’d stay far away from this.

Last year, during the “meme stock” craze, Robinhood forcibly liquidated some of its customers. In short: They hung their customers—mostly young, inexperienced investors—out to dry.

It also goads users into overtrading, nudges them towards risky products, and their customer service is one of the worst in the business.

Robinhood is also connected with the FTX drama. Fraudster and FTX founder Sam Bankman-Fried has a 7.6% stake in Robinhood. Robinhood claims it’s nothing to worry about. We’ll see.

Robinhood has lost about a third of its users this year. The 1% deal smells like a desperate attempt to bring some back. Let me know what you think at chriswood@riskhedge.com.

And forget about investing in Robinhood stock. When it IPO’d last year, Chief Trader Justin Spittler urged readers to avoid it at all costs. It’s down 75% since then… and it’s still a stay-away.

- I’m always watching out for “true but misleading” stats about the stock market. Here’s a new one…

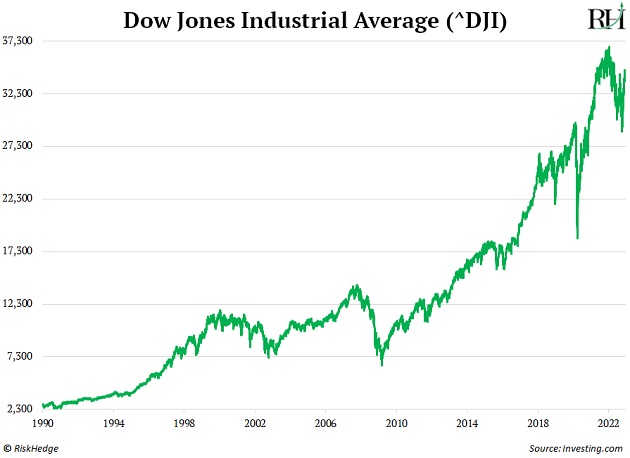

The Dow Jones Index is just 10% from its all-time high, as you can see here:

The Dow is one of the most widely followed indicators in the world, which is too bad, because it’s a poor gauge of how the stock market is doing. The way the Dow index works is outdated and, frankly, makes no sense.

Health insurer United Health is the biggest component of the Dow at 10%. Apple—the world’s biggest company—makes up less than 3%, even though it’s almost 5 times bigger than UNH.

Why? The Dow is “price weighted”—which treats UNH like a bigger company simply because it has a high per-share price of $539.

The S&P remains down 18%, while the Nasdaq is down 30%. That’s a much more accurate reflection of how the average investor is doing and feeling this year.

Chris Wood

Editor, Project 5X

In the mailbag…

We love Elon democratizing Twitter and will support Tesla. Don't you like free speech? Are you one of those cancel culture guys? —Lim

Chris’s comment: I’m a big fan of Elon too, but I’d like him to stay out of politics.

My best advice is steer well clear of politics / hate speech / woke, etc. It serves no benefit to you to go anywhere near this stuff. This is not business.

I’m a former investment banker and businessman who has lived in 8 countries. This stuff is best left out of business. If you don’t like a company’s policies just don’t mention it. Even Bob Iger said let’s chase profits not subscriber numbers. He’s a businessman. He’s not going to mess around risking shareholder money by going down the risky topic of politics. The risk v. reward pay-off of even mentioning this stuff is grossly unattractive. —Gregor

Chris comment: Agreed! Unfortunately you can’t discuss Disney these days without discussing wokeness.